From Sales Attempts to Strategic Planning: The Role of Geopolitics in Shaping Firms’ Internationalization Decisions

Published by Marzia Moccia. .

Planning Conjuncture Foreign markets Uncertainty International marketing International marketing Recent developments have made it increasingly clear that the international environment is characterized by a growing and persistent level of uncertainty and geopolitical instability, directly affecting both operational conditions and strategic decisions for companies.

Trump’s second term further accelerated this trend, highlighting how political and strategic factors can quickly translate into tangible economic impacts for firms operating abroad. Tensions between major economic regions, including the transatlantic corridor, rising regulatory and trade uncertainty, and the increasing fragmentation of value chains are no longer exceptional events, but represent a new structural international framework in which companies must operate.

Geopolitics as a central factor in companies’ internationalization decisions

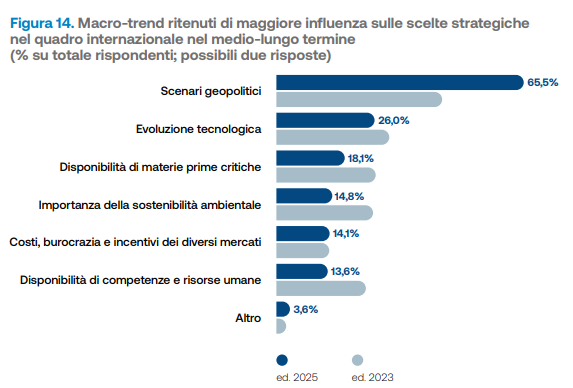

This trend is clearly reflected in the 2025 Internationalization Survey by Confindustria Lombardia, which involved over one thousand companies and provides a snapshot of one of Italy’s most important industrial systems in the midst of strategic adaptation.

Source: 2025 Internationalization Survey – Confindustria Lombardia

65.5% of respondents identify geopolitical scenarios as the macro-trend with the greatest influence on medium- to long-term internationalization strategies, up significantly from the 2023 edition. Notably, more than 7 out of 10 companies report having adjusted their strategy in response to ongoing geopolitical changes: 28.1% assess partners more carefully, 25% review budgets more frequently, and 23.1% have redirected exports toward markets considered “safer.”

If geopolitics becomes a determining factor in internationalization strategies, what are the operational implications?

Such an uncertain and rapidly changing international scenario could lead SMEs in particular to favor a "trial export" approach. Trial export typically falls under passive export, representing the initial stage of international activity in which a company has no structured internationalization strategy yet and responds opportunistically and reactively to foreign inquiries. Market access often occurs without an organized development plan, following occasional contacts, trade fairs, direct requests from foreign customers or intermediaries, or through existing business relationships.

Is resorting to the typical tactical approach of a “trial sale” really a solution?

From an operational perspective, trial export is characterized by a low level of strategic planning, which makes it quick to implement, with management of foreign relations often handled by staff already engaged in domestic markets.

However, this apparent initial flexibility comes with significant structural limitations, primarily the sporadic nature of revenue. When a significant share of foreign turnover comes from occasional market penetration, it becomes difficult for a company to plan growth and development on a stable basis, relying on inherently fluctuating resources. The absence of preliminary market analysis and prioritization tools often results in fragmented operations, increasing exposure to commercial and operational risks.

In this context, reflection on market diversification and focus becomes central to moving from an opportunistic approach to a more structured export strategy.

Geographic diversification spreads risk across regional economic cycles, political-regulatory instability, and local shocks, allowing downturns in some markets to be offset by better performance in others. At the same time, it increases managerial complexity and demands strong organizational capabilities.

Focus involves selecting a limited number of priority markets based on alignment with the company’s value proposition, available distinctive competencies, and foreign demand potential, enabling more efficient allocation of resources. However, excessive concentration can reduce resilience in an increasingly volatile global context, where trade wars, sanctions, or new alliances can rapidly reshape established scenarios.

This highlights the need for a dynamic balance between diversification and focus, capable of overcoming the limitations of trial export and supporting more stable, informed international growth.

Faced with these trade-offs, the real challenge for companies lies in combining a sustainable mix in the short and medium-to-long term through continuous monitoring, risk analysis, and strengthened operational flexibility. A hybrid solution can ensure rapid adaptability to changes in the international environment.

Strategic planning, when effectively leveraged, becomes a key tool to turn flexibility into competitive advantage, enabling fast and targeted responses to changes abroad. By integrating control and adaptability, companies can proactively manage global uncertainties without compromising structured growth.