ECB disappoints markets

In spite of Wall Street mayhem, the dollar is catching up.

Published by Alba Di Rosa. .

Exchange rate Eurozone Central banks Uncertainty Dollar United States of America Exchange rate risk Euro Emerging markets Exchange ratesThe spread of the COVID-19 emergency, and its heavy consequences, continues to be the key variable influencing financial markets movements. In Italy an almost total lockdown has been reached, aimed at containing the spread of the epidemic; neighbouring European countries are starting to react as well, adopting containment measures. As of today, US President Trump has stopped flights from Europe.

In the wake of the Federal Reserve's first moves last week, further interventions by major central banks took place in the last few days, in order to contain the impact of the coronavirus epidemic on national economies.

Bank of England: surprise move

About two weeks ahead of the planned monetary policy meeting, last Wednesday the Bank of England announced a 50 basis point cut in interest rates and introduced measures to encourage lending to the real economy, particularly small businesses.

Analysts appreciated the coordination of monetary and fiscal policy: in the same days, the British government launched a £12 billion package to support the economy and businesses in this difficult phase.

Fed: liquidity injections to calm the panic

After last week’s rate cuts, the Federal Reserve took the field again, resorting to liquidity injections totalling $1.5 trillion, in an attempt to calm the markets. As a matter of fact, US stock exchanges are marked by high volatily since the beginning of the coronavirus crisis: this week the VIX index reached record levels, surpassing October 2008 all-time high. Yesterday was defined as one of the worst days for Wall Street since 1987, with massive losses partially recovered today.

The ECB disappoints the markets

Another key event this week was the meeting of the Governing Council of the European Central Bank, which took place yesterday and represented a first challenge for the new President Christine Lagarde. Apparently, markets have been disappointed with the decisions of the council. Milan stock exchange, which had already recorded losses yesterday morning, confirmed this trend in the afternoon; the FTSE MIB index closed the day with one of the biggest losses in its history (-16.92%). Minor losses for Paris and Frankfurt stock exchanges, as well.

The common opinion is that the words of President Lagarde have not reassured the markets, which would have appreciated a new "whatever it takes". Instead, the measures announced by the ECB were relatively more timid, not including a rate cut.

Like the Bank of England, the ECB's primary objective has been to “support liquidity and funding conditions for households, businesses and banks” and “help to preserve the smooth provision of credit to the real economy”.

The ECB resorted to the instruments of LTRO (Long Term Refinancing Operations), TLTRO (Targeted Longer Term Refinancing Operations) and an increase in purchases under the Asset Purchase Programme.

The ECB has also urged governments to do their part with a strong fiscal policy action, which is now more necessary than ever.

The reaction of currencies

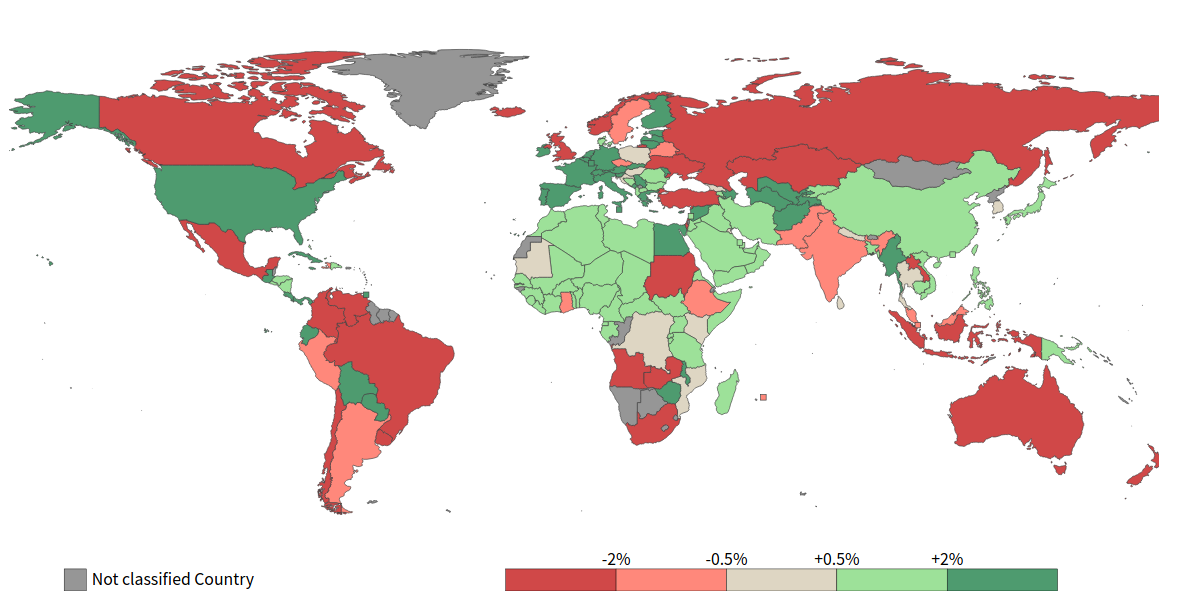

In this context of constant emergency, the overview of exchange rate trends is divided on two fairly clear-cut fronts: except for the euro, the dollar, the Swiss franc and the yen, as well as the currencies which are pegged to them, currency markets show general suffering. It is not just emerging markets currencies: Australian and Canadian dollar keep on weakening, as well as Brazilian real, Russian rouble, Mexican peso and many others.

Effective exchange rates - March 13, 2020

Source: ExportPlanning Exchange Rates Tool.

While the strength of the dollar is justified by its safe-haven currency status, and the suffering of emerging countries currencies by a general risk aversion, the only "unusual" element in this picture is the strength of the euro, since the end of February. According to analysts, this is mainly linked to investors closing positions on risky assets, which therefore leads them to buy back euros.

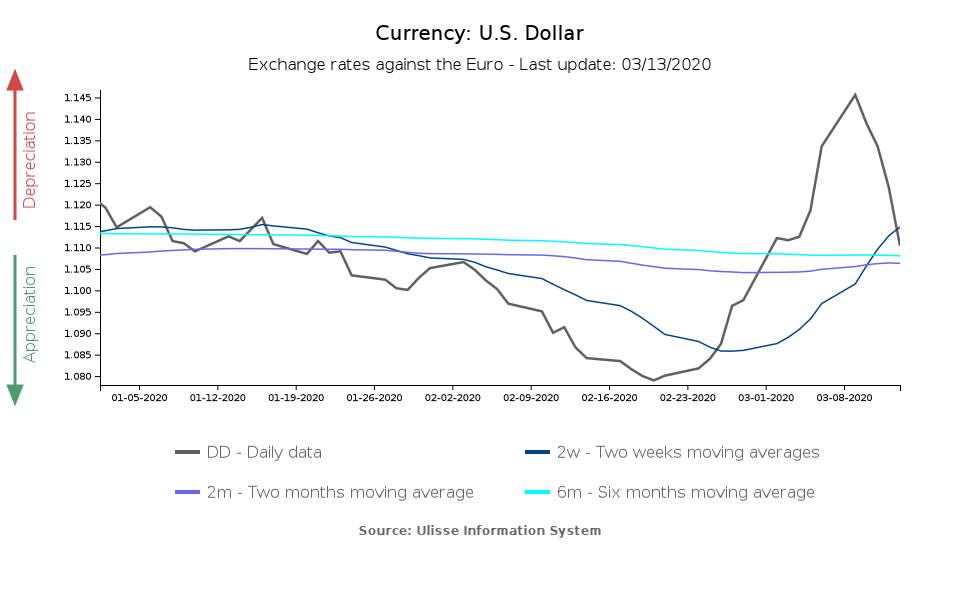

Looking at euro-dollar exchange rate, interesting cues emerge in terms of balance of power: despite stock exchange turbulence, this week the dollar, after hitting a low of 1.145 at the beginning of the week, managed to recover 3.5% against the single currency, returning to 1.11 dollars per euro.

This reversal of fortunes could confirm the temporary nature of the strengthening of the single currency in early March, in the face of a structural strength of the dollar, the main currency that investors look for in times of difficulty.

Looking at exchange rate movements in the last few days, the two currencies may also have reflected, on the one hand, disappointment with the ECB's measures and, on the other hand, market appreciation for the fiscal stimulus measures that the Trump administration is allegedly about to launch, in response to the coronavirus emergency.

The evolution of the exchange rate in the coming months will in any case be linked to the pandemic: if the virus spreads significantly in the US, even king dollar could suffer.