EU foreign trade: Q2-2021 figures

Exceeded expectations for recovery in Q2 2021, up +6% over the same period in 2019

Published by Simone Zambelli. .

Export Europe Conjuncture Industries Forecast Global economic trends

The availability of ExportPlanning pre-estimates on the second quarter of 2021 foreign trade data of EU countries, accessible through the EU countries datamart, allows to document the economic situation of exports from the Old Continent and offers a clearer overview of the economic recovery.

Following the sharp fall suffered in the months of the pandemic crisis, EU exports seem to have caught up with the growth phase of world demand: European exports have in fact already recovered their pre-pandemic levels since the beginning of 2021 and show a further intensification of their recovery path in the second quarter of the year.

Source: ExportPlanning

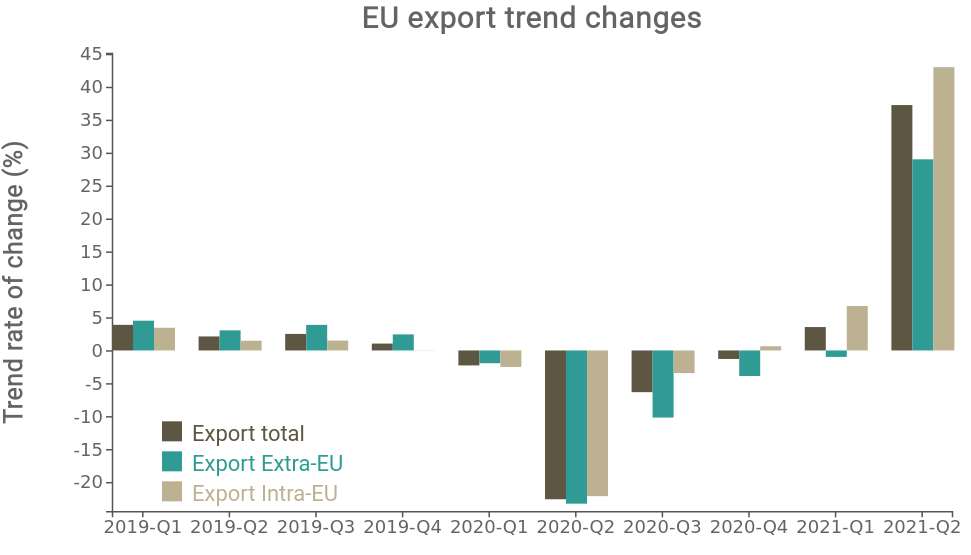

As can be seen from the proposed graph, the very strong positive variation of the second quarter of 2021 immediately jumps out, which must, however, be ascribed to a mere "base effect" of statistical nature, due to the comparison with the large fall recorded in the months of the Great Lockdown of the previous year. In light of this, in order to make more accurate assessments, it is useful to compare Q2 2021 data with Q2 2019 data: when compared to Q2 2019, EU exports mark a largely positive change and equal to +6% in euro.

Overall, in the first half of 2021, EU exports mark a growth of +3.6% compared to the first half of 2019, with a driving role of Intra-EU markets and a relatively mixed performance for the main Non-EU countries.

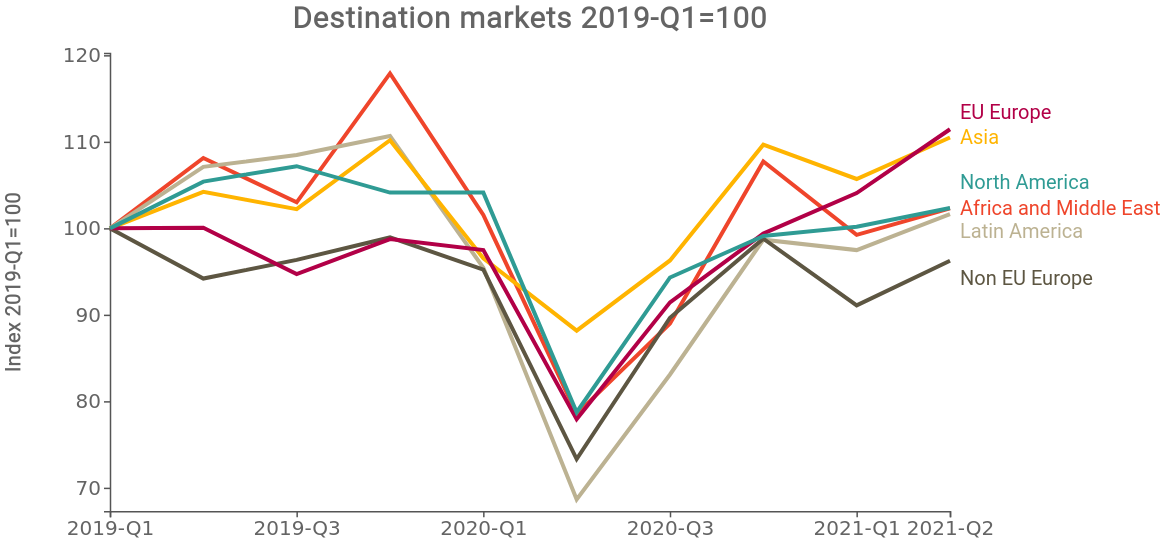

If compared to pre-crisis levels, in fact, the performance of European exports is growing strongly towards the main EU partners and towards Asia, where the increase on the Chinese market stands out. There are also good signs of recovery in demand for goods made in the EU in the markets of the American continent (North and South America) and the MENA region, while non-EU European markets seem to be recovering more slowly, with a negative performance in the British market (see graph below).

Source: ExportPlanning

EU exports by country and by industry

On the side of the main European exporters, even the most recent data show a certain differentiation in terms of the performance of the different Member States, as we have had the opportunity to recount on several occasions. The graph below allows us to compare the variation experienced in the first half of 2021 compared to the same period in 2019 (y-axis), taking into account the variation recorded in 2020 (x-axis).

Source: ExportPlanning

The countries of Central-Eastern Europe are placed in the top right section of the graph, by virtue of their good 2020 performance and strong growth in the most recent quarters, among which Poland stands out. For the Central-Western European cluster, Italy's positioning is particularly interesting, with one of the best results.

To complete the analysis, it may be useful to examine the performance of European exports from a sectoral viewpoint. As in the previous case, the map below allows us to compare the performance of European exports, showing, on the y-axis, the variation experienced by the different industrial sectors in the first half of 2021 compared to the same period in 2019 (y-axis), taking into account the variation recorded in 2020 (x-axis).

Source: ExportPlanning

First of all, it is clear that the data for the first half of 2021 on the sectoral performance of European exports appear to be in line with what was observed in the previous quarters, confirming certain ongoing trends.

On the consumer goods front, the signals coming from essential goods (Health System and Agro-food) continue to be extremely positive. Particularly significant is the positioning of the finished personal goods sector, which, after spending several quarters in negative territory, closed the first half of 2021 with a slight recovery (1.1%).

On the contrary, the intermediate textile segment continues to record the most significant losses (-7% compared to H1-2019).

While European consumer goods exports seem to have fully recovered from 2019, the same cannot be said of investment goods for which there are several sectors that underperform compared to 2019 levels. Specifically, the weakness of the transportation equipment sector (F3) continues, which despite the recovery of automotive components, registers a -2.7% decline compared to first semester 2019 values.

Conclusions

The overview we have just given of European trade data for the second half of 2021, shows a decisive recovery in exports, especially to the Intra-EU area and Asia. This growth phase, however, differs both by country, favoring the East European area, and by industry, with consumer goods particularly on the rise, to the detriment of investment goods. In the coming months, it is expected that world trade will continue to ride this phase of recovery in economic activity and will be a great opportunity to boost the economies of many countries.