Pre-consensus 2022: cyclical point on global demand for goods

Despite a slowdown scenario, world trade closes 2022 better than initially assumed

Published by Simone Zambelli. .

Slowdown Uncertainty Global demand Conjuncture Global economic trends

The availability of ExportPlanning pre-estimates for Q4 2022 foreign trade data -accessible through the datamart World Conjuncture- allows us to document the "year-end" performance of world trade in goods.

Indeed, 2022 was a year filled with critical events, such as the war in Ukraine, the energy crisis, rising commodity prices and strong inflationary pressures. These factors, which seemed to constitute a "perfect storm," led major forecasters to predict a more-or-less significant slowdown in the pace of trade growth, for an overall increase of close to 3 percent in volume over the previous year. Does the 2022 pre-fiscal information confirm these expectations?

First, it is important to read the information available in constant prices, in order to purify the data from the nominal changes related to price increases and exchange rate developments recorded during the year.

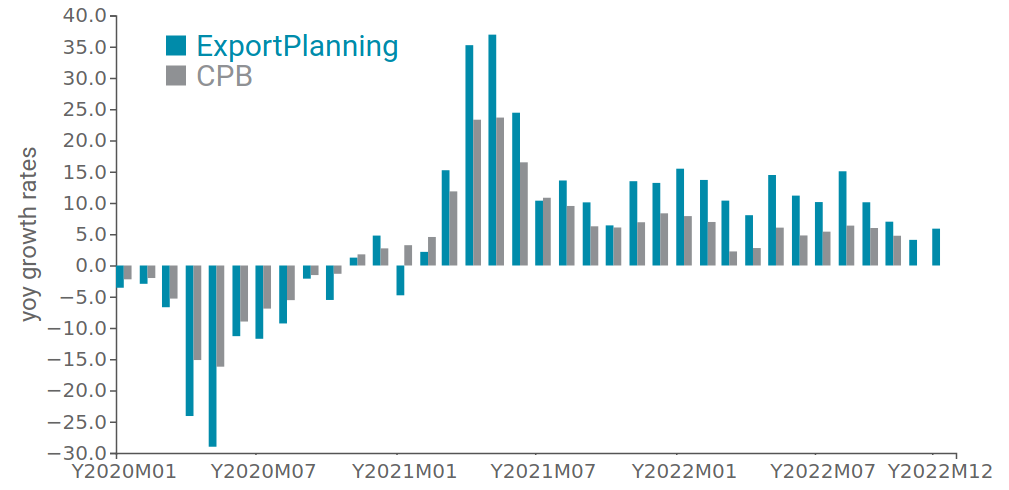

The following graph shows monthly changes in world trade in manufactured goods in quantity, comparing the data collected and systematized by ExportPlanning with those of the Central Planning Bureau.

Fig.1 - World trade in quantity

(CPB data vs. ExportPlanning data, trend change)

Source: Elaborazioni ExportPlanning.

After a strongly growing 2021, aided by the economic recovery that took place in the post-pandemic period, it is evident how the first months of 2022 also maintained a pace of growth relatively in line with that which had also characterized the second part of 2021. The slowdown appears most evident from the fall of 2022 onward, with world trade moving from growth in quantity close to 8 percent to a more tentative 3.5 percent increase in the fourth quarter of 2022 compared to the corresponding quarter of 2021.

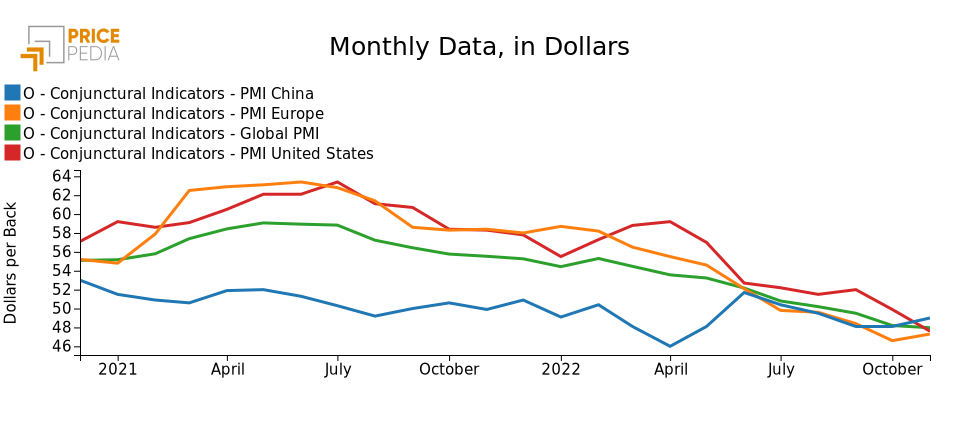

Confirming what has just been said, there are the obvious signs that can be gleaned from the global manufacturing Purchasing Managers Index, a "real-time" indicator of economic performance, which summarizes the outlook regarding levels of industrial activity, based on companies' purchasing statements. The indicator shows signs of a slowdown for all major economies since September, with values below the neutral threshold of 50.

Fig.2 - Purchasing Managers Index - Manifatture

Source: Pricepedia.

Even against a backdrop of a slowdown, however, it is noteworthy that world trade closes 2022 better than initially assumed: ExportPlanning preestimates, based on a cyclical sample of reporting countries, testify to a 7 percent increase in world trade in manufactured goods in quantity over last year.

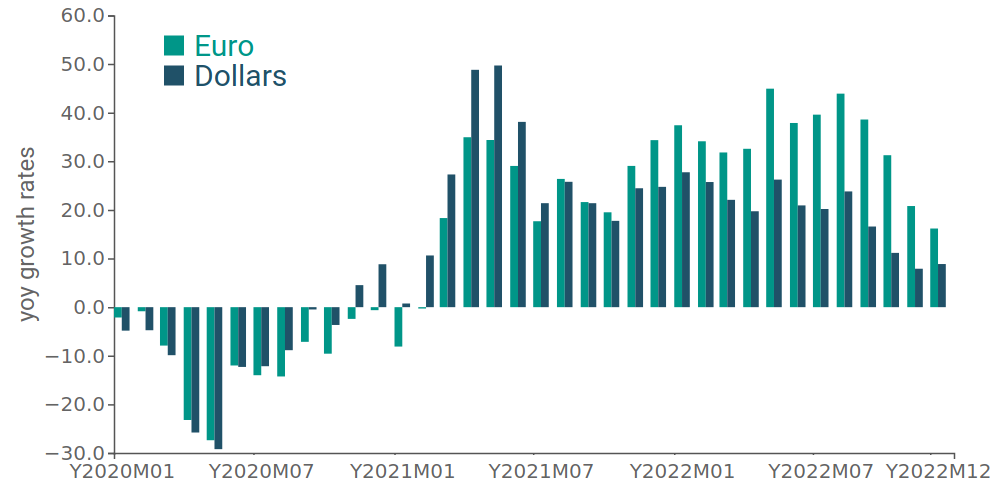

As mentioned earlier, when analyzing the information in value, inflation and the depreciation of the euro are certainly prime aspects to consider. The following figure shows the monthly trend changes in value of world trade in both euros and dollars.

Fig.4 - World trade in values

(trend rates of change in euros and dollars)

Source: Elaborazioni ExportPlanning.

The graph shown unmistakably highlights the profound difference between the changes that have occurred in euros and dollars, although the decline in the last quarter still remains evident. This gap has been widening since the early months of 2022, in which the dollar has implemented a rapid recovery against the euro, until it has been back to substantial parity since September. Even more striking are the differences in the monthly changes between the current-price and constant-price graphs: on average, the latter have values half as high as the former, showing that stripping out the price effect is crucial in reading the data correctly.

Conclusions

The year 2022 was a year of turbulence that had a strong impact on world trade. Although there was a significant slowdown, especially in the final part of the year, it was on the whole quite contained, never registering negative values, contrary to the expectations accrued during the year. It will be important for all countries to monitor the economic situation in order to try to limit the difficulties, including by implementing ad hoc measures against high energy, commodity and inflation prices.