European Exports: 2021 Figures

ExportPlanning pre-estimates report 6% growth compared to pre-crisis levels

Published by Simone Zambelli. .

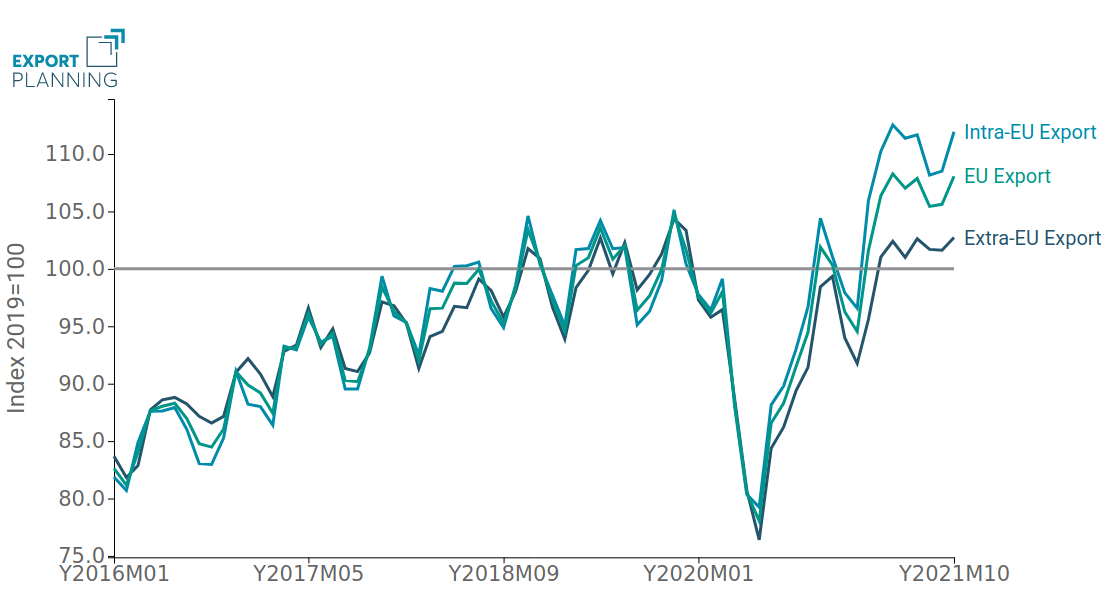

Eurozone Europe Conjuncture Slowdown Covid-19 Great Lockdown Global economic trendsThe availability of ExportPlanning pre-estimates on EU countries' foreign trade flows, accessible through the related database, makes it possible to take stock of the performance of European exports in 2021, in a sanitary picture that is improving, but still posing risks. As already highlighted in the previous article (European exports in the Covid 2-years), after a very positive first part of the year, starting from the summer months there has been a progressive normalisation of the growth pace for Member States' exports (see Fig. 1).

Fig. 1: EU Exports in euro

(2019=100, three-term moving average)

Source: ExportPlanning.

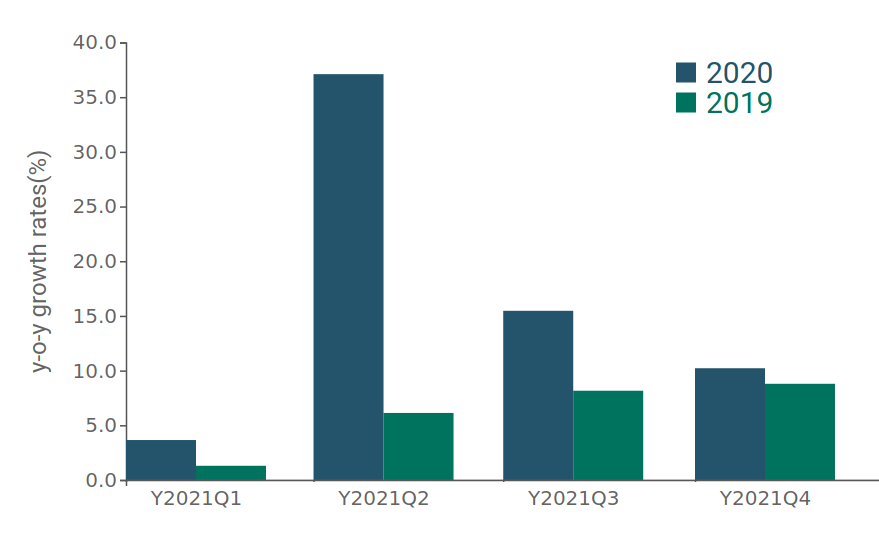

In fact, the first part of 2021 was characterised by significant growth compared to 2020. The comparison with the 2019 figure is particularly significant, as it allows to strip out the statistical base effects linked to the contraction recorded in the second quarter of last year: in each period of analysis, despite the slowdown in the second part of 2021, European exports have always remained above pre-crisis levels (see Fig. 2).

Fig. 2: EU Exports in euro

(rate of change over the corresponding period in 2019 and 2020)

Source: ExportPlanning.

Overall, European exports are estimated to close 2021 with a 15% year-over-year growth rate in euro, and a 6% increase compared to pre-crisis levels.

However, not all the different European manufacturing industries closed 2021 with a full recovery to pre-crisis levels.

In the graph below, the different industries are positioned on the basis of the rate of change in 2020 (x-axis) and that of 2021 compared to 2019.

Fig. 3 - EU exports by industry in euro

a table that summarizes the data related to the selected industry

Source: ExportPlanning

As we can see from the chart, almost the entire Consumer Goods cluster experiences growth on 2019 above the overall average of 6%. The result affects not only the most resilient industries in the pandemic context (Agribusiness-E0/B1 and Pharma-E4), but also the Home System (E3) and Consumer Goods (E1). The only exception is the fashion system and, more generally, final products for the person (E2), which are experiencing a rather slow recovery compared to the other sectors. It is, however, significant that the industry is at +2% compared with the pre-crisis period.

The raw materials cluster, after the collapse in 2020 especially of industrial raw materials (A2), was the one that grew the most last year, given the record prices recorded by most commodities.

Finally, it is interesting to focus on investment goods, for which the persistent difficulties of the automotive sector and related components are evident. ITC equipment is, on the contrary, among the fastest growing industries in 2021 (+8.5%), together with the positive performance of equipment for industry (F2) and electrical engineering (D4).

The positioning of the different EU exporting countries in 2021 reflects the different manufacturing specializations. Overall, we can see that the highest growth rates have been sustained by Eastern European countries, led by Poland and Baltic Republics, while Western countries show smaller variations. Sectoral performance particularly affects the growth of French exports, still 4% lower than 2019, and German exports (+2% on 2019). In this context, Italy's performance is better, showing a 6.7% increase compared to pre-crisis levels.

Conclusions

The scenario of European exports in the fourth quarter of 2021 shows a gradual normalization of the pace of growth in recent months; however, the values remain higher than those recorded in 2019.

At the industry level, we can see a lot of heterogeneity: raw materials and consumer goods are growing strongly, while other sectors, first and foremost automotive, are still struggling to recover pre-crisis levels, reflecting persistent inefficiencies along the value chains.