Country Relative Score

The daily score of the financial markets on world countries

Published by Luigi Bidoia. .

International marketing Conjuncture Covid-19 Internationalisation toolsA year and a half after the novel coronavirus was first detected, the pandemic still serves as a stress test to assess the quality of global institutions as well as countries’ economic outlooks. While the health crisis has had an asymmetric impact over the globe, world governments tackled the emergency in different ways. The analysis of the various outcomes can therefore shed light on a given country’s internal cohesion and economic development, along with its readiness to make tough decisions.

In the financial environment, gathering info may generate a significant competitive advantage

For financial players, this stress test provides key information which can be used to gain competitive advantage over the main competitors within financial markets. To this extent, the high economic return justifies any significant investment in data processing and related analysis.

Financial actors give their evaluations in daily transactions

Though financial players are reluctant to share the information with others, they are nonethless forced to express their evaluations on securities. By doing so, they indirectly decide whether the country issuing those securities is economically stable or not.

Draghi effect

A concrete example of financial index evaluation consists of Italy/Germany 10-Year Government Bond Spread. Analyzing the spread movements is key to understand why financial markets improve/worsen their evaluation of the Italian social and economic prospects. What happened at the beggining of 2021 is particularly significant: once the ECB former president was appointed as Italy’s prime minister, the spread between Italy’s 10-year bond and its German counterpart narrowed by 25 basis points, bringing Italy's ten-year spread below the threshold of 0.50% for the first time (that phenomenon is also referred to as the “Draghi effect”).

A combination of different indexes

That also applies to stock indexes. If a country has a good financial reputation, foreign investors will tend to purchase more and more shares in that country’s stock market. As a result, demand and prices will increase. Also exchange rates are involved in this scenario. The improvement in the economic outlook of a country will push foreign intermediaries to invest in assets denominated in the local currency, ultimately leading to currency appreciation.

In a nutshell, any improvement/worsening of country’s economic outlook by financial players leads to increasing/decreasing stock market indexes, decreasing/increasing interest rates, and a currency appreciation/depreciation. By combining these different indexes, it is possible to compute a composite index (CI) that mirrors the changes in financial market evaluations. This index is simply calculated as the dollar value of the local stock market index, "discounted" by the interest rate on 10-year government bonds[1].

Country-relative score

Whilst, in terms of overall dynamics, the discounted stock market index is easy to understand, its levels are more difficult to catch as they stem from the comparisons of indexes with different bases.

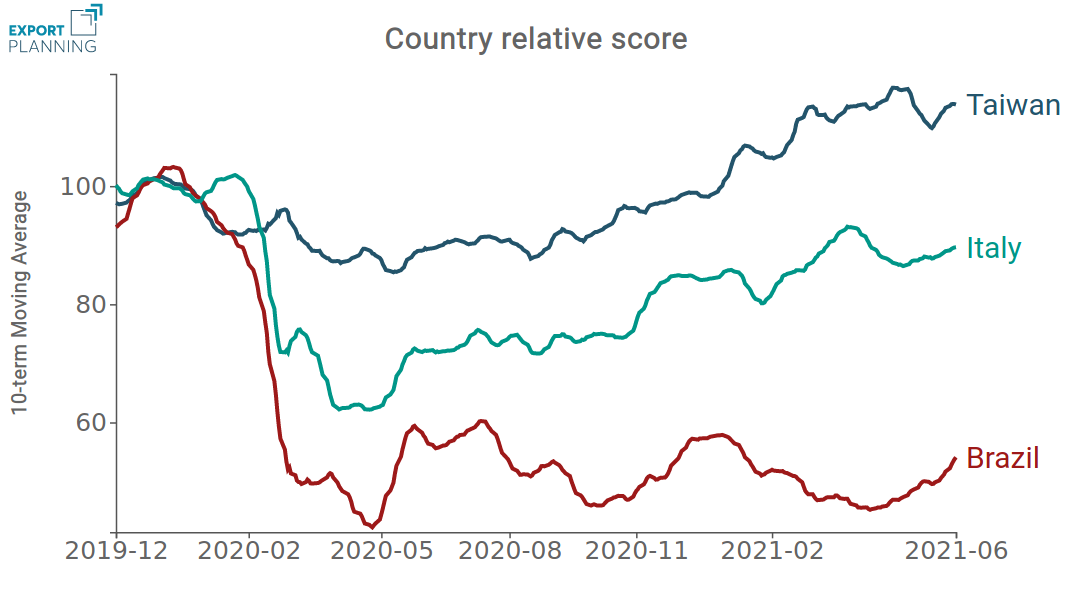

Therefore, we may want to choose a single base period. If we were to select December 2019 (the month before the first spread of Covid-19 in China) we could get a score saying whether financial markets are evaluating the country more or less favourably than before the pandemic. Finally, it is possible to compare the index for a country with that related to the largest financial market in the world, i.e. the United States. In this way we will have a measure of how much the financial evaluations of the country have improved/worsened in relation to those of the United States.

The following graph shows results for Taiwan, Brazil and Italy. While the Asian country is certainly among those that have successfully passed the “stress test” of the pandemic, the world’s picture of Brazil has been negatively affected by the pandemic. Italy is in the mid between the two.

By looking at the three series, we can observe the different evaluation that financial markets have expressed on these countries over the last 18 months. At the beggining of the crisis, the judgment was quite severe for Italy, characterized by high numbers of contagions and deaths. Yet much more severe was the judgment on Brazil, where the Bolsonaro government faced the pandemic with irresponsible behaviour. On the other hand, financial markets "rewarded" Taiwan, which was able to manage the health emergency with rigorous contact tracing, targeted quarantines and widespread masks-wearing.

The first lockdown success has led Italy to a recovery path. This improvement, however, does also mirror the contemporary worsening of the health situation in the United States. No improvement was recorded, on the other hand, in the evaluations of financial markets over Brazil, where the mismanagement of the pandemic resulted in the country ranking first in the world for Covid deaths per inhabitant.

[1] IC = STOCK/( 1+ Beta* I/100)* EX) where:

- STOCK is the local stock market index;

- EX is the exchange rate of the local currency relative to U.S. dollar;

- I is the interest rate on 10-year bonds.

- Beta is a parameter fixed equal to 20, aimed at rebalancing, at least partially, the variance between interest rates with that of stock market indices.