World Trade in Manufactured goods: economic Outlook

World trade in goods ended the year with 4% growth on pre-crisis levels, but the slowdown continues

Published by Marzia Moccia. .

IMF Uncertainty Conjuncture Slowdown Covid-19 Global economic trendsThe information updated in November, relating to customs declarations by companies in the world's main economies, makes it possible to take stock of the economic situation of international trade, now having a pre-estimate of the 2021 final balance, which can be accessed through the World Trade Datamart available in ExportPlanning. International trade is in fact a special observer of the current international economic situation, both because it has immediately highlighted the sudden recovery in world demand for manufactured goods following the pandemic shock, and because of the supply chain disruption phenomenon, which is still threatening the recovery. After a less negative 2020 than expected, 2021 was characterised by a solid and robust recovery, especially in the first part of the year, which then gave way to a gradual slowdown. Overall, global merchandise trade ended 2021 with a positive performance, growing 12% in quantity compared to 2020 and 4.3% from pre-crisis levels.

However, while global trade in goods is higher in quantity than before the pandemic, it is still showing a continuation of the slowdown that began in the summer months. As previously documented, the pace of growth in international trade has decelerated since July, reflecting the dysfunctional nature of supply chains, the rise in commodity prices and the continuing improvement in the health situation, although not without risks.

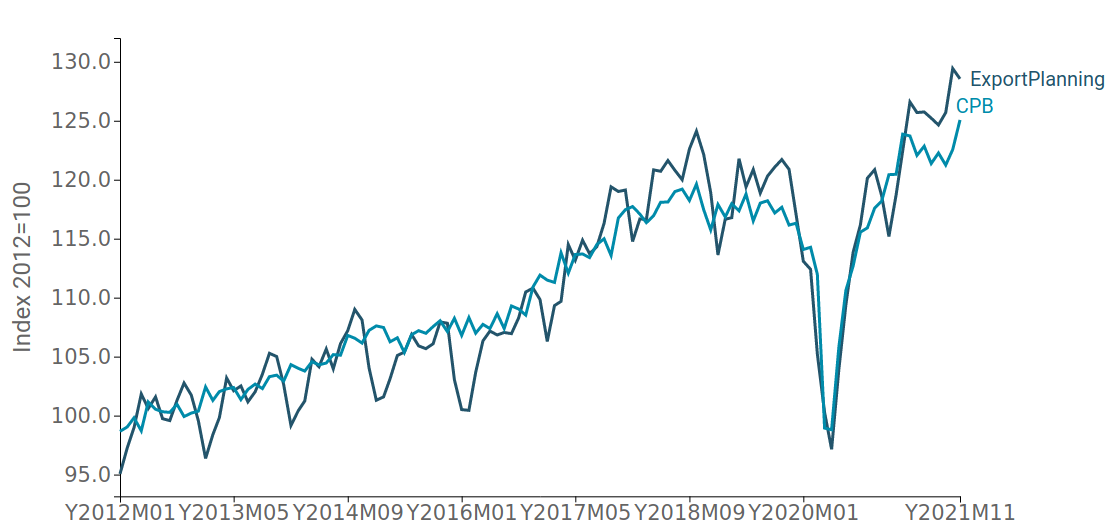

The graph below shows in detail the economic situation of world demand for manufactured goods - measured at constant prices - by comparing the data collected and systematised by ExportPlanning with those of the Central Planning Bureau, which in turn collects and processes information on international trade in goods.

Fig.1 - World trade in quantity

(three-term moving average)

Source: ExportPlanning.

It is clear that both institutes are consistent in reporting a moderation in the pace of expansion of global demand for goods since July, which followed a strong first half of the year. This phenomenon seems to have been only weakly interrupted by the November figure, which, however, will need to be confirmed by the availability of forthcoming information.

Overall, rising commodity prices, including high energy prices, persistent bottlenecks in international value chains and the spread of the Omicron variant are important risk factors.

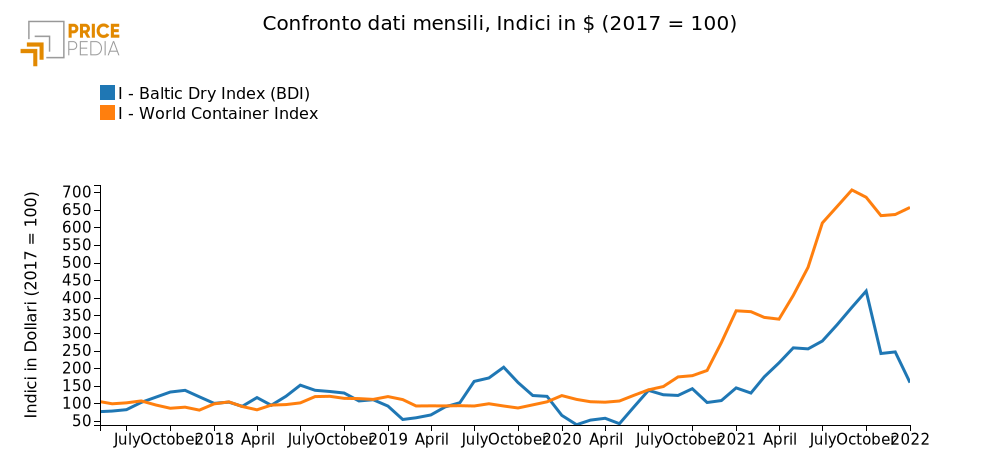

Particularly interesting at this point is the analysis of global prices in US dollars of non-liquid bulk (Baltic dry index-BDI) and container (Global container index-GCI) freight rates shown in the graph below.

Source: ExportPlanning.

Since November 2021, it is clear that the two economic indicators have started to diverge: after significant growth throughout 2021, the BDI has reversed this trend for the first time, while the GCI has remained, more or less steadily, at its all-time high. Given its nature as a leading indicator, the development of the BDI is a precursor to a possible downturn in economic activity, mainly linked to a drop in demand for ferrous materials from China. On the other hand, demand for container shipping is still very strong.

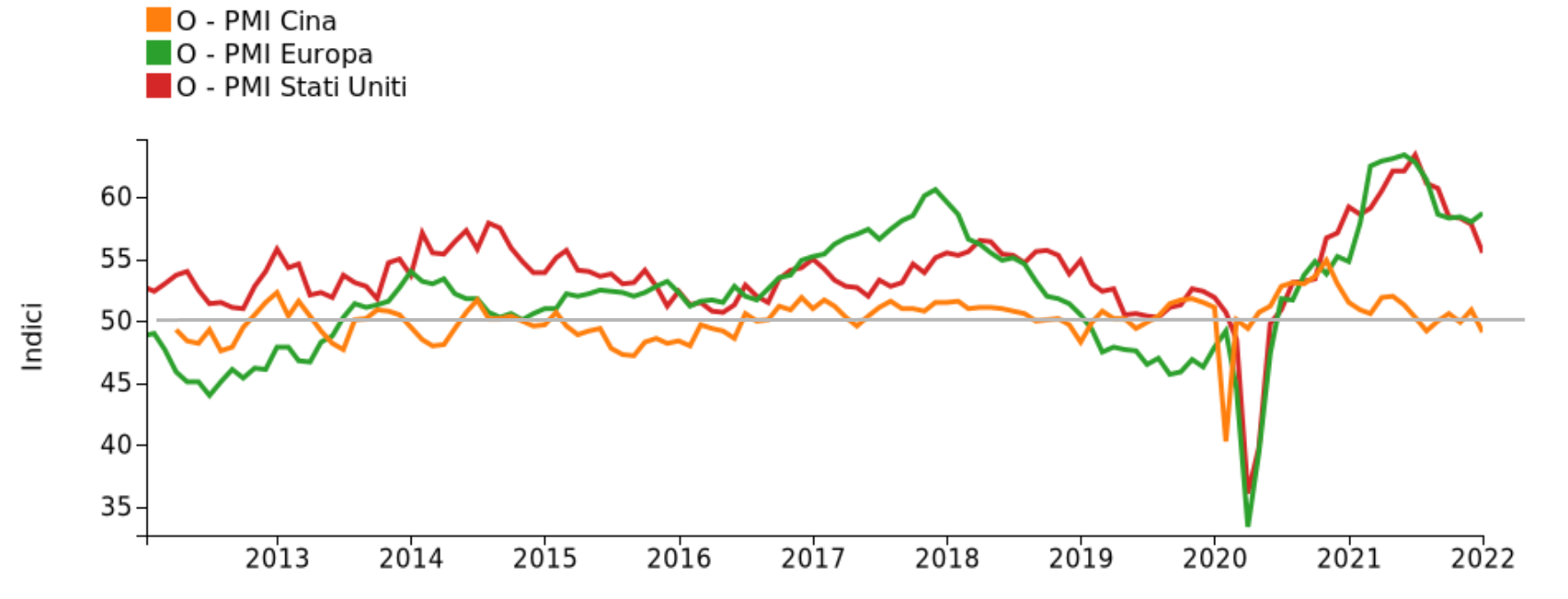

The global manufacturing Purchasing Managers Index, a real-time indicator of economic performance that summarises the outlook for industrial activity levels, based on companies' purchasing declarations, also points in the same direction. Of the world's major economies, only China is just below the expansion threshold of 50, but signs of slowing growth are widespread.

Fig.3 - Purchasing Managers Index - Manufacture

(the grey line indicates the expansion threshold of 50)

Source: ExportPlanning.

Particularly significant is the new foreign orders component of the Global Manufacturing PMI, which for the first time recorded a value of just under 50, rising from 51.1 in December to 49.9 in January. Despite a positive end to the year, expectations for world trade in the coming months remain more cautious, assuming a gradual unwinding of supply chain problems and a gradual moderation in global demand for goods during 2022.