World exports of Capital Goods: Widespread Recoveries in 2021

The recovery showed very weak results only in the Automotive sector

Published by Marcello Antonioni. .

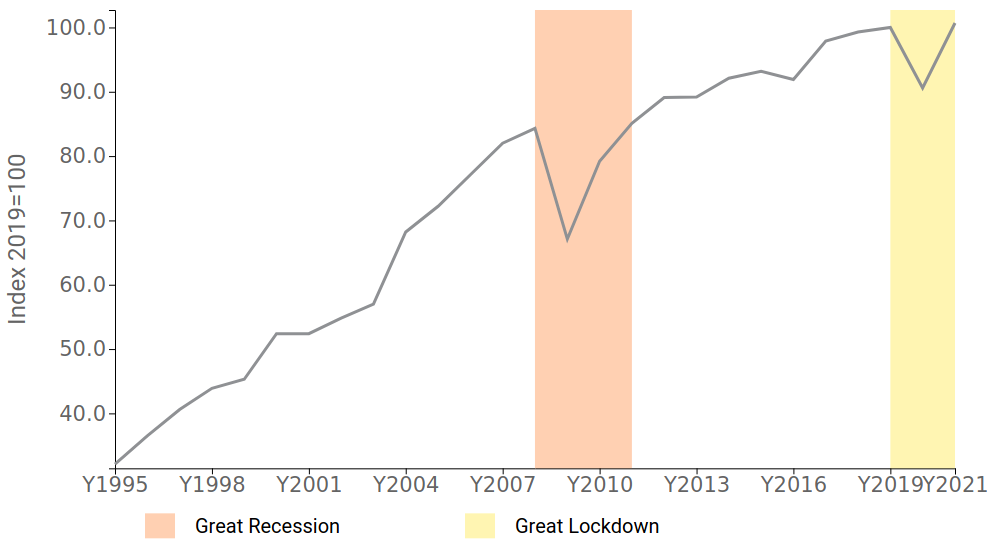

Check performance Metal industry Industrial equipment Automotive Conjuncture Industries Great Lockdown Global economic trends In pre-final 2021, world exports of capital goods1 marked an overall increase of more than 11 percentage points in quantities, recovering the pre-pandemic levels of 2019.

This is a substantial difference from the crisis of the Great Recession (2009) when exports after a much deeper fall (-20.4% in 2009, compared to -9.4% in 2020), it took two years to fully recover the penalty suffered.

Evolution of World Exports of Capital Goods

(index at constant prices)

Source: ExportPlanning

With the relevant exception of Automotive,

all major sectors of capital goods returned above 2019 levels

The picture looks even more favourable if we exclude the Automotive segment. The latter, which was heavily penalised in 2020, saw only a partial recovery (and in the case of the Automobile segment, even a new drop: -2.4% in quantity) in world exports on average in 2021: Trains and rolling stock +2.7% (after -28.1% in 2020), Forklifts and Handling Equipment +3.6% (after -16.1% the previous year), Aircraft +6.8% (after a 42% drop the previous year),

Special Vehicles +8.4% (after -23.5% in 2020).

More significant recoveries, but just enough to return to 2019 levels, characterised world exports of Ships and Yachts (+15.8%, after -13% in 2020) and Motor vehicles for the transport of goods (+22.9%, after -18.5% in 2020).

The only notable positive exception within the Automotive sector concerns world exports of Motorcycles, which, after a steady 2020, grew by more than 23 percentage points in quantity last year.

World Exports by capital goods sector

(% changes at constant prices)

| 2020/2019 | 2021/2020 | 2021/2019 | |

| Electrotechnical | -6.4 | +13.4 | +6.2 |

|---|---|---|---|

| ICT and Service Equipment | +4.0 | +13.9 | +18.5 |

| Industrial Tools and Equipment | -4.7 | +13.5 | +8.1 |

| Automotive | -25.0 | +4.0 | -22.0 |

| Earth-moving Machinery | -15.3 | +26.8 | +7.4 |

| Agricultural Machinery | -6.3 | +11.5 | +4.5 |

| Industrial Machinery | -6.8 | +18.9 | +10.8 |

| Industrial Plants | -10.5 | +12.2 | +0.5 |

| TOTAL Capital Goods | -9.4 | +11.2 | +0.7 |

Source: ExportPlanning, Quarterly World Trade Database

The most favourable dynamics characterised the ICT and Service Equipment sector, whose world exports - which had already been growing during 2020 (+4%) - increased by almost 14 percentage points in quantity last year, reaching levels more than 18 percentage points above pre-pandemic levels.

Computers and peripheral equipment (whose global exports rose almost 22 percentage points above 2019 levels) and Communication equipment (+15.9% over 2019) sectors made the largest contributions to growth in the sector.

Significant recoveries were also seen in world exports of Industrial Tools and Equipment, which - after declining by less than 5 percentage points in quantity in 2020 - increased by almost 14 percentage points last year to more than 8 percentage points above pre-pandemic levels.

Within the sector, there were general recoveries (with the only negative exception of Boilers and Furnaces, whose global exports last year were 9 percentage points below 2019 levels), with the largest positive contributions coming from Measuring Instruments, Electromechanical Tools, Pumps and Filters, Lifting and Handling Equipment, Spraying Tools and Tools and Molds.

Double-digit percentage growth - with full recovery to pre-pandemic levels - characterised world exports of Electrotechnical last year (+13.4% compared to 2020, with a gain of more than 6 percentage points compared to 2019).

Particularly noteworthy are the performances of the Electric Motors sector (+13.8% last year in world exports, with a recovery of about 9 points compared to 2019), of Switchboards (+13.7%, with a recovery of 8 percentage points), Lamps and parts of lighting equipment (+12.7%, with a recovery of more than 11 percentage points), Parts for electrical equipment (+16.7%, thus a recovery of almost 7 percentage points), Electrical stuff (+12.3%, thus a recovery of 3.6 percentage points).

Recoveries were also completed for world exports in the Earth-moving Machinery and Agricultural Machinery sectors. In the first case, after the significant penalties of 2020 (-15.3% at constant prices), world exports increased by almost 27 percentage points in quantity, settling at levels more than 7 percentage points above those of 2019. Less intense, but still sufficient to return above pre-pandemic levels, was the evolution of world exports of agricultural machinery (+11.5% compared to 2020, at constant prices), with a gain of about 5 percentage points compared to 2019.

As already highlighted in another article on the subject, world exports of Industrial Machinery showed excellent dynamics last year (+18.9% at constant prices), returning to levels measured in quantity almost 11% higher than in 2019.

The favourable evolution of the sector saw the positive contribution of almost all the main sectors (Machine tools for metals above all), with the exception of Metalworking machinery and Printing machinery, which - although growing in double-digit percentage terms in 2021 world exports - have not yet been able to recover 2019 levels.

Finally, in the case of Industrial Plants, the growth performance of world exports in 2021 "stopped" at +12.2% in terms of quantity, which was nevertheless sufficient to more than offset the reduction suffered the previous year (-10.5%).

Pumps and compressors, Valves and pressure reducers, and Heat exchangers made the biggest contributions to the recovery of pre-pandemic levels. On the other hand, the insufficient performance to ensure a return to 2019 levels for global exports of Boilers and turbines (-3% at constant prices compared to two years earlier), Apparatus for automatic control (-4.4% compared to 2019), Iron and steel plants (which are almost 12 percentage points lower at the end of 2021 than in 2019) and, above all, Chemical plants (with a gap at the end of 2021 of almost 20 percentage points compared to two years earlier) should be noted.

Conclusions

The global capital goods cycle is recovering more quickly from the penalties suffered in 2020 - the most critical phase of the pandemic - than it did during the Great Recession. Indeed, the penalties at that time were greater than those experienced in 2020, due to a financial crisis that had severely affected the investment capacity of international economic operators. On the other hand, the particularly accommodating monetary and fiscal policies adopted in the current cyclical phase have undoubtedly supported the rapid recovery of global sales of capital goods.

An analysis of the 2021 results for world exports of the various capital goods sectors shows a fairly generalised recovery from the downturns seen in 2020. The only sector that is still significantly far from pre-pandemic levels is the automotive sector, which is experiencing both cyclical difficulties, linked to inefficiencies along the value chains that continue to be recorded, and structural difficulties, with a difficult transition from thermal engines to more environmentally friendly ones.

1) The aggregate considered refers to the following sectors: Electrotechnical, Industrial Machinery, Industrial Tools and Equipment, ICT and Service Equipment, Industrial Plants, Automotive, Earth-moving Machinery and Agricultural Machinery.