First signs of the start of a global energy transition pathway

At a time of declining global trade, electric cars and the electrical engineering industry are bucking the trend

Published by Luigi Bidoia. .

Slowdown Foreign markets Conjuncture Global economic trendsSince the end of 2022, the global manufacturing industry has experienced negative signs, both on the side of production volumes and international trade. This article highlights how the recessionary phase in world industry, started in late 2022, kept going in the first part of 2023 at a very modest pace, showing no particular acceleration. On the contrary, during the spring, thanks to the recovery in industrial activity levels in China, the worldwide downturn seems to have partially eased.

Behind this situation of slowly declining world trade lie very different realities at the country and industry levels. We can analyze these different situations by considering the change in imports of goods for different countries and industries considered in the ExportPlanning Information System.

Imports of goods by country

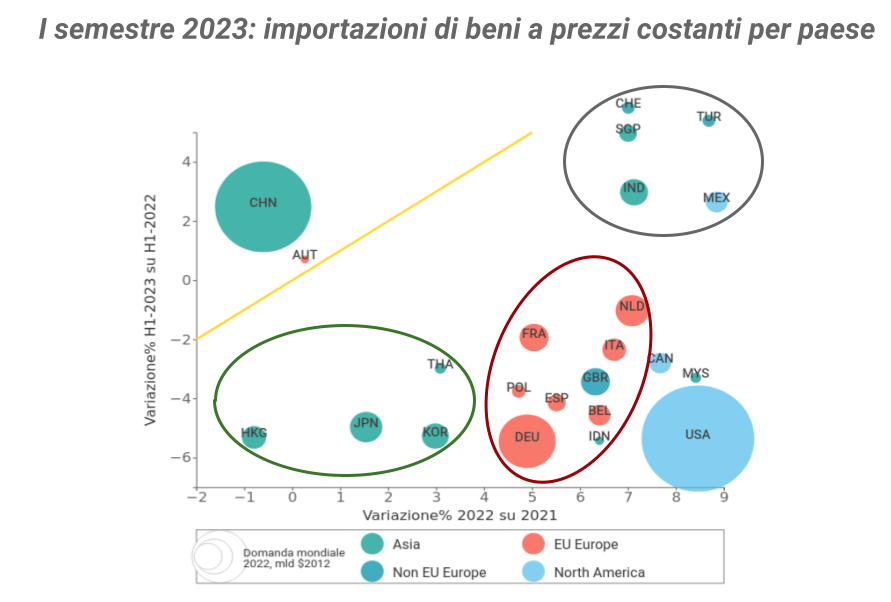

The bubble map below shows the world's major economies, positioning them based on the rates of change in goods imports at constant prices recorded in 2022 (X-axis) and the first half of 2023 (Y-axis). Imports are measured in constant prices to allow for a reading of the dynamics, net of price changes.

The bisector is plotted in the map, which allows us to highlight the countries (positioned above the bisector) that experienced accelerating rates of change in goods imports in the first half of 2023. Only two countries appear positioned in this area of the map: China and Austria. All other countries are positioned below the bisector, signaling a phase of slowing growth or increasing declines.

Given the size of the Chinese economy, all chances for the recovery of world trade rest, therefore, on China. The acceleration of Chinese imports, however, is not very strong and does not reach +3%.

As reported before, all other countries experience a phase of deceleration for imports, with significant differences among them. Four clusters of countries can be clearly identified:

- North America, characterized by a very strong slowdown, especially Canada and the United States, which go from just under 10 percent growth to a sharp reduction in just a few months;

- Industrialized Far East (Japan, South Korea and Hong Kong), whose low growth in 2022 is translating into a significant reduction in imports in 2023;

- Europe, led by Germany, which is positioned between the industrialized Far East and North America, with significant reductions in imports after an all in all favorable 2022;

- the resilient economies, led by India, whose slowdown is significant but not such as to bring imports into negative territory in 2023.

World imports by industry

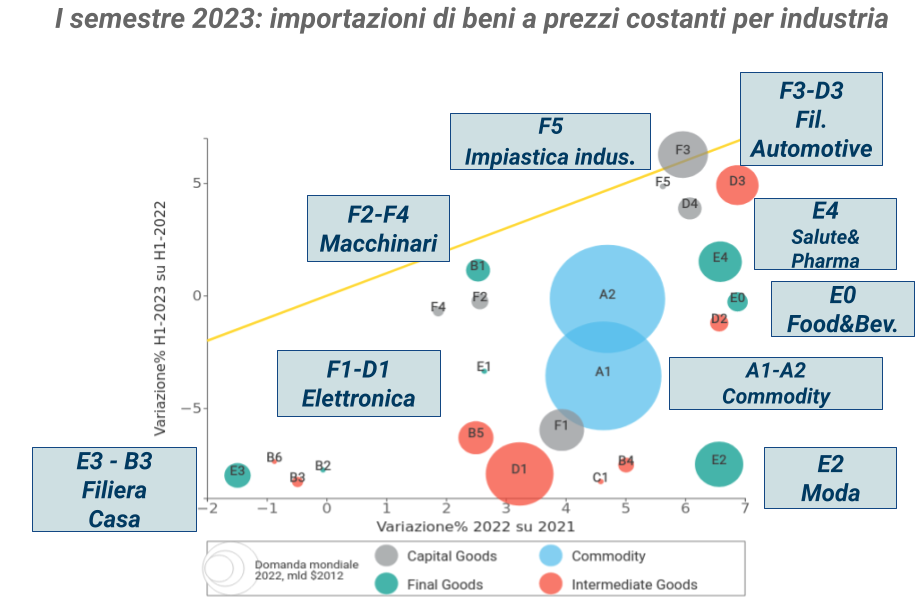

Equally informative is the bubble map of world imports by industry, shown here.

The analysis of this map allows to highlight elements that characterize the current world trade conjuncture:

- the automotive supply chain, both means of transport (F3) and components (D3), emerges as the most supportive factor in the current economic phase of world trade, following the 2020-2021 two-year downturn. Of course, the driver of this growth is the electric car, whose world trade at constant prices is increasing at rates of around 40 percent;

- the capital goods industry (Machinery and Equipment) is also resilient to the current economic situation, with positive rates of change close to those recorded last year. It is not easy, however, to interpret this dynamics. It may, in fact, reflect either the maintenance of a discrete propensity to invest, unscathed by the current economic situation and the rise in interest rates, or also a delay between investment decisions and the delivery of purchased goods. In the latter case, the continuation of a growth phase in world trade in machinery would be the positive, fading effect of investments decided between late 2022 and early 2023;

- the home system is the sector experiencing the strongest slowdown, already begun in 2022. The sector discounts the normal downward phase that durable goods exhibit after periods of strong growth;

- very strong is the slowdown in world trade of the fashion system, whose imports fell from +6.5% in 2022 to -7% in the first half of 2023. This slowdown is the result of a worldwide change in consumer choices, induced by rising prices and shrinking affordability, eroded by inflation and rising rates;

- also significant is the slowdown in the electronics industry, both finished goods (F1) and components (D1). It reflects more "normal" user purchasing policies, after product shortages had led distributors and users to increase precautionary inventory levels during 2021 and the first part of 2022;

- prudent purchasing policies are the main determinant of the slowdown in imports of intermediate metal (B4) and chemical (B5) goods;

- instead, the resilience of world imports of electrotechnical goods seems to suggest the start of a global energy transition path.

Conclusions

Signs emerging from world merchandise trade indicate a sharp divide between the world's two major economies. On the one hand, albeit slowly, China's recovery is consolidating; on the other, the slowdown in U.S. imports is very strong. The sectoral analysis brings out the first signs of the start of an energy transition process, greater caution in corporate purchases of raw materials, semi-finished goods and components, and the collapse of compressible consumer items (home and fashion).

The high dispersion of economic dynamics, both at the country and sector level, suggests that exporting companies should carefully analyze the potential expressed by different foreign markets, especially in view of the 2024 budget. Indeed, at the budget stage, it will be crucial to direct resources for marketing and commercial investments toward the most promising markets.