Trade Policy Uncertainty and Global Trade: Current Trends and Future Outlook

Published by Marzia Moccia. .

Uncertainty Trade war IMF Global economic trends

“We are entering a new era as the global economic system that has operated for the last 80 years is being reset”, with this statement the Chief Economist and Director of the Research Department of the International Monetary Fund, Pierre-Olivier Gourinchas, introduced the new World Economic Outlook, published last April 22.

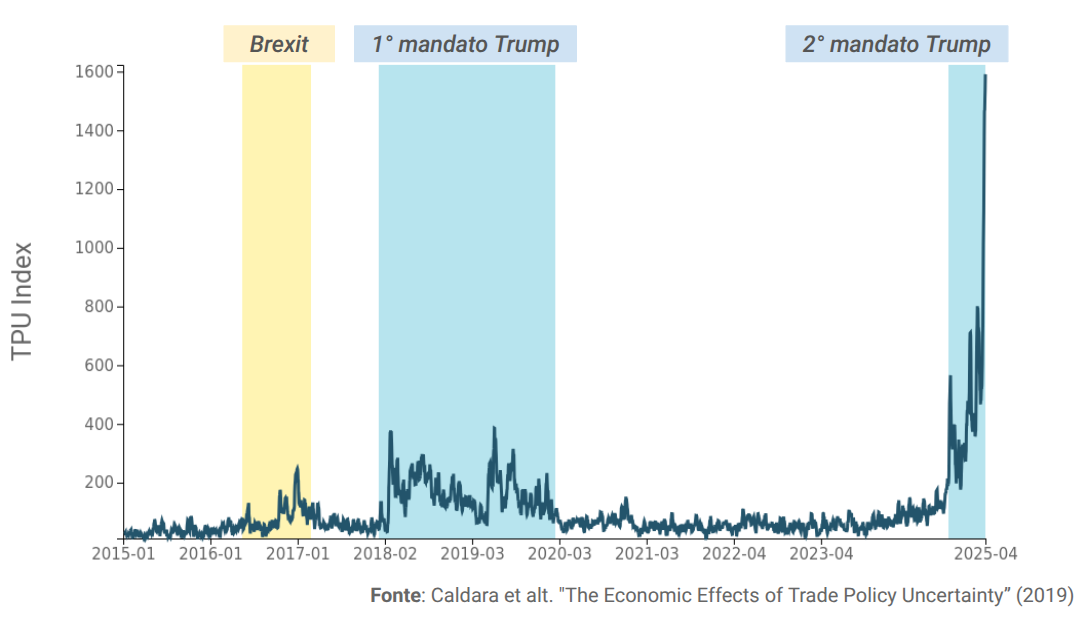

The uncertainty characterizing the international scenario has, in fact, seen a sudden and rapid increase in recent months, particularly in its component related to trade policy. The return of the Trump administration and the protectionist spiral of U.S. trade policy, culminating in the announcement of generalized tariffs on April 2, has led to an unprecedented surge in trade policy-related uncertainty, making it a key factor in global economic growth prospects and, naturally, in foreign trade.

As shown in the graph below, the Trade Policy Uncertainty Index reached peak levels in recent weeks, rising to values nearly four times higher than those recorded during the first Trump administration.

Fig.1 - Global Trade Policy Uncertainty Index

(daily dynamics, 7-day moving average)

In the current context, businesses are therefore facing a broad-spectrum uncertainty scenario, which significantly affects planning activities and investment and growth prospects, severely threatening the recovery path that world trade had begun during 2024.

What signals can we, then, draw from the information regarding the first quarter of the year, and what trend had characterized it in the most recent period?

Global trade in Q1 2025

The availability of ExportPlanning pre-estimates for the first three months of the new year – accessible through the Global Economic Outlook datamart – allows for a current assessment of the most recent dynamics in global goods trade.

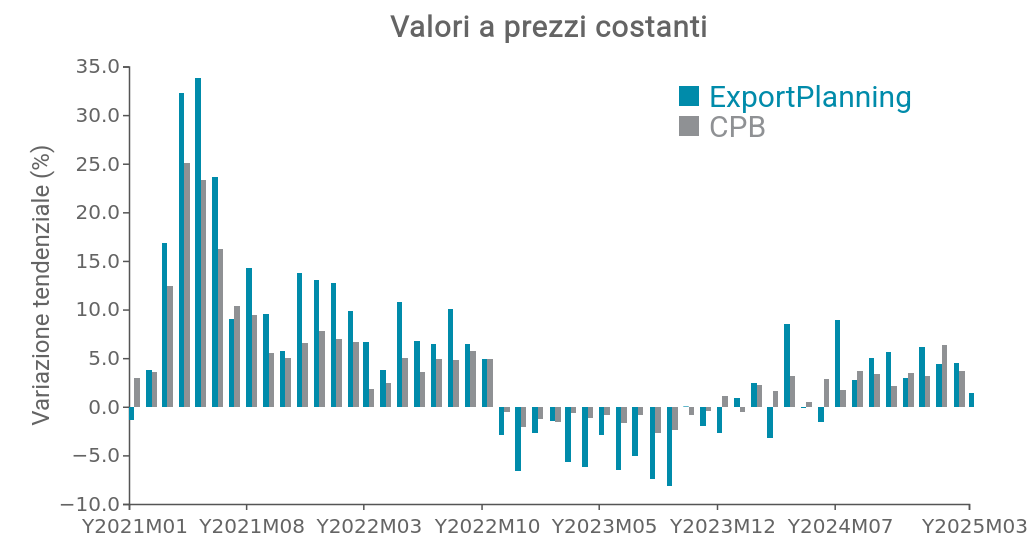

Figure 2 shows the series of monthly quarterly changes in world imports of manufactured goods at constant prices, that is, net of price and exchange rate dynamics, comparing data collected and systematized by ExportPlanning with those of the Central Planning Bureau, an institute that also collects and processes information on international goods trade.

Fig.2 - Global demand in dollars

(CPB data vs ExportPlanning data, year-over-year change)

Source: ExportPlanning elaborations.

Both sources document how 2024 was a year of substantial recovery in trade flows; a recovery that began in the early months of last year, but that solidified especially at the end of 2024. Overall, ExportPlanning estimates indicate a 3% rebound compared to the decline in 2023.

The data for the first quarter of the new year is particularly interesting, as it represents a substantial continuation of the growth trend that characterized trade in the winter months and reasonably includes a so-called “inventory effect,” anticipating the entry into force of the new U.S. tariffs. In the January–March 2025 period, world imports are estimated to have grown by 3.4% compared to the same period last year.

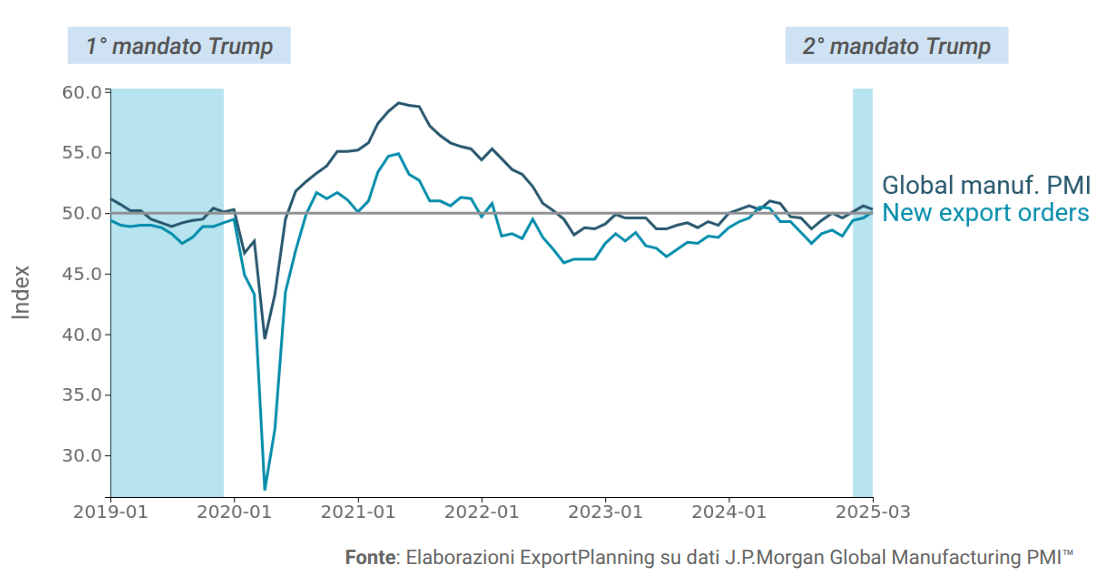

In this regard, the comparison with signals from the global Manufacturing Purchasing Managers' Index (PMI), a real-time indicator of economic performance that synthesizes future prospects for industrial activity levels based on companies’ purchasing declarations (Fig.3), is noteworthy: values above the threshold of 50 indicate expectations of expansion, while values below signal deteriorating expectations.

Fig.3 - Global manufacturing PMI and New Export Orders

(the grey line marks the neutrality threshold of 50)

During March, economic operators' expectations regarding overall manufacturing output – which had just returned above the 50 threshold – registered a relative decline. However, this does not yet seem to affect the New Export Orders component, a leading indicator for foreign trade dynamics, which is currently at the reference threshold, indicating a continued improvement in expectations that has remained unbroken in recent months.

This effect was also observed in 2019, when the outbreak of the U.S.-China trade war led to a slowdown in international trade: the decline in expectations for overall manufacturing output preceded the downturn in foreign orders.

The surge in trade policy-related uncertainty therefore comes at a time of recovery in global goods trade, significantly impacting the 2025 growth outlook. Net of anticipatory purchasing dynamics that may support trade flows in the short term, major international forecasters have sharply revised down their estimates for global goods trade growth for the current year. According to the WTO, it is expected to contract by 0.2%, compared to the previous forecast of 3.1% growth.