Chinese Exports 2025: Asia Grows, US and Russia Decline

Published by Simone Zambelli. .

Trade war Uncertainty Export Asia Global economic trendsAs highlighted in the article “Chinese exports between US protectionism and global overcapacity”, the impact of US tariffs on Chinese exports varies significantly across industrial sectors, with some able to redirect sales and others more exposed. A similar pattern emerges on the geographical front: in the first eight months of 2025, Chinese exports show very different trends depending on the trade partner, reflecting both new opportunities and tensions in Beijing’s international economic relations.

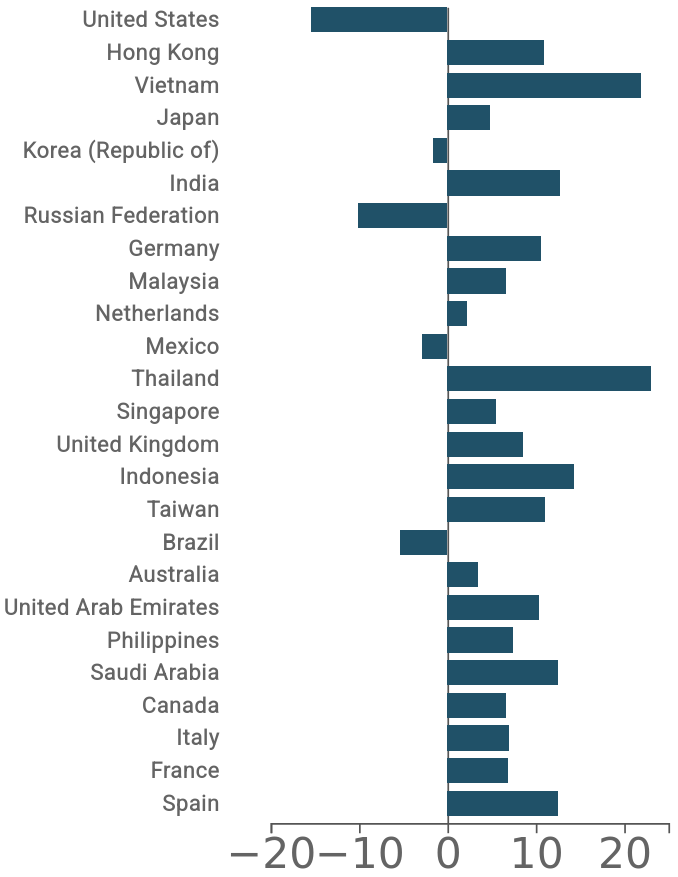

The chart below illustrates the year-on-year % variation, expressed in dollars, of Chinese exports to the main trading partners (ranked by relevance in 2024) in the first eight months of 2025 compared to the same period in 2024.

Chinese exports by trading partner

(Year-on-year % variation in dollars)

Source: ExportPlanning

Thailand and Vietnam lead the ranking of increases, with variations above +20% compared to the same period in 2024. Indonesia also records a double-digit increase (+14%). This confirms the central role of Southeast Asia in China’s diversification strategies, with the region increasingly establishing itself as a fast-growing industrial and consumer hub.

Alongside Southeast Asia, India also stands out as an expanding market, with imports from China growing by around +15%. Despite geopolitical tensions, trade flows between the two Asian giants remain strong, driven by electronics, machinery, and intermediate goods.

The United Arab Emirates and Saudi Arabia show robust double-digit growth, a sign of increasing energy and industrial interdependence with Beijing. The area thus consolidates as one of the emerging poles for Chinese exports.

In Europe, Chinese exports rise to Spain, France, Italy and Germany, with variations between +6% and +12%. This is a sign of resilience in trade relations, despite European debates on industrial protection and strengthening internal supply chains.

The most negative figure concerns the United States, where Chinese exports fall by -15%. The decline is mainly linked to the punitive tariffs introduced by the Trump administration, which hit technology, electronics, and manufacturing.

Latin America is also weak: Mexico records a slight decline, while Brazil shows a -5% drop, highlighting a contrasting dynamic within the region.

Completing the picture of difficulties is Russia, where Chinese sales return to decline after the boom of 2022-2023 linked to Western sanctions. The reorientation towards Moscow therefore seems to have reached its limit.

Conclusions

The overall picture is that of a Chinese industry progressively shifting the center of gravity of its exports: strongly expanding towards Southeast Asia, India and the Middle East, while contracting in American markets and in Russia. Europe, despite tensions and defensive measures, continues to grow and remains a key destination.

The map of Chinese exports therefore appears fragmented but in transformation: Beijing strengthens ties with its Asian neighbors and Gulf energy partners, while consolidating its presence in Europe. A shifting mosaic that demonstrates China’s ability to adapt to an uncertain global context and confirms its central role in redefining the balance of international trade.