Food: Potential and Accessibility to the Canadian Meat products and Hams Market

Published by Valeria Minasi. .

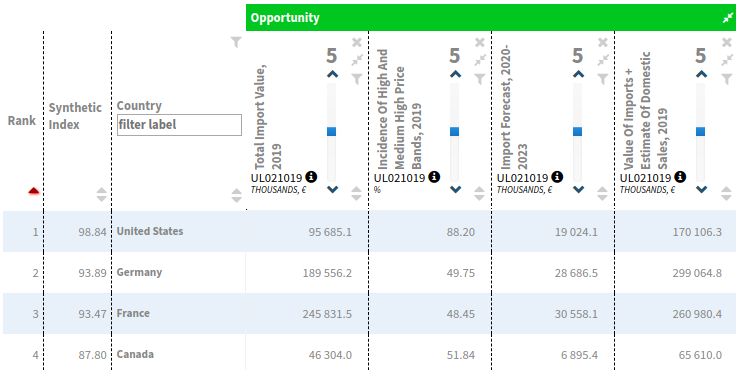

Food&Beverage Planning International marketing Made in Italy Marketselection Free trade agreements Foreign markets Export markets Market AccessibilityCanada offers relevant opportunities to meat products and hams exporters: as it results in the «short-list» of high potential markets in ExportPlanning ranking.

Export Potential of Meat products and Hams: Top Markets

Source: ExportPlanning - Market Selection

As reported above, Canada is in the top 4 high potential market in ranking developed by ExportPlanning, taking into account:

- an overall import value for Meat products and Hams that, last year, exceedeed 46 millions €, increasing +12.3% and doubling its values with respect to ten years ago;

- the size of the «premium» segment (High and Mid/High price ranges), which in 2019 was 52% of total imports; ten years earlier, this amount was just 24.5%, that is a quality upgrading results from the market;

- an overall increase of over 10 millions € in the 2020-2023 scenario; in particular, after an expected lost of about 6% in 2020 (due to the Covid-19 effects), in 2021 is expected a +9,3% increase, with an average annual growth of +6% in 2022-2023.

Furthermore, Canada represents an accessible market for European companies, thanks to the Comprehensive Economic Trade Agreement (CETA) between the EU and Canada. About Trade Barriers, this market has:

- Tariffs: 0%

- Trade Defense Measures (Anti-Dumping; Safeguards; etc): None.

Market Accessibility Information

Although Canada is an accessible market, it requires a knowledge about some accessibility elements:

- Non-tariff Measures;

- Specific Rules for Customs Code;

- General Documents;

- Specific Documents for Customs Code.

Non-tariff Measures

About Non-tariff Measures, the Canadian Government has established the BizPal online portal, which offers access to information on permits, licences and other requirements to be fulfilled in order to establish and operate businesses. In general, import documents should be prepared in English or French. Anyways, the Canadian Border Service Agency (CBSA) provides a range of service options to established importers which aim at facilitating the clearance procedures. Exporters should bear in mind that besides officially required documentation, additional necessities may result from contractual agreements with the importer.

Specific Rules

About Sanitary and Phytosanitary controls, the Canadian Food Inspection Agency (CFIA3) is the authority in charge for live animals and animal products controls in Canada.

General Documents

About documents to export, shipping and clearance, it is worth of notice that, in addition to general documents (necessary for every goods exported), customs authorities requires specific documents for this product category. Exporters haven’t to prepare each document; actually, for the most part, they have to be prepared by the importer or by the shipper, but it is important that the exporter knows all the necessary achievement to avoid unpleasant surprise with clearance4.

Exporter Documents

In general, the exporter has to provide the Canadian Customs Invoice (when it isn’t prepared by the importer), the Commercial Invoice, the Packing List and the Certificate of Non Preferential Origin or the Proof of Preferential Origin.

Importer Documents

The importer must provide an Advanced Commercial Information, the Customs Import Declaration and the Canadian Customs Invoice (if not provided by the exporter).

Carrier Documents

The carrier or the shipper have to deal with the Pre-Arrival Notice for Vessels, the General Declaration for Aircraft (or, alternatively, for Vessels), the Customs Cargo Control, the Air Waybill and/or the Bill of Lading.

Specific Documents

The "Safe Food for Canadian Regulations" (SFCR), which entered into force on 15th January 2019 (thus repealing a set of 14 former regulations concerning the trade in foodstuffs), stipulates that an Import Licence for Foodstuffs, also referred to as Safe Food for Canadians (SFC) licence, is to be obtained from the CFIA prior to the importation of such goods. In the particular case of meat imports, the meat inspection system of the country of export must have been approved by the CFIA so that the conformity with the Canadian health and product standards is guaranteed.

Conclusions

Canadian market accessibility offers relevant opportunities to exporters, both to the uprising demand and for the accessibility promoted by the CETA.

Nevertheless, it is important for exporters who decide to approach this market, to take advice about the necessary requirements and documents to a correct application of Rules.