EU Exports of Capital Goods for Industry: in the first 3 months of 2023

Published by Marcello Antonioni. .

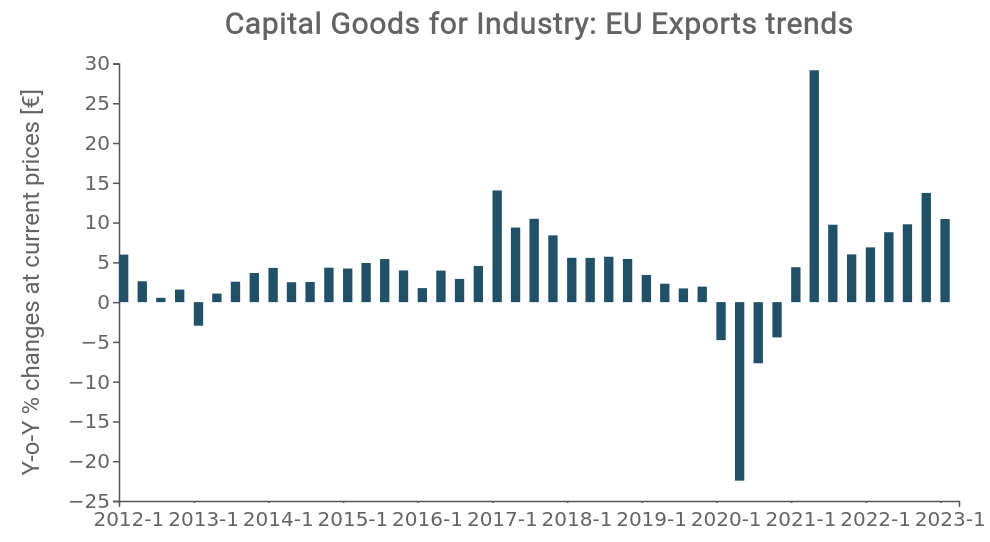

Check performance Metal industry Industrial equipment Uncertainty Conjuncture Slowdown Industries Global economic trendsThe pre-estimates elaborated by StudiaBo, starting from Eurostat data, signal the continuation in the first quarter of 2023 of the expansion phase in the values denominated in euro of the EU exports of capital goods for industry1.

As shown in the graph below, according to the most recent data available in the ExportPlanning Information System, in the period January-March 2023, EU exports - measured at current prices - of capital goods for industry (tools and equipment, machinery and plants, plant engineering) again recorded a double-digit percentage growth trend (+10.5%).

Source: ExportPlanning processing

- year-over-year appreciation2 of the euro against the dollar of 4.4%;

- year-over-year retracement of the prices of raw materials and basic materials in the order of 3.3% for all industrial commodities and 10.6% for all energy inputs (source: PricePedia.it).

The largest positive contributions to the trend growth of EU exports of capital goods for industry came in the recent quarter - in order - from the following markets: United States (+1.7 billion euros compared to the first quarter of 2022), Germany (+€0.7bn), Taiwan, France and Turkey (all with increases close to +€0.6bn), Netherlands and Poland (both +€0.4bn).

Industrial tools and equipment

In the first three months of the year, EU exports of tools and equipment for industry3 marked - for the ninth consecutive quarter - a new trend growth in values denominated in euro, equal to +9.2 per cent.

This is a new high point in the nominal values relating to the first quarter of the year for the European sales of this industry (46.1 billion euros), with an annual accumulated equal to 181 billion euros.

In the first quarter of the year, the largest positive contributions to the trend growth of EU exports of tools and equipment for industry came - in order - from the following markets: United States (+615 million euros compared to the first quarter of 2022), Germany (+€613m), France (+€323m), Turkey (+€284m) and Poland (+€244m).

Machinery

Even for EU exports of machinery4 the first quarter of the year showed - for the ninth consecutive quarter - a growth trend in values denominated in euro, equal to +10.5 per cent.

Also in this case, it is a question of a new maximum point in the nominal values relating to the first quarter of the year for the European sales of this industry (28.2 billion euros), with an annual cumulative equal to 122.4 billion euros.

In the first quarter of the year, the major positive contributions to the trend growth of EU exports of machinery came - in order - from the following markets: United States (+869 million euros compared to the first quarter of 2022), Taiwan (+€694m, thanks to the strong increase recorded in the semiconductor manufacturing machinery sector) and Germany (+€208m).

Industrial plant engineering

In the first three months of the year, EU exports of industrial plant engineering5 confirmed a high dynamism in values denominated in euro, with a trend growth - for the eighth consecutive quarter - by +13.8 percent.

This is a new high point in the nominal values relating to the first quarter of the year for the European sales of this industry (17.2 billion euros), with an annual accumulated equal to 65.6 billion euros.

In the period January-March 2023, the major positive contributions to the trend growth of EU exports of industrial plant engineering came - in order - from the following markets: Turkey (+211 million euros compared to the first quarter of 2022), United States (+€172m), France (+€152m), Germany (+€144m), United Kingdom (+€107m) and Brazil (+€100m).

Conclusions

The data for the first three months of 2023 seem to attest to the continuation of the expansionary phase (in progress for at least two years) European sales of capital goods for industry b>. Although available only in nominal values in euro, the dynamics of EU exports in the sectors analyzed here indicate, in fact, the maintenance of particularly accelerated growth rates, in the double-digit percentage range.

In addition, it should be noted that both the recent trend of reappreciation of the euro against the dollar and also the tendential reduction in the prices of industrial raw materials should have "calmed down" the increases in sales lists in this first part of the year6.

In essence, the resulting signal is of an investment cycle for industry which - at least with reference to the sales of European companies - continues to be favourable, despite the current slowdown in the international economy.

A first hypothesis is that the signs of stability found in the last quarter may actually reflect more of a time lag between orders and deliveries, i.e. that the latter (detected by customs flows) are deliveries of "old" orders, decided on time back.

However, there is a second hypothesis, decidedly more encouraging, which contemplates the fact that the world manufacturing system believes that the recession forecast for the next few months in some of the main Western economies may be of a slight entity and above all transitory, such as not to lead to a downward revision of the demand for capital goods for industry.

1) The aggregate considered includes the following industries: tools and equipment for industry, machinery, industrial plant engineering.

2) In the first quarter of 2023, the average Euro/Dollar exchange rate was 1.07 $ per €, compared to an average value of 1.12 $ per € in the first quarter of 2022.

3) For a description of the sectors included therein, see the related sector profile.

4) For a description of the sectors included therein, see the related sector profile.

5) For a description of the sectors included therein, see the related sector profile.

6) A verification in this sense will certainly come from the next update of the World Trade Datamart of the ExportPlanning Information System, which provides for the deflation of historical series in monetary values, through the measurement of phenomena at constant prices.