Dental care and Oral hygiene products: Insights from World Trade

World trade data can be a valuable source of information for monitoring ongoing changes in the structure of demand in different countries of the world

Published by Marzia Moccia. .

Health products Foreign markets Consumption pattern International marketingThe last 20 years have been characterised by a significant growth in demand for health goods and products on a global scale, driven by rising per capita income, an ageing population, the development of knowledge and an increasing interest in public and welfare policies. Within this macro-process, particular attention was paid to the demand for dental care and oral hygiene products.

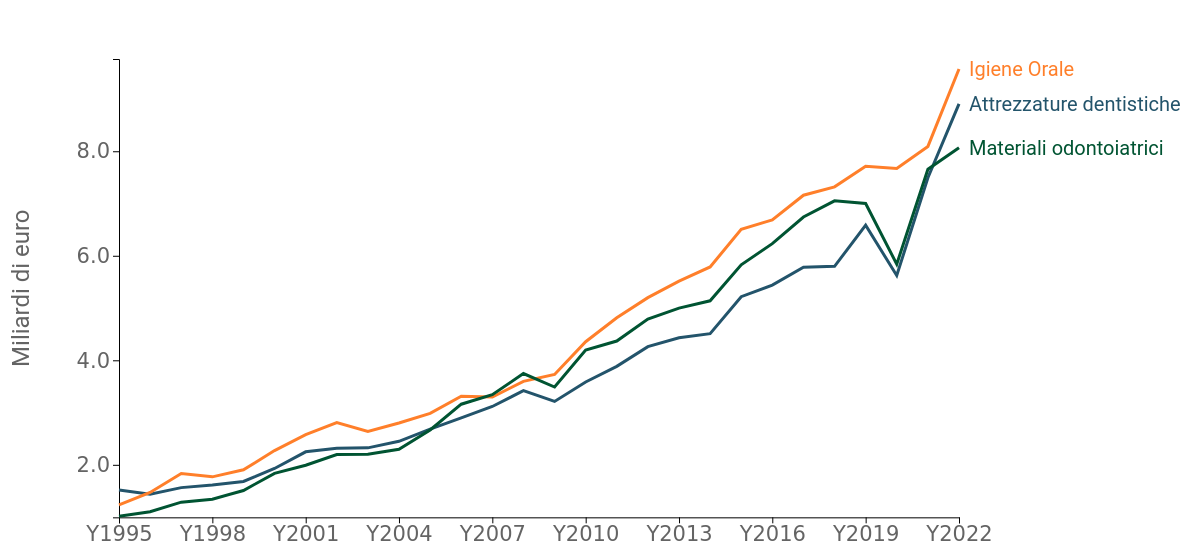

Whereas in 1995 the total trade in goods and equipment for dental care and oral hygiene was worth just over 3.5 billion euro, the first figures for 2022 show a level in excess of 25.5 billion euro, with uninterrupted growth throughout the period. In particular, the increase covered all the main segments of the segment (Fig.1), represented by:

- personal oral hygiene products (toothpaste, dental floss, toothbrushes, etc.);

- dental machinery and equipment (dental chairs, dental drills and instruments, x-ray equipment, etc.);

- dental supplies (dental filling products, artificial teeth and prostheses).

Fig.1 – Worldwide demand for dental care and oral hygiene products

Source: ExportPlanning.

The graph shows that the three sub-segments of the industry are characterised by very similar levels and dynamics. Only the pandemic year has introduced an element of differentiation between the trends of the three series: if in fact the more intense fall in world trade of dental equipment and materials clearly shows the effects of the lockdown on the demand for goods, the use of which takes place in conjunction with personal services, the substantial resilience of oral hygiene products testifies to the resilience of the demand for household goods, which have also found in e-commerce an additional distribution channel to the traditional ones.

The 2009 crisis had already shown the first differences, with hygiene goods holding up substantially and demand for dental care equipment and materials plummeting. However, unlike the pandemic crisis, the intensity of the fall appears significantly different, as personal services were not directly affected in the 2009 crisis. From the second decade onwards, there is a divergence, with the increase in demand for hygiene goods much more pronounced than for dental equipment and materials. As per capita income has risen, demand for hygiene goods has in fact exploded in many emerging countries, while demand for care goods, although sensitive to income growth dynamics, only jumps when two conditions seem to be fulfilled:

- the number of middle-income households becomes significant, thus ensuring a more robust increase in demand;

- the country's education system manages to ensure an adequate supply of professionals.

The post-Covid recovery also seems to have consolidated the development trend that emerged in the last decade, with a further boost in demand for oral hygiene products to nearly EUR 9.6 billion in 2022.

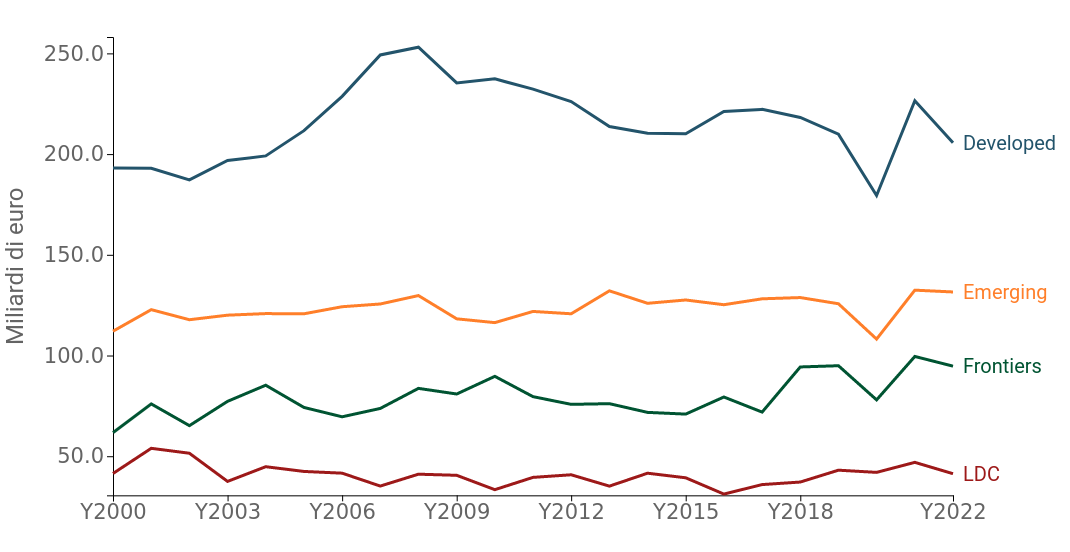

An obvious illustration of this development pattern is provided by the figure below, which shows, for the last two decades, the percentage ratio of purchases of care goods (equipment plus consumables) to those of hygiene goods. This ratio is calculated by grouping the different countries according to their stage of development: developed, emerging, pre-emerging and economically underdeveloped.

Fig.2 - Purchases of equipment and materials as a % of oral hygiene products

Source: ExportPlanning.

The graph highlights the very different levels of this ratio. For developed countries it is close to 200: in these countries purchases for care-related goods are almost double those for hygiene. In emerging or pre-emerging countries, the ratio does not reach 100: consumption for care is limited and does not equal that for hygiene. Finally, in economically underdeveloped countries, low consumption of oral care goods is associated with almost zero consumption of care goods and related services.

Conclusions

World trade data can be a valuable source of information both for monitoring the ongoing changes in the structure of demand in the different countries of the world and for developing market analyses that highlight the different potential of various goods, depending on the characteristics of the different countries, first and foremost their stage of development.