New US sanctions on Russia: what impact on the ruble?

Sanctions hit bond market, but don't ban secondary market trading

Published by Alba Di Rosa. .

Russian rouble Exchange rate Central banks Uncertainty Economic policy United States of America Exchange rate risk Covid-19 Emerging markets Exchange ratesYesterday, the US Treasury Department announced a new round of sanctions against Russia: it is the first operation of this sort carried out by the Biden administration. With a new Executive Order, the US Treasury wanted to punish the "aggressive and harmful activities by the Government of the Russian Federation [...] that threaten the national security and foreign policy of the United States". In particular, these sanctions are mainly related to accusations of interference in the 2020 elections and cyber attacks. Let us take a closer look at the measures adopted and their impact on the exchange rate of the ruble.

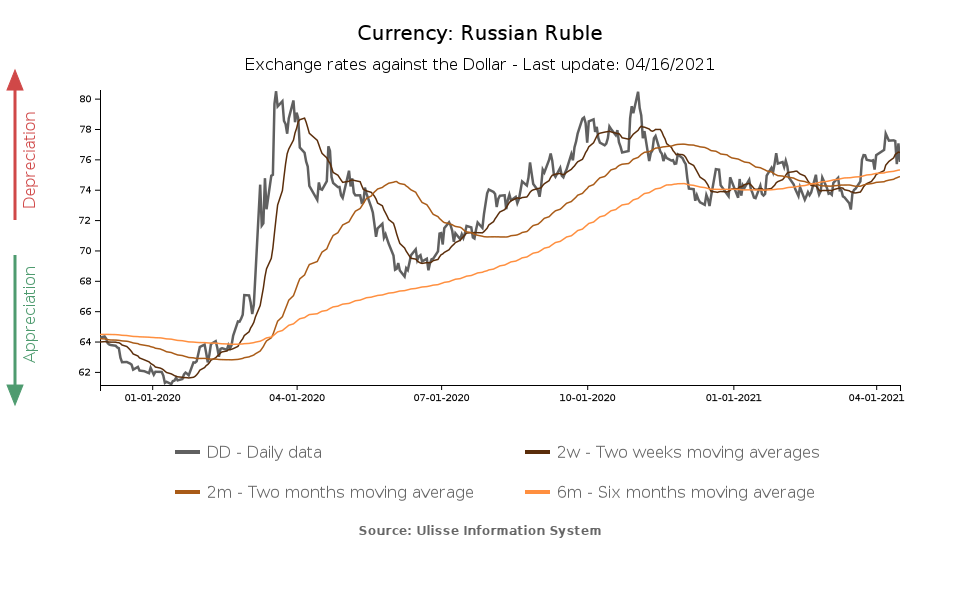

Russian ruble: weakness in Q1-2021,

escalated from late March

As can be seen from the chart shown above, and as reported in a previous article, the ruble's exchange rate against the dollar has not shown a strong recovery in the post-Covid period, when compared to the performance of other currencies in the same cluster. Indeed, the exchange rate has not returned to pre-crisis values, currently standing at levels more than 20% weaker than in early 2020. The reasons for this are mainly attributable to the dynamics of capital flows and to geopolitical uncertainty.

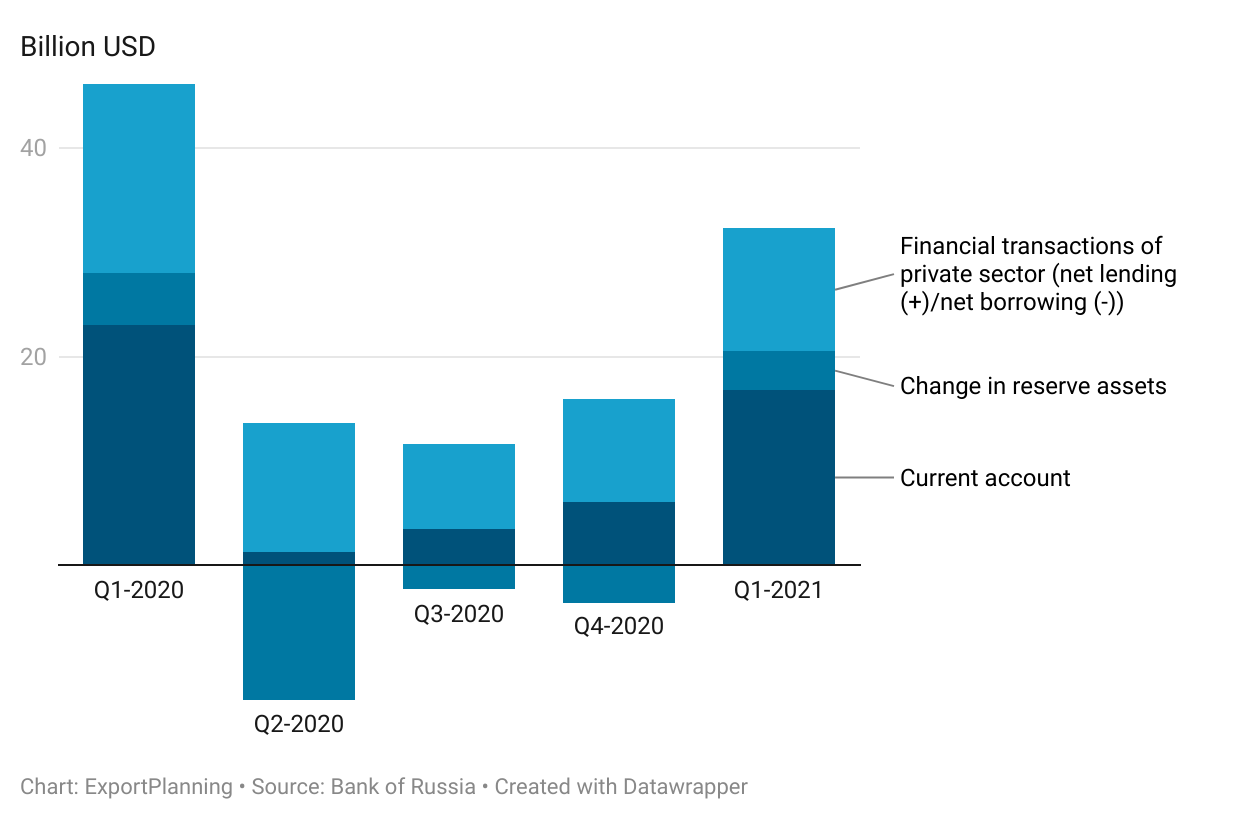

As for the former, private sector's financial transactions in Q1-2021 are still marked by net outflows, in line with the trend shown in 2020. On the other hand, on the goods' side of the balance of payments, we can see that in Q1-2021 Russia's current account surplus grew on a QoQ basis, while remaining one-third below the levels of the corresponding period in 2020, due to a significant recovery of imports over exports.

Russia: balance of payments

On the geopolitical front, according to analysts the almost constant tensions with the West in recent months would have led the ruble to incorporate such kind of risk, which has been largely priced in by the markets for months now. Reportedly, the perceived risk of possible sanctions would be quite high as early as mid-2020.

In this situation of overall stability of the exchange rate - although at lower levels compared to the pre-Covid period - which characterized the first months of the year, we can see a discontinuity from the end of March, when the Russian currency entered a phase of weakening. The exchange rate against the dollar went from 72.69 RUB per USD at the end of March to 75.83 today. Investors' sentiment seems to have been influenced by the fear, which had become particularly concrete, of new sanctions by the US, and by the resurgence of tensions with Ukraine.

Particularly in the last few days, market attention has grown considerably on the prospect of US sanctions, which appeared imminent. On Tuesday, April 13, the currency showed a weak appreciation in connection with a phone call between US President Joe Biden and Russian President Vladimir Putin, interpreted by the markets as a sign of easing of diplomatic tensions. Nevertheless, sanctions were announced on Thursday 15: in intra-day trading on Thursday, the ruble once again lost ground against the dollar, reaching RUB 77.4 per USD (-2%), to then partially recover the fall over the day.

The relatively muted reaction of the markets to the announcement can also be seen in the stock market indices, which did not show deep declines in the closing values of April 15: the RTSI lost 1% compared to the previous day, while the MOEX dropped by 0.22% (source: DailyDataLab).

Sanctions hit bond market,

but don't ban secondary market trading

To better understand the reaction of the markets, let's go deeper into the content of the sanctions.

- The latest round of US sanctions targeted more than 30 of individuals, entities and companies, accused of attempting to influence the 2020 US election through disinformation activities and of carrying out hacking attacks in the service of Russian intelligence; sanctions were also imposed in relation to the occupation of Crimea and related human rights abuses on the population. Designated individuals, entities, or companies are barred from owning property in the United States; they may not engage in transactions with US persons, or transactions involving transit through the United States.

- The new Executive Order also prohibits US financial institutions from participating in primary market trading in bonds (denominated in rubles or other currencies), that are issued after June 14, 2021 by the Central Bank of the Russian Federation, the National Wealth Fund of the Russian Federation, or the Ministry of Finance of the Russian Federation; they are also prohibit them from lending to these three entities.

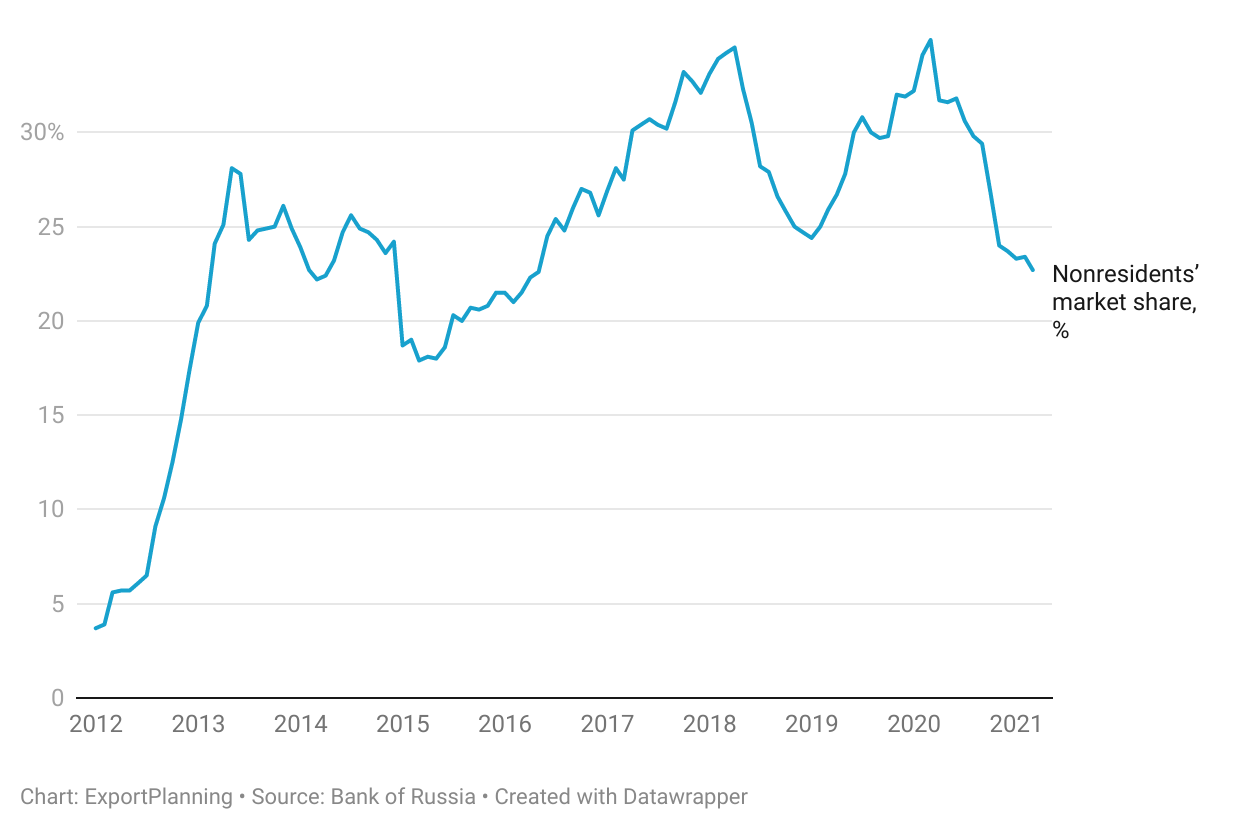

Among the listed sanctions, those that have most captured market interest due to their potential impact on the currency are those involving sovereign debt - i.e., the so-called OFZ, ruble-denominated bonds. At present, the market share held by non-residents in the OFZ market is close to 23%, totaling more than $40 billion.

Russia: Non residents' share in OFZ market

The ban on American purchases has long been feared. Nevertheless, according to analysts' forecasts, the decision to limit US purchases only on the primary market, and not on the secondary market, will most likely contain the negative impact of such a measure: both on the financing possibilities of the country - which has, moreover, an extremely low debt-to-GDP ratio of 20% - and on the ruble.