Phase of Weakness for the Ruble

Geopolitical uncertainty and capital flows take centre stage

Published by Alba Di Rosa. .

Russian rouble Exchange rate Central banks Economic policy Exchange rate risk Covid-19 Emerging markets Exchange ratesAfter the case of the Indian rupee, discussed last week,

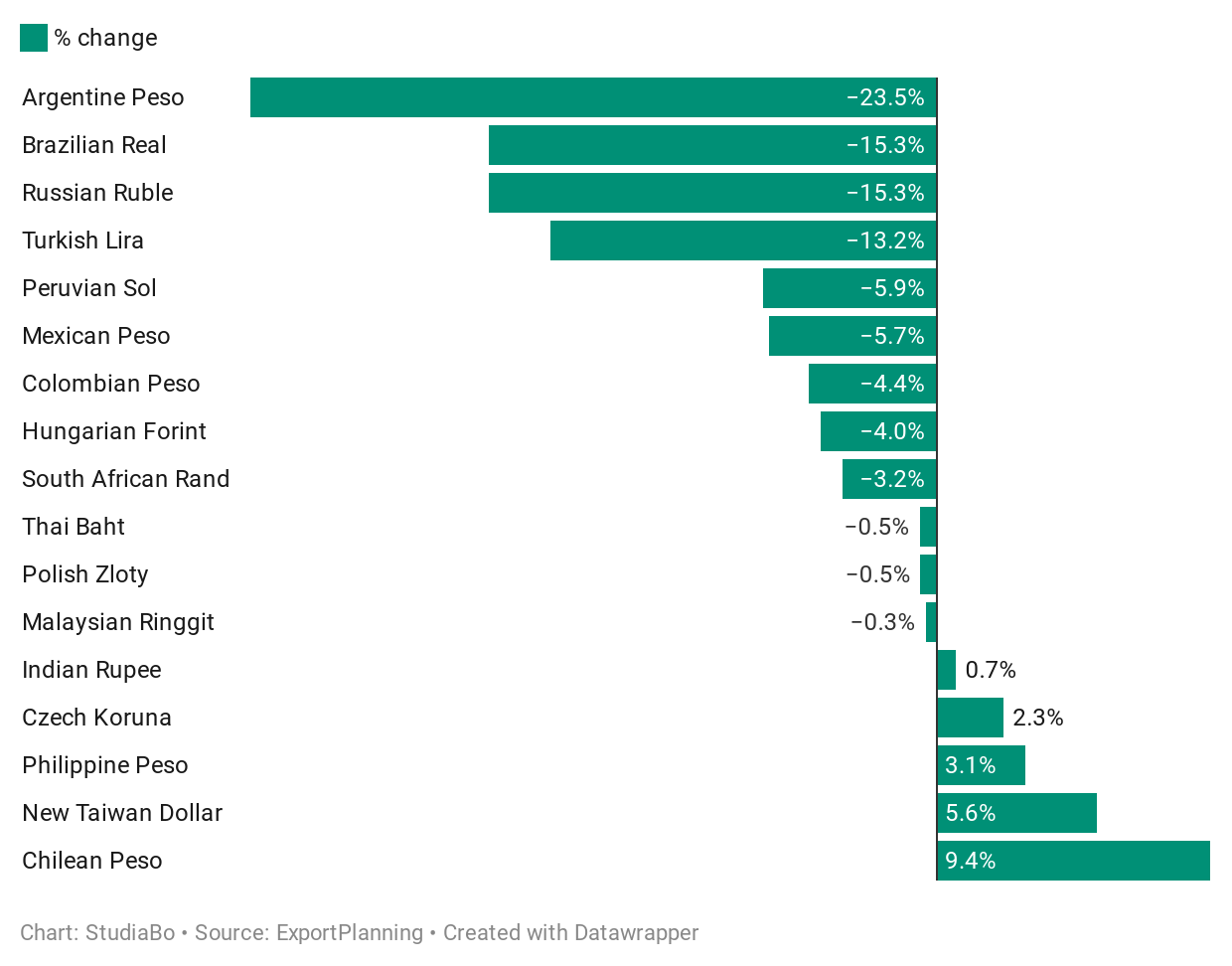

a further case of exchange rate underperformance, compared to the average of the EM cluster during the 2020, is that of the Russian rouble. Looking at the effective exchange rates for floating emerging markets' currencies, available in the Exchange Rates section of ExportPlanning, we can see that, after the Argentine peso, the Russian rouble and the Brazilian real have shown the greatest weakening since early 2020 (-15.3%).

In terms of the effective exchange rate, the rouble is currently only slightly above the lows reached during last spring's nosedive; its exchange rate against the dollar ended the week close to 75 RUB per USD, while it showed values of just over 60 before the Covid crisis. Among the currencies included in the Economist's Big Mac Index, the rouble is the second most undervalued against the dollar as of January 2021, just after the Lebanese pound.

Effective Exchange Rate (% change)

Jan. 2, 2020 - Feb. 5, 2021

Several factors need to be taken into account when analysing the rouble. First of all, let us consider the budget rule, introduced to ease the exchange rate's dependence on the price of oil. According to the most recent update of this rule, revenues from the sale of oil (Urals) above $43.3 per barrel are allocated to a state fund (the National Wealth Fund), so as to prevent an excessive appreciation of the exchange rate when the price of oil is above the threshold, while at the same time managing to ensure a mechanism for selling foreign currency reserves when the price is below it.

In relation to the budget rule, the Bank of Russia sold foreign currency in the first months of the pandemic, reduced its sales in the summer and during the autumn, and then returned to buying in January and February 2021. This mechanism thus seeks to give the rouble some stability, in spite of the fluctuations in the price of oil.

If oil price dynamics have a limited impact on the rouble, thanks to the central bank's stabilising action, let us move to other factors. Of primary importance is geopolitics.

With the Navalny case rekindling in recent weeks, the risk of sanctions on Russia by the EU and the US has returned to the fore. Since the end of January, when the Navalny case resurfaced with the arrest of the activist on his arrival to Russia and the subsequent street protests in many parts of the country, the rouble has lost relatively moderate ground (-1.6% against the dollar). According to observers, geopolitical risk is a key factor for Russia at this historical juncture, and is therefore already priced in by the markets, as can be seen from the rouble's medium-term weakness in this post-Covid phase, and not so much in a short-term effect related to the events of recent weeks.

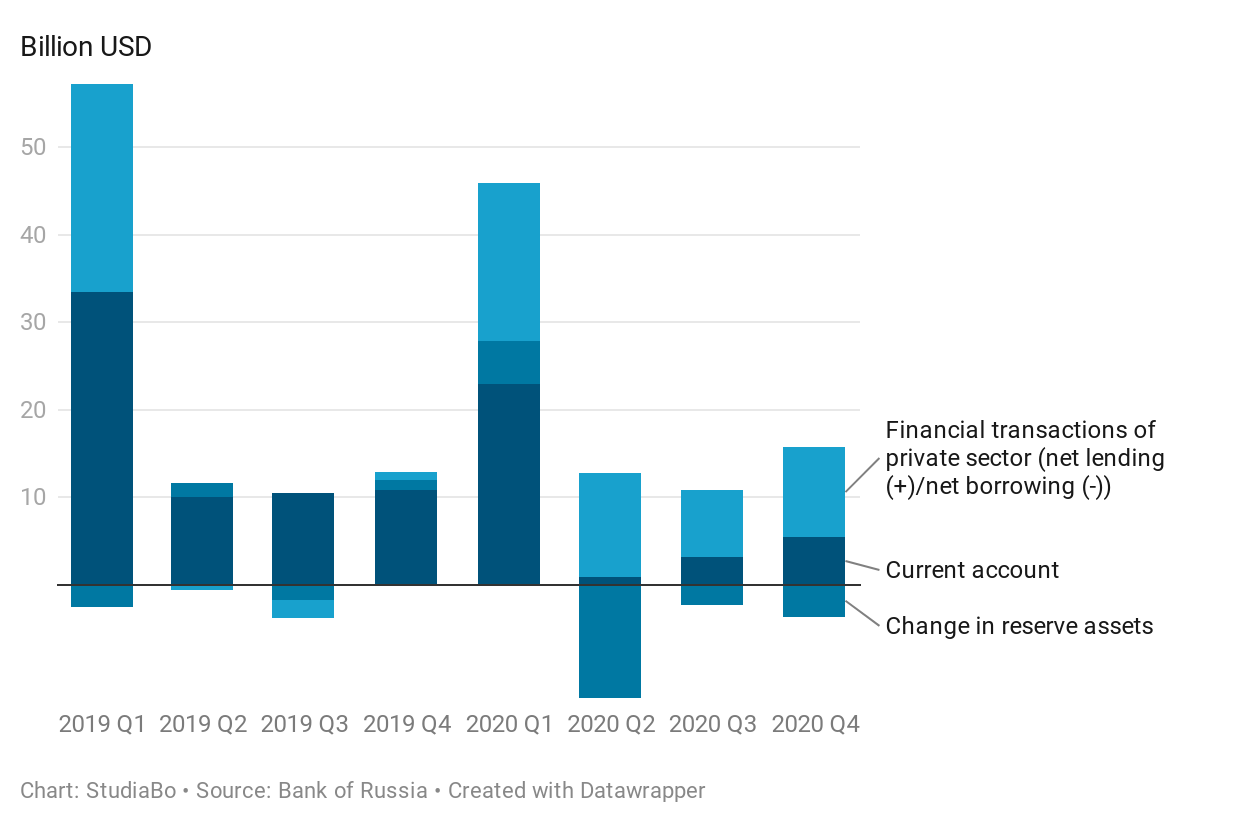

Another important factor in the analysis of the rouble's dynamics, besides geopolitical uncertainty, is capital flows. The Bank of Russia's balance of payments data on private sector financial transactions show an outflow of capital in the course of 2020, as can be seen in the graph below.

Russia: Balance of Payments

Signs of hesitation on the part of investors can also be read in the dynamics of the OFZ market, the Russian bond market, in which the share held by non-residents has fallen since the beginning of the year.

From these elements, analysts deduce a decrease in confidence on the part of both foreign and local investors during 2020: factors such as geopolitical uncertainty and rising inflation in spite of a weak demand (the consumer price index closed in December at 4.9%, above the 4% target) may limit the flow of foreign investors to the local bond market, while at the same time pushing Russian capital abroad.

Some risks to the recovery of this confidence can be seen at the local level, such as weak levels of income and investment, as well as limited room for further monetary and fiscal stimulus of the economy.