Mechanical Engineering: the BLOC markets of the industrial plant sector

Published by Marcello Antonioni. .

Uncertainty Foreign markets Marketselection Metal industry International marketingThe dynamics of world trade in mechanical engineering for industrial plants

One of the most important sectors of mechanical engineering is the one for industrial plants1. This is a sector that is showing particularly accelerated dynamics of world trade. At the end of 2022, the value of these trades is estimated to have reached approximately 156 billion euros, the new absolute maximum point of the sector.

Even when measured at constant prices, world trade highlighted last year the achievement of a new maximum point, approximately 12 percentage points higher than pre-pandemic levels (2019).

All the main sectors of the sector (except for apparatus for automatic control) have (in some cases largely) recovered their pre-pandemic levels...

At pre-final 2022, within the sector, we note the excellent performance of world trade in the heat exchangers segment, growing last year by almost 26 percentage points at constant (+31.4% in euro values), on levels of over 42 percent compared to 2019.

Another segment with decidedly favorable performances is that of boilers, turbines, engines, which shows an increase in world trade of almost 17 percentage points in the valuation at constant prices compared to 2019, after a 2022 which marked a year-on-year growth of 11 percentage points (+25.3% in euro values).

Double-digit percentage growth compared to 2019 also characterized world trade in the valves and pressure reducers segment (+12 percent at constant prices; +17 percent in euro values), albeit with a 2022 performance slowing down in valuations at constant prices (+4.9%), but still decidedly dynamic in euro values (+17%).

In addition, the world trade of pumps and compressors is slowing down, which in 2022 when measured at constant prices recorded an average annual growth of less than 3 percentage points (+15.9% in euro values), reaching levels almost 10 percentage points higher than the pre-pandemic ones (+21.2% in euro values).

Lastly, the case of the apparatus for automatic control segment should be mentioned, where last year world trade showed limited growth in measurement at constant prices (+5.2%), insufficient to fully recover pre-existing levels -pandemic (-3.6% compared to 2019 in the measurement at constant prices, but +7% in euro values).

World trade in mechanical engineering for industrial plants

| Values 2022 | % changes at current prices |

% changes at constant prices |

|||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Boilers, turbines, engines | 45.1 | +25.3 | +17.4 | +11.0 | +16.7 |

|---|---|---|---|---|---|

| Pumps and compressors | 41.9 | +15.9 | +21.2 | + 2.8 | + 9.7 |

| Apparatus for automatic control | 29.7 | +16.6 | + 7.0 | + 5.2 | - 3.6 |

| Valves and pressure reducers | 24.4 | +17.0 | +21.3 | + 4.9 | +12.0 |

| Heat exchangers | 14.9 | +31.4 | +43.2 | +25.5 | +42.4 |

| TOTAL | 155.9 | +20.2 | +18.8 | + 7.7 | +11.8 |

Source: ExportPlanning-Annual Trade Flows Datamart

.. thanks to the presence of several BLue OCean (BLOC)

markets in an acceleration phase.

The BLOC Markets

Boilers, turbines, engines

In 2022, world trade in the boilers, turbines, engines2 sector exceeded 45 billion euros (+6.7 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

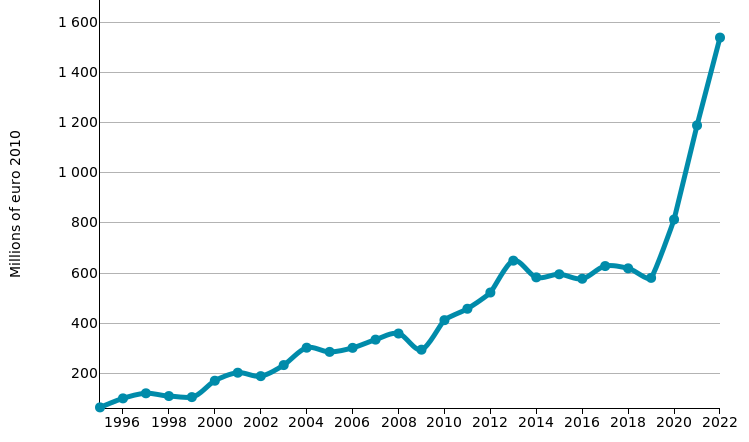

Some of the key BLOC (BLue OCean) markets in the segment are as follows:- Canada: with over 1.6 billion euros in 2022, it is the 5th world importer in the segment, thanks to a performance of significant, quantifiable growth in the last five years (2022/2017) by more than 52 percentage points in values at constant prices;

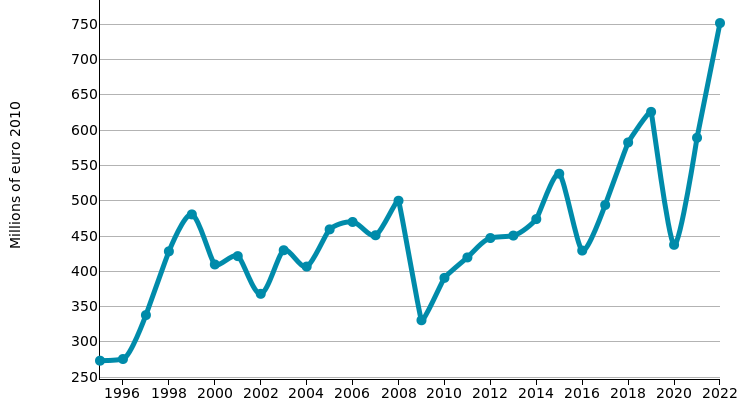

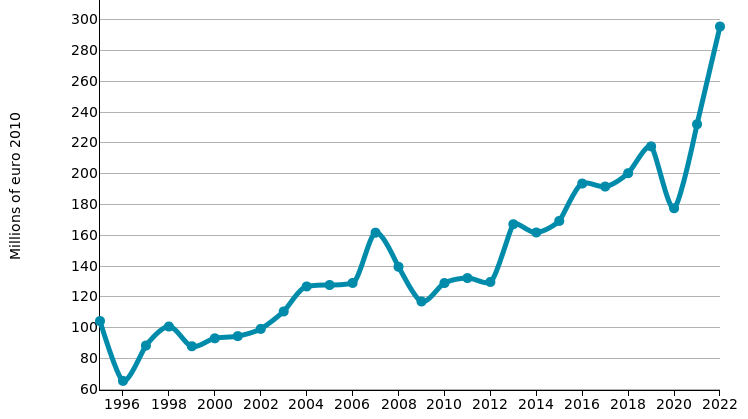

- Poland: as shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the last decade; in the last five years (2022/2017), in particular, there has been an overall increase in imports of almost 54 percentage points in values at constant prices.

Boilers, turbines, engines: selection of BLOC markets

| CANADA | POLAND |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Pumps and compressors

In 2022, world trade in the pumps and compressors3 segment reached almost 42 billion euros (+7.3 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

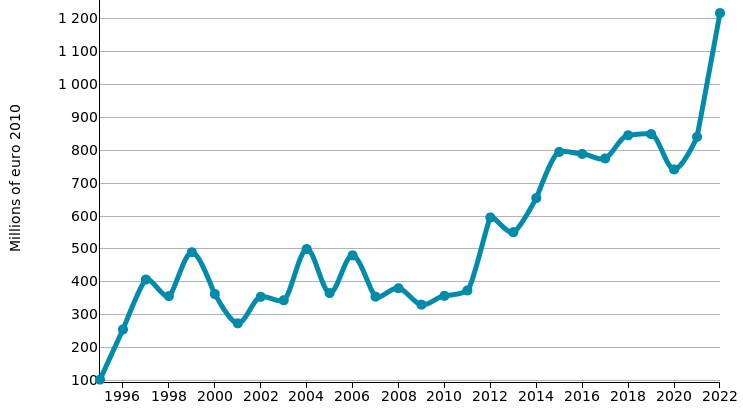

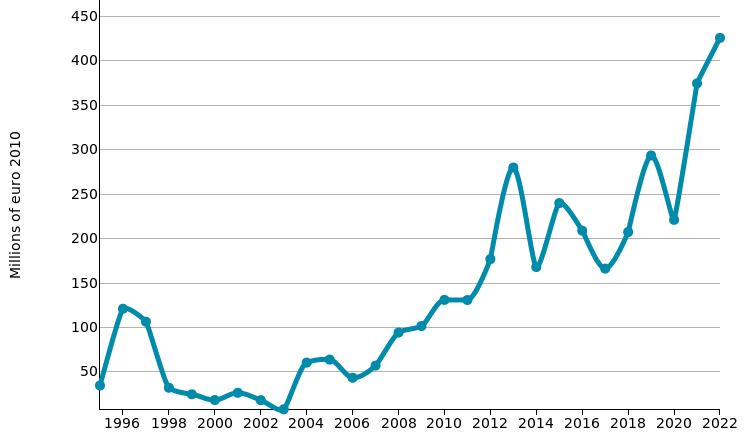

Some of the key BLOC (BLue OCean) markets in the segment are as follows:- Brazil: with 624 million euros in 2022, it is the 19th world importer in the segment; in the last five years (2022/2017) it has shown a particularly accelerated trend in its imports (+109 per cent in values at constant prices);

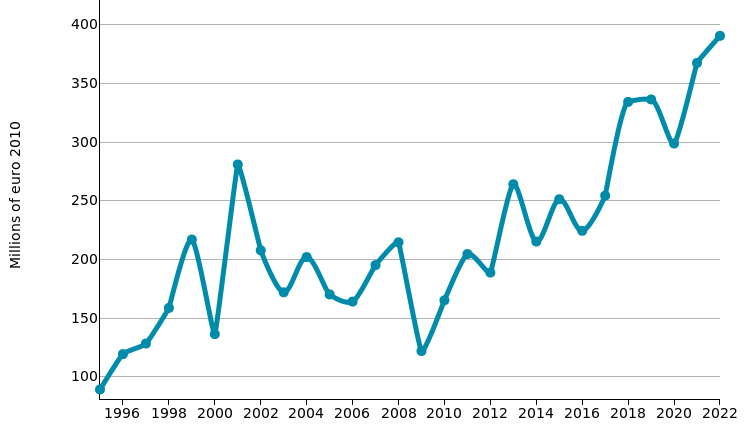

- Vietnam: as shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the last decade; in the last five years (2022/2017), in particular, there has been an overall increase in imports of around 78 percentage points in values at constant prices.

Pumps and compressors: selection of BLOC markets

| BRAZIL | VIETNAM |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Apparatus for automatic control

In 2022, world trade in the apparatus for automatic control4 segment reached a new high point in euro values (29.7 billion euros), almost 2 billion higher than 2019 values. This performance, although not particularly dynamic if measured in values at constant prices, finds support in some BLOC markets (BLue OCean), among which we highlight:

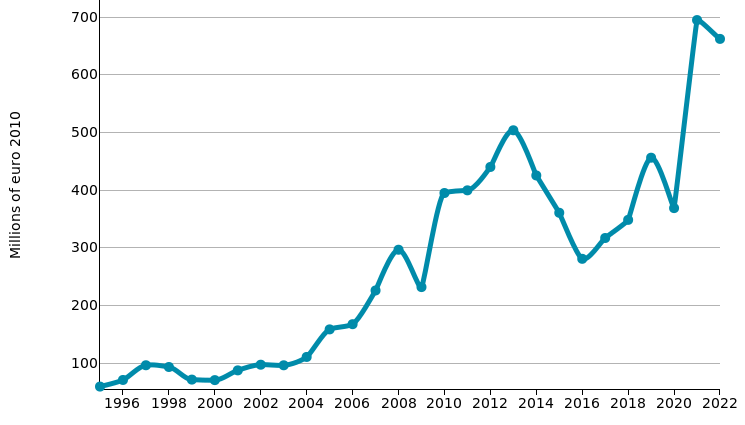

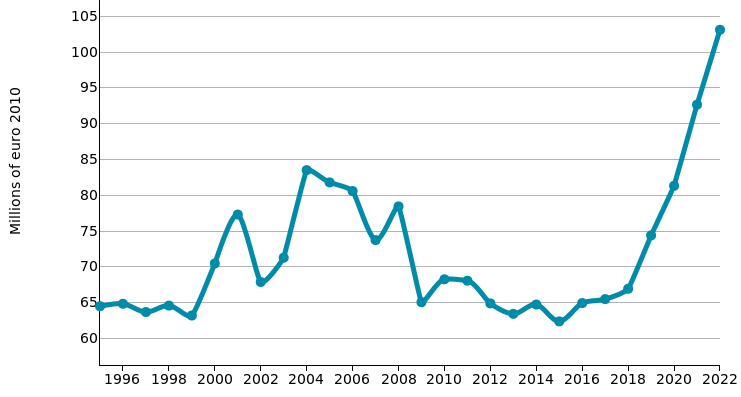

- Brazil: with its 1.4 billion euros in pre-final 2022 it is the fourth largest import market in the segment in the world. As shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the most recent years, with an overall increase in imports of 165 percentage points in values at constant prices in the period 2020-2022;

- Switzerland: with 209 million euros in 2022, it is the 32nd world importer in the segment, but with very accelerated growth dynamics in the most recent period, as evidenced by an overall performance in the last three-year period (2022/2019) of +39 per cent in values at constant prices (see the graph below).

Apparatus for automatic control: selection of BLOC markets

| BRASILE | SWITZERLAND |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Valves and pressure reducers

In 2022, world trade in the valves and pressure reducers5 segment exceeded 24 billion euros (+4.3 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

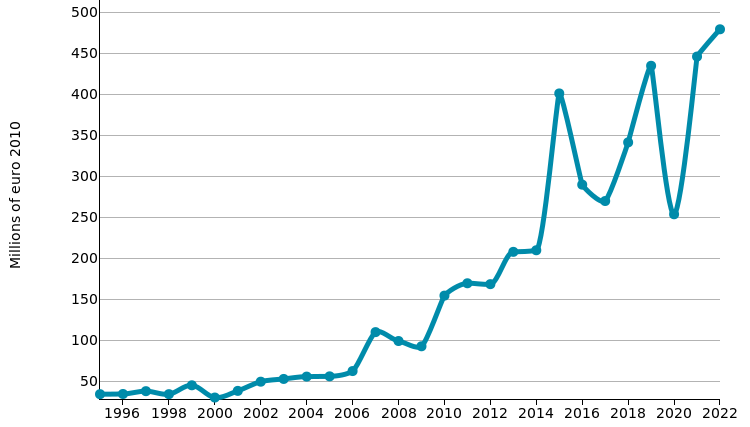

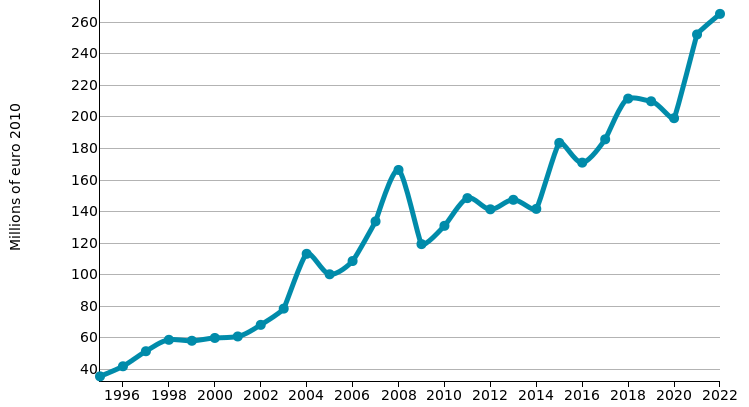

Some of the key BLOC (BLue OCean) markets in the segment are as follows:- Mexico: with its 1.1 billion euros in pre-final 2022 it is the fourth largest import market in the segment in the world. As shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market; in the last five years (2022/2017), in particular, there has been an overall increase in imports of over 43 percentage points in values at constant prices;

- Poland: with 367 million euros in 2022, it is the 19th world importer in the segment, but with decidedly accelerated growth dynamics, as evidenced by an overall performance in the last five years (2022/ 2017) by +43 per cent in values at constant prices (see the graph below).

Valves and pressure reducers: selection of BLOC markets

| MEXICO | POLAND |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Heat exchangers

In 2022, world trade in the heat exchangers6 segment reached almost 15 billion euros (+4.5 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

Some of the key BLOC (BLue OCean) markets in the segment are as follows:- United Kingdom: with 457 million euros in 2022, it is the 7th world importer in the segment, with accelerated growth dynamics, as evidenced by an overall performance in the last three years (2022/2019 ) by +36 per cent in values at constant prices (see the graph below);

- Indonesia: with its 310 million euros at pre-final 2022 it is the 14th import market in the segment in the world. As shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the last period, with an overall increase in imports in the period 2020-2022 of 45 percentage points in values at constant prices.

Heat exchangers: selection of BLOC markets

| UNITED KINGDOM | INDONESIA |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Conclusions

After a particularly dynamic two-year period 2021-2022 for the world trade of mechanical products varies for industrial plant engineering (+15.4% annual average, in euro values), the prospects for the next four years (2023-2026) are much more selective, with expectations of average annual growth in the order of +4.7% in values in euro7.

In such a context of greater selectivity, the search for foreign markets BLue OCean (BLOC), resilient to the cycle, should be a priority for exporting companies in the sector .

The instrumentation made available in ExportPlanning, in the Market Selection module, can allow you to select the so-called BLOC markets, during the acceleration phase of your imports.

1) For a list of the segments analysed, please refer to the relative sectoral description.

2) For a list of the products included therein, please refer to the relevant segment description.

3) For a list of the products included therein, please refer to the relevant segment description.

4) For a list of the products included therein, please refer to the relevant segment description.

5) For a list of the products included therein, please refer to the relevant segment description.

6) For a list of the products included therein, please refer to the relevant segment description.

7) These are sector forecasts formulated by StudiaBo, within the ExportPlanning Information System, based on the latest macroeconomic scenario of the International Monetary Fund.