Conjunctural scenario of the european exports in the second quarter of 2025

European non-EU exports slow: decline to Asia, positive signs from emerging markets

Published by Silvia Brianese. .

Europe Conjuncture Global economic trendsThe latest update of the EU foreign trade data, collected by ExportPlanning within the Conjuncture EU Countries datamart, provides an overall picture of the trend in European exports over the past three years, with a focus on the first two quarters of 2025.

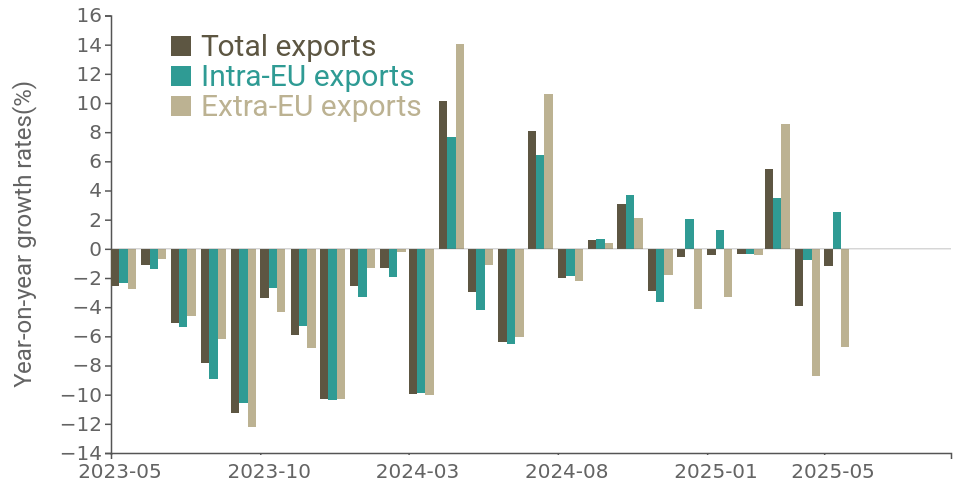

The graph shows the time series of monthly European exports trend changes, broken down by destination: intra-EU and extra-EU

Year-to-year changes of the EU exports in euro (monthly)

After the complexities of 2023, the dynamics of European exports in values showed signs of recovery during 2024, albeit with some discontinuity. In contrast, a more volatile trend was recorded at the turn of 2024 and the first part of the new year, as the framework of international uncertainty brought by the second Trump administration deteriorated. While until the last months of 2024, intra-EU and extra-EU exports had in fact followed a similar trend, since December 2024 there has been a gradual displacement between the dynamics of the two flows, which has continued into the first months of 2025.

In particular, extra-EU exports recorded negative changes in almost all periods, while intra-EU exports remained in generally positive territory.

However, it is not the US, which is still in an inventory advance phase, but a highly differentiated profile of EU sales performance in the major destination markets outside the EU that has led to the negative extra-EU result.

Which trading partners are “driving” the drop in non-EU exports in Q2 2025?

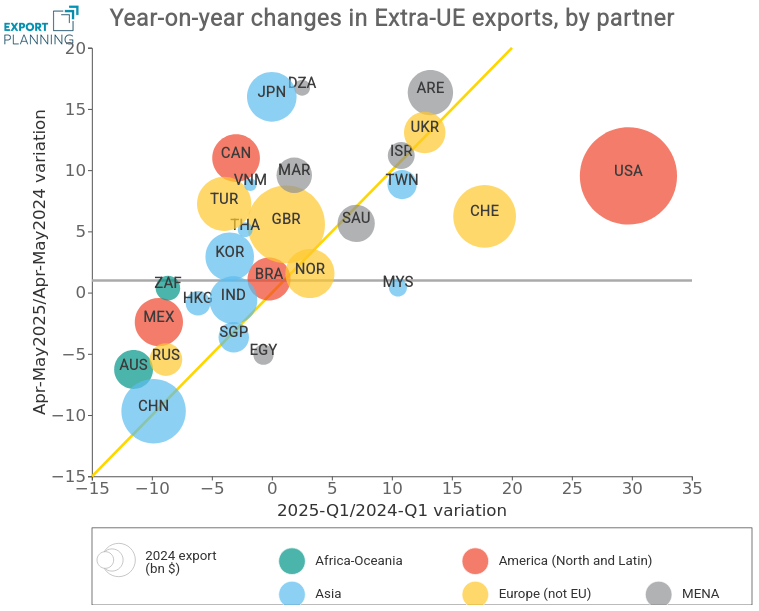

The graph below shows the top destination markets for European non-EU exports, comparing the trend change in euro of European exports recorded in the first quarter of 2025 and that for April-May 2025 compared to the same period of the previous year.

It is clear from the graph that the contraction of European exports to non-EU countries in the first two quarters of 2025, compared to the same periods in 2024, is mainly attributable to the decrease in exports to China.

In fact, the European Union is caught between the need to protect itself from Chinese overcapacity entering the single market, which is bound to increase with the introduction of US tariffs, and the desire to increase the geographies served with a view to market diversification.

Along with China we also find Mexico and Australia, as well as several Asian countries, including India and Singapore.

The United States, as discussed in the article "US imports of goods after Liberation Day", remains a destination to which European exports are growing in the first two quarters of 2025, mainly due to the pharmaceutical sector and the advance of inventories by US companies; however, compared to the first three months of the new year, the marked slowdown observed in April and May is evident.

Finally, Arab Emirates, Algeria, Canada, Japan and Vietnam are confirmed as interesting economies, having recorded growth in imports of European goods in early 2025. In particular, an increase in exports of jewellery and precious metals, as well as fashion products such as clothing, accessories and footwear, can be observed to the UAE. Relevant sectors for European exports to these countries also include pharmaceuticals and alcoholic beverages for Canada and Japan, and food (especially meat and fish) for Vietnam and Algeria.

The “resilient” economies also include the large markets of United Kingdom, Switzerland and Turkey.

Conclusions

The economic picture outlined shows that the geographical profile of European non-EU exports in the first two quarters of 2025 is highly heterogeneous. Alongside declining markets, such as China and Mexico, there are counter-trend areas that continue to show signs of vitality, such as the Arab Emirates, Canada and some countries in South-East Asia and North Africa.

This high degree of differentiation and dispersion of results suggests the importance of carefully monitoring the evolution of demand conditions in individual markets, taking into account both sectoral dynamics and the political and trade context.

Fostering market diversification strategies and adapting to changes in the global context are therefore key tools to support the competitiveness of European exports in a complex and changing economic environment.