Luxury on the Wrist: High-End Watch Trade is Growing

Published by Marzia Moccia. .

Foreign markets Premium price Foreign market analysisAs anticipated in the article New frontiers of growth for luxury: Leather goods in the markets of Thailand, Malaysia, Turkey and Poland, in recent years the debate has grown around the increasing vulnerability of the high-end segment in the face of an increasingly unstable international environment and the new consumption habits and purchasing strategies of international consumers.

In this context, the availability of foreign trade information systematized by ExportPlanning makes it possible to apply an analytical, data-driven approach, providing an objective view of the dynamics that have shaped international trade and the composition of demand. The analysis of the global trade in high-end watches represents an emblematic case.

Global watch trade

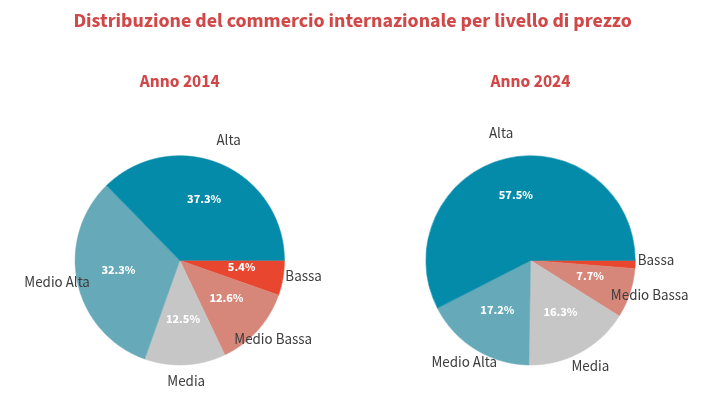

In 2024, global trade in watches reached a value of €51 billion, following a gradual post-pandemic recovery. Particularly significant is the data relating to the breakdown by price range: international trade in ultra-high-end watches, identifiable with the highest price segment, now accounts for over 57% of the global market for watches. When including the upper-medium segment, roughly 75% of global trade in these products is concentrated in high value-added categories.

Source: ExportPlanning - Reporting Tool

The increase in the share of the most premium price ranges has been particularly significant for the segment of mechanical wristwatches, which have undergone a progressive product transformation over the century, becoming true status symbols. Unlike electronic wristwatches, mechanical watches have gradually evolved from tools designed solely to measure time into objects of design and prestige—genuine fashion accessories, and at times even fine pieces of jewelry to be collected and displayed on special occasions. This evolution appears to have shielded them from the competition of new-generation wrist devices such as smartwatches and fitness bands.

The growth of the luxury segments in watchmaking has involved major international markets such as the United States, the United Kingdom, France, Germany, and China. However, two markets stand out for their sharp increase in high-end watch imports: South Korea and the United Arab Emirates.

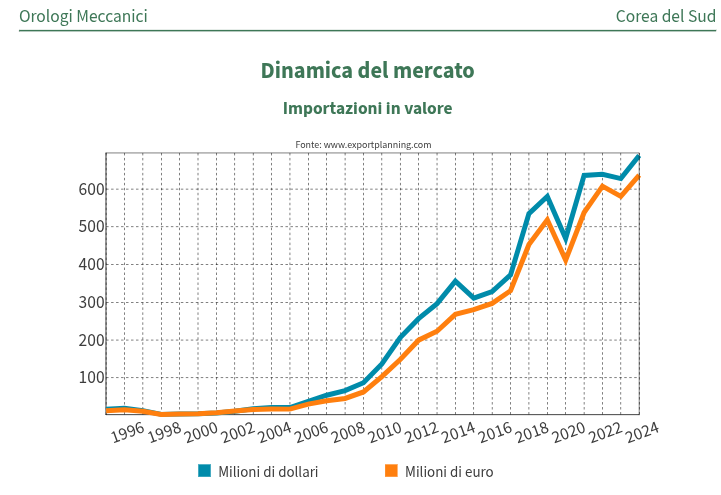

The rise of South Korea’s mechanical watch imports

The South Korean market has experienced a rapid and robust growth in imports of mechanical watches over the past two decades, reaching a value of €636.8 million in 2024.

Although there remains ample room for further growth, it is noteworthy that the country’s imports are almost entirely concentrated in the higher price ranges.

Source: ExportPlanning - Reporting Tool

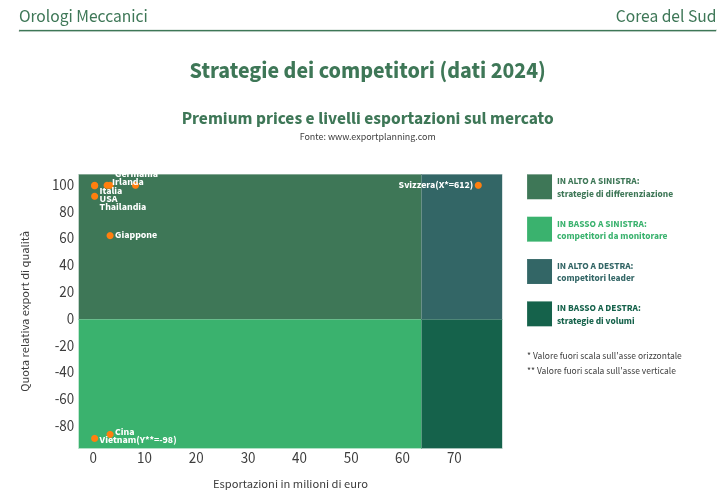

The market is largely dominated by Switzerland, which holds an undisputed global leadership thanks to its long-standing tradition in the sector. However, among the players with smaller export volumes but strong positioning in terms of premium pricing, we also find Italy.

Source: ExportPlanning - Reporting Tool

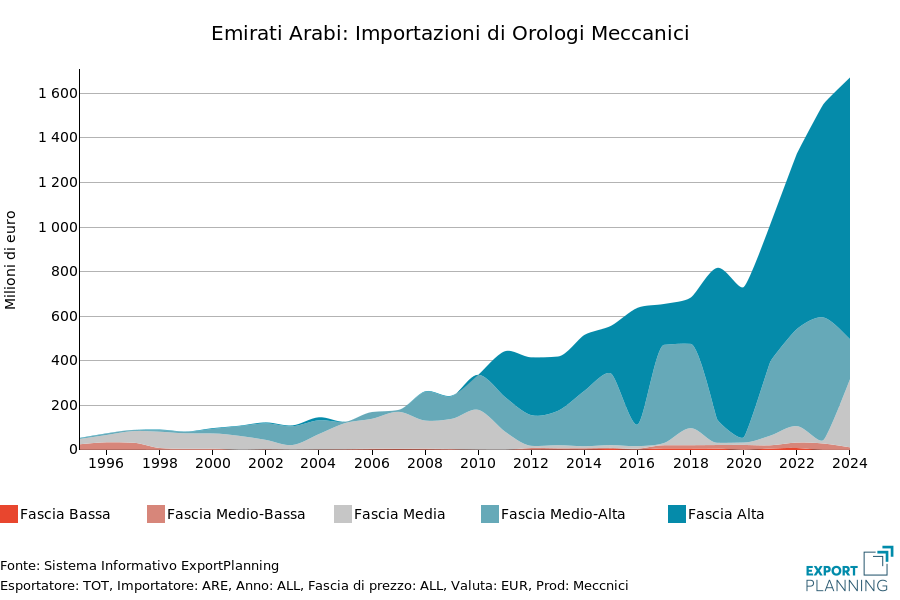

The growing relevance of the Emirati market

While the expansion of South Korea’s Asian market has developed steadily since the Great Recession, a surge that has been particularly remarkable in the post-pandemic period concerns the United Arab Emirates: in just a few years, the value of mechanical watch imports has essentially doubled, focusing on the most premium price segments.

Source: ExportPlanning - Reporting Tool

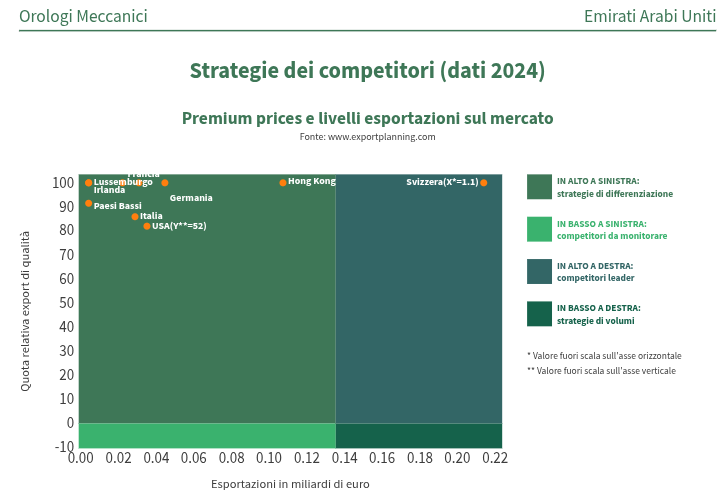

Here too, Switzerland maintains an undisputed leadership position; however, Italy appears to be carving out a niche market.

Source: ExportPlanning - Reporting Tool

In the watchmaking industry, the ability to combine tradition with distinctive product features remains a key element of competitive resilience. Economic uncertainty and growing market volatility have supported a further upgrading of demand, which has shifted toward higher quality and more prestigious segments. On one hand, there is a growing interest in high-end watches as a form of tangible investment; on the other, there is a clear need to imbue the object with symbolic meaning—as an expression of identity, taste, and status symbol.

Conclusions

The evolution of the high-end watchmaking sector highlights its ability to combine tradition and innovation, maintaining its appeal even in an uncertain global context. Demand is increasingly focused on products with high symbolic and qualitative value, reaffirming the role of the mechanical watch as an emblem of identity, investment, and style. In this scenario, the analysis of international trade flows proves to be an essential tool for identifying and interpreting new market trajectories.