Airbus Tariffs: the First US Revision

There are no substantial changes to the duties in force, but the application of the carousel retaliation creates deep uncertainty and amplifies risks.

Published by Marzia Moccia. .

Europe Uncertainty Made in Italy Conjuncture United States of America Foreign markets Global economic trends

One of the most important news of the week concerns the US revision of EU products list hit by tariffs following the WTO's sentence on the Boeing-Airbus affair. As we have already discussed on several occasions, US tariffs action are part of the long Boeing-Airbus legal dispute started in 2004 on the issue of illegal subsidies.

On 2 October 2019 the WTO issued a first ruling in favour of the US Boeing, which allowed the US administration to impose compensatory tariffs on EU products, up to a maximum of $ 7.5 billion.

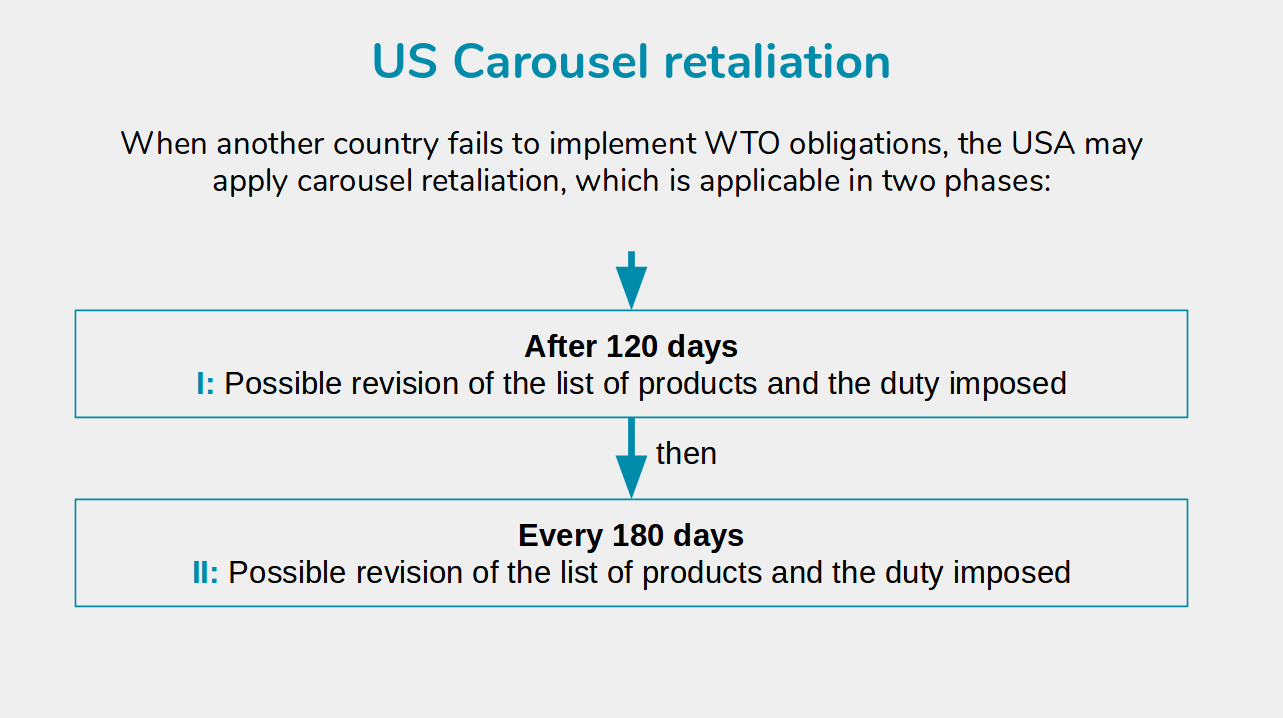

However, after only 120 days, the list of EU products subject to tariffs has already been subject to an initial review. Indeed, under Section 407 of the Trade and Development Act of 2000, when another country fails to implement WTO obligations, the U.S. Trade Representative has the option to apply the "carousel retaliation". According to this discipline, after the first 120 days from the tariff action, and subsequently every 180 days, the USTR has the possibility to modify the tariff list of products and/or the percentage of the duty applied, substantially implementing a rotation of the products concerned.

The US tariff list revision

The current tariff revision did not make any substantial changes since last October's tariff action.

The most significant change concerned the rate affecting exports of civil aircraft from the founding countries of the Airbus consortium (France, Germany, United Kingdom and Spain), which was increased from 10% to 15%. Minor changes were made to the other products hit by tariffs. As reported in section 1 of the US notice, the US administration has removed plum juice from the list of affected products, introducing instead kitchen knives exported from France and Germany, with a 25% duty; provisions that will come into force between 5 and 18 March 2020.

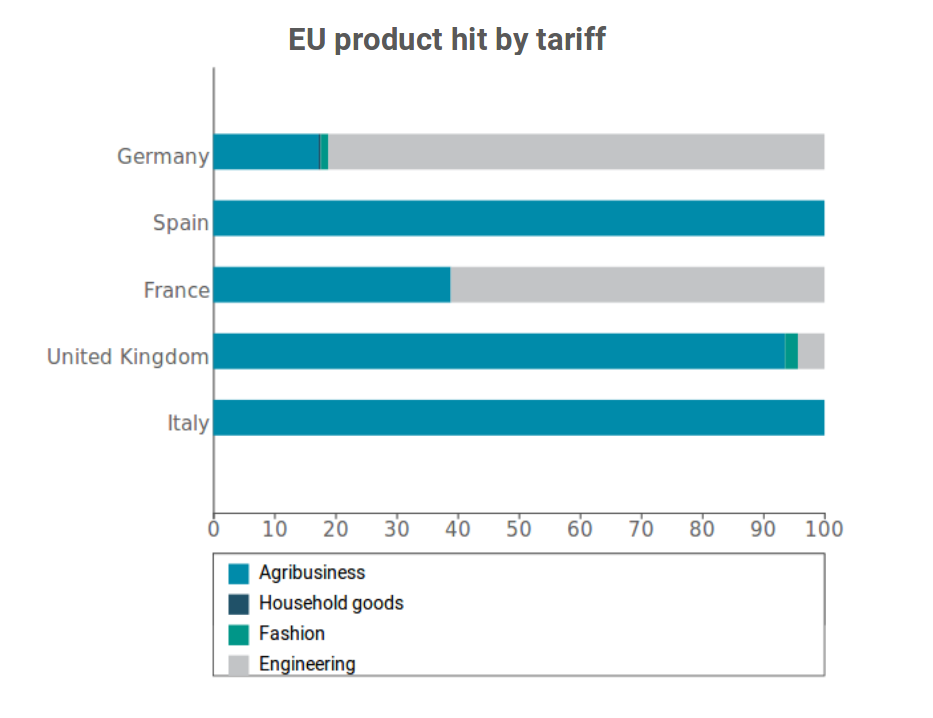

This first review has in fact proved to be absolutely marginal, without significantly changes in the composition of products subject to duties, nor mitigating the highly differentiated treatment reserved to EU partners. The graph below shows the current distribution of tariffs by country and by sector, which is in fact unchanged from last October.

Source: ExportPlanning

Although this first review has not introduced any substantial changes since last October's action, it is important to note that the mechanism of tariff list revision provided generates deep uncertainty for foreign operators active in the US market.

According to the law, in fact, the revision could not only provide for a modification of the tariff rate applied, but it could also exempt and introduce new products, thus modifying the basket of EU products affected , increasing the degree of uncertainty. This mechanism makes it very difficult to minimise the imposed cost of the tariff, both for the target market and for major trading partners, and maximises the negative impact of duties.

In fact, several Member States have launched several government missions in order to mitigate for national operators the risks linked to the actions of the American administration. Although at this early stage, these actions appear to have yielded some results, the question of US-EU duties remains open for Member States, and this is an additional factor of uncertainty in the already sensitive transatlantic relationship.