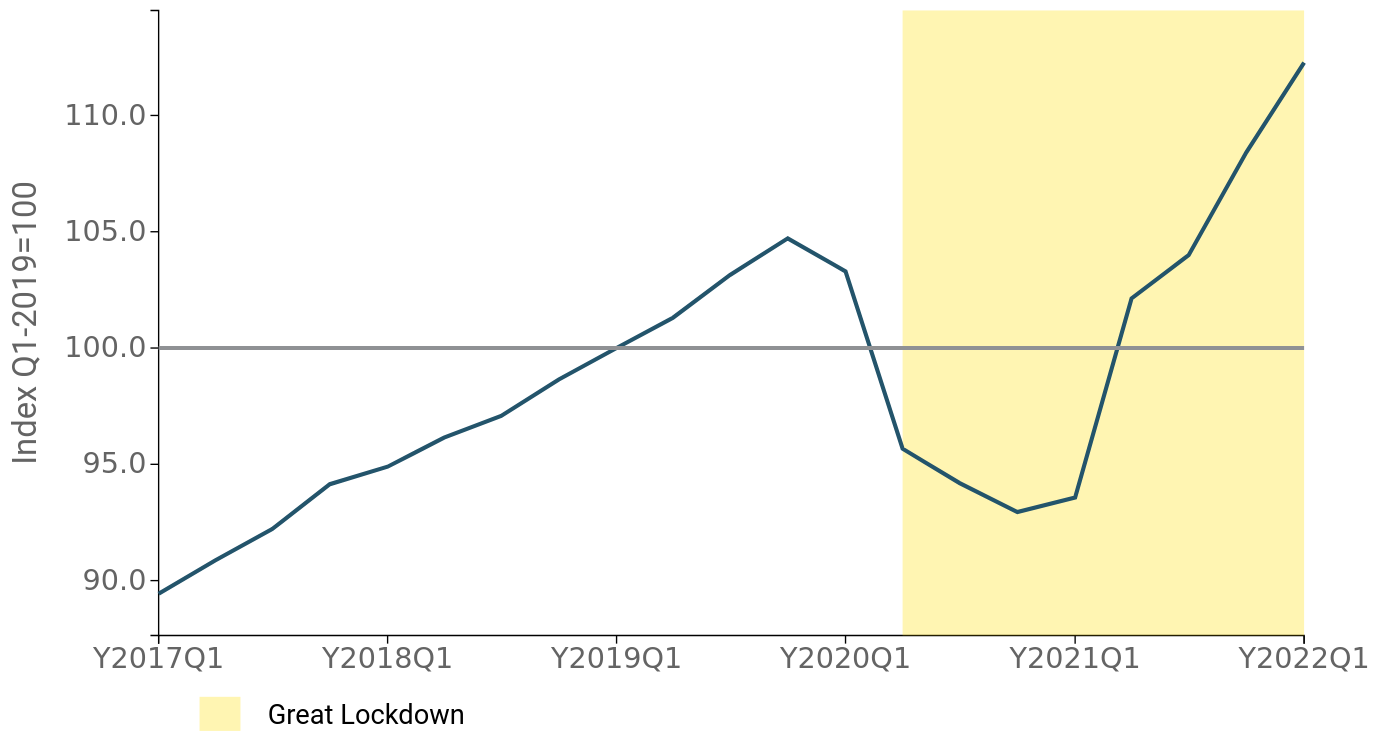

EU Exports of Fashion Products: all major sectors above pre-pandemic levels in Q1 2022

In the first three months of the year, EU exports in euro of the Fashion industry returned 12 percentage points above the corresponding period in 2019

Published by Marcello Antonioni. .

Export Check performance Fashion Europe Conjuncture Global economic trendsThe first quarter of 2022 confirmed the recovery of European sales of Fashion products, which had been particularly penalised by the outbreak of the Covid19 pandemic, when a fall of more than 30% in sales was followed by another two quarters of decreases.

In the first three months of the year, in fact, the EU exports of Fashion products registered a new intense year-over-year increase (+15.6% in the values in euro), on the same development rhythms of the final part of last year.

This resulted in reaching a new maximum point in cumulative annual terms, on values 12 percentage points higher than those of the pre-pandemic period.

Fashion industry: evolution of EU Exports

(quarterly cumulative values, index in current euros)

Source: ExportPlanning-EU Trade Datamart

All major sectors (including those most affected by the pandemic) have recovered to peak levels

In the face of an average decrease for EU Fashion exports of 11.2% during 2020, some sectors had shown particularly significant penalties: Underwear and hosiery (-11.9%), Perfumes and cosmetics (-12.7%), Lenses and spectacles (-16%), Bags, suitcases and wallets (-16.5%), Jewellery and watches (-25.3%).

However, thanks to the recovery that began in 2021 and that for many sectors materialised in the first few months of 2022, all the sectors that make up the Fashion industry recorded EU export values above pre-pandemic levels in the first quarter of 2022.

The vast majority of sectors surveyed reported double-digit growth in EU export values in the first quarter of the year.

The only exceptions, albeit with positive EU export growth rates, were Small appliances for the person (+0.4%, a sector that was not penalised by the pandemic crisis), Photo-Optical (+6.8%) and Books and other products of creative activities (which recorded a gratifying 8.2% growth rate).

In the majority of sectors with double-digit growth in the first quarter of the year, the most significant performances were recorded by European exports of Jewellery and watches (+24.5%), Lenses and spectacles (+22.2%), Bags, suitcases and wallets (+21.2%), Sporting goods and musical instruments (+18.1%), Perfumes and cosmetics (+16.4) and Outerwear (+16.3%).

Fashion-industry: EU Export Performances

(% changes in current euros)

| Q1-2022/Q1-2021 | Q1-2022/Q1-2019 | |

| Outerwear | +16.3 | +14.2 |

|---|---|---|

| Footwear | +11.0 | +4.3 |

| Perfumes and cosmetics | +16.4 | +11.0 |

| Underwear and hosiery | +14.4 | +3.8 |

| Jewellery and watches | +25.3 | +3.3 |

| Bags, suitcases and wallets | +21.2 | +14.8 |

| Books and other products of creative activities | +8.2 | +6.8 |

| Sporting goods and musical instruments | +18.1 | +44.1 |

| Lenses and spectacles | +22.2 | +18.5 |

| Clothing Accessories | +11.2 | +25.7 |

| Bicycles, strollers and invalid carriages | +15.7 | +22.0 |

| Small appliances for the person | +0.4 | +13.8 |

| Photo-Optical | +6.8 | +10.8 |

Source: ExportPlanning-EU Trade Datamart

Comparing the values of Q1 2022 with those of the corresponding quarter of 2019 (pre-pandemic period), the strong increases in Sporting goods and musical instruments (+44.1% in Q1 2022 compared to the corresponding period in 2019) and Bicycles, strollers and invalid carriages (+22%), sectors that were certainly less affected by the consumption crisis of the pandemic period, but above all the recovery of sectors that were more penalised by the "Great Lockdown" phase, such as Outerwear (+14.2%), Bags, suitcases and wallets (+14.8%) and Clothing Accessories (+25.7%).

Conclusions

If it is certainly true that, at least in part, the recovery recorded by European sales of products of the Fashion industry can be attributed to the inflationary phase that is characterising the prices of materials of the main production chains (with an inevitable transfer downstream - at least partial - of the price increases)1, there is no doubt that the European sales of this industry have been able to recover from the penalisations caused by the social distancing measures and the closure of commercial activities in the most acute phases of the pandemic, and that this has exceeded the expectations formulated in the most critical phase of the market.

The European Fashion industry is therefore demonstrating a high degree of resilience and adaptability in an unfavourable competitive environment. It will be important, however, for European companies in the sector - in a context of further turbulence in the competitive context induced not only by the growth in consumer prices, but also by the recessionary winds induced by the Russian-Ukrainian conflict - to consolidate the progress recorded so far, by continuously monitoring demand conditions and comparing their results with those of their competitors in the reference markets2.

1) When measured in physical quantities (kilograms), EU exports of Fashion products recorded a trend growth of +7% in the first quarter of the year, which is much lower than in nominal values in euro. However, in comparison with the corresponding period of 2019, even in physical quantities, the levels of European exports of Fashion products are confirmed to be (slightly) higher than in the pre-pandemic period.

2) To support this specific activity, the ExportPlanning platform provides the Market Barometer tool, which allows a company to assess its performance on foreign markets in real time, using the performance of major competitor countries as a benchmark.