The Other Side of the Coin: Dollar Strength and Emerging Markets Woes

Widespread weakening in emerging markets currencies during August

Published by Alba Di Rosa. .

Exchange rate Central banks Trade war Uncertainty Argentine peso Trade balance Dollar Turkish lira Brazilian real Exchange ratesSome weeks ago, in our Currency Update, we focused on the theme of the strength of the greenback, driven by US bond yields – which are relatively high compared to those in other strong currencies – as well as by the good performance of the US economy.

Today we will focus on the other side of the coin: the reaction of emerging markets currencies, closely linked to dollar dynamics and Federal Reserves decisions.

As a matter of fact, the exchange rate of emerging countries’ currencies is not only penalized by the strength of the greenback in purely arithmetical terms, but it also reflects the difficulties that a strong dollar entails (e.g. capital outflows and the increase in the cost of loans contracted in foreign currency). This is combined with the ongoing climate of uncertainty related to trade war, as well as domestic factors.

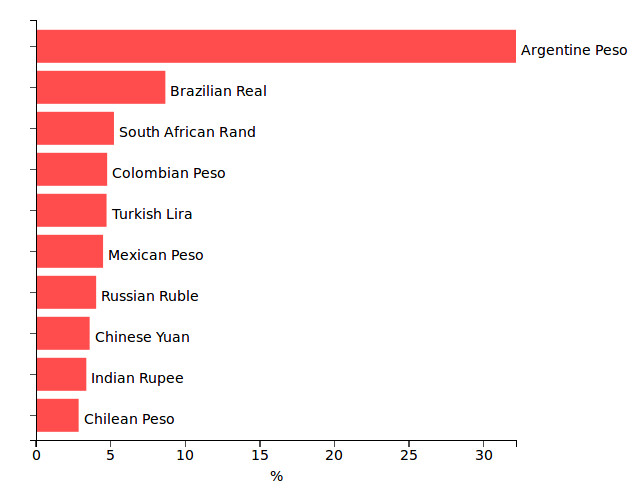

Among emerging markets’ currencies, which of them have shown the greatest depreciation against the dollar in the last month?

Emerging markets currencies

Depreciation against the dollar (August 2019)

Source: StudiaBo elaborations on ExportPlanning data.

On the basis of the data that you can find in ExportPlanning’s exchange rate tool, we can infer that the Argentine peso suffered the greatest depreciation against the dollar, penalized by domestic political and economic factors. The peso collapsed following the defeat of the incumbent president Macri in the primary elections of August 11, in favor of the Peronist Alberto Fernández.

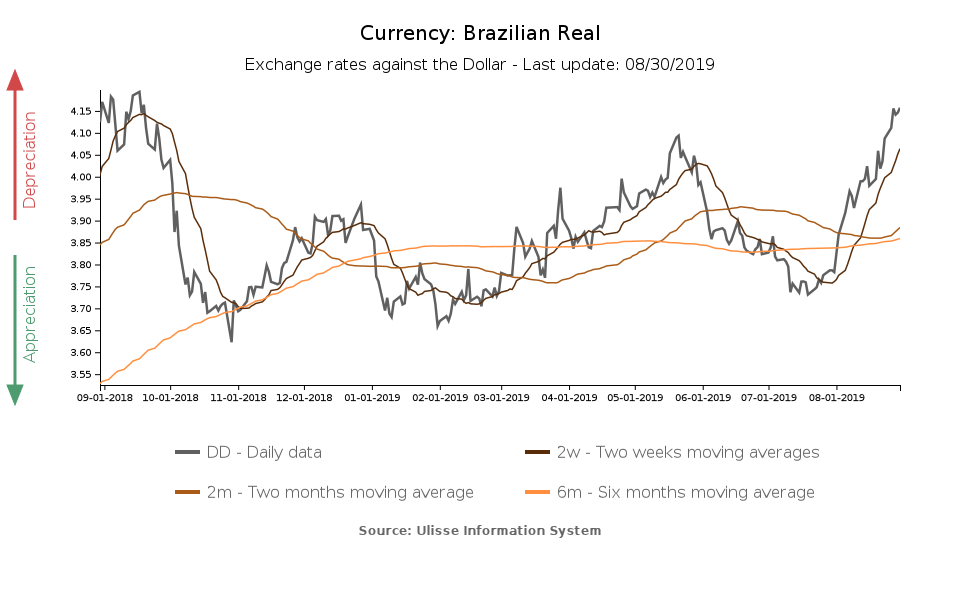

Also noteworthy is the case of Brazil: the real lost more than 8% of its value against the dollar since the beginning of August, after a phase of strengthening in the first part of the summer.

At the moment, the major risk for the Brazilian currency is a further depreciation. The weakness of the domestic economy weighs on the currency: data recently released by the country's central statistical institute indicate that industrial production has contracted in June (-0.6%); the contraction was particularly strong in the consumer goods sector.

On the GDP front, however, news are a bit brighter. In Q2-2019 Brazilian GDP grew by 0.4%, avoiding the risk of a recession.

According to analysts, the weakness of the real also results from external shocks, such as the ongoing trade tensions and the economic crisis in neighboring Argentina.

The Turkish lira entered a new phase of depreciation in August (-5% against the dollar), in spite of a recovery in terms of current account deficit. The currency may have reacted negatively to a strongly expansionary monetary policy move on the part of the central bank (reduction in the levels of minimum reserves requirements for some banks), which could jeopardize the progress made on the current account deficit front.

The latest balance of payments data released in June also indicate a reduction in foreign direct investments inflows (y-o-y) and an outflow in foreign portfolio investments.

Last but not least, a look to the East: in the last month the Indian rupee lost 3.4% of its value against the greenback. Together with the impact of trade war and uncertainty, the rupee suffers some elements of domestic weakness, as well:

- Slowdown in industrial activity (particularly in the manufacturing and mining sectors) and in the pace of economic growth, revised downwards in the last monetary policy committee of the Reserve Bank of India

- Moderation in inflation, seen as a potential signal of a slowdown in consumer demand

- Foreign portfolio investments outflows, due to the recent FPI tax surcharge