Household Products: the BLue OCean (BLOC) markets to focus on

The "Salone del Mobile" Exhibition at Milan next week is an opportunity to analyze some markets of this industry in a phase of structural acceleration

Published by Marcello Antonioni. .

Home items Uncertainty Marketselection Foreign markets Export markets International marketingIn 2022, the phase of strong growth in world trade in Home System products in euro values continued...

Last year, world trade in finished household products1 recorded a new significant increase in values denominated in euro (+15.2%), substantially equaling the excellent performance in 2021 (+16.2%), and reaching a new absolute maximum point, equal to 810 billion euros, on values of +35 percent higher than pre-pandemic values .

.. but worrying signs of a slowdown have emerged,

as documented by the measurement at constant prices

However, it should be highlighted that, unlike 2021 - when the growth in world trade in finished products for the home measured in quantity (at constant prices) was also in double digits (+13.6%) -, the last year the evolution of world trade measured at constant prices showed an average annual result of substantial stability (+0.2%), penalized by a second half of the year with negative trend rates of change.

The slowdown in 2022 in the measurement at constant prices affected all the main sectors of the Home System

Last year all the main sectors of the Home System analyzed showed a significant slowdown in the pace of development of international trade.

In particular, the greatest penalties concerned the Lighting technology sectors (with world trade down by -3.6% compared to 2021 if measured at constant prices), Home Appliances (-2% compared to 2021 at constant prices), Consumer Electronics (-0.3%). Furthermore, there were slight increases (if measured at constant prices) in world trade in Home Textiles (+0.3% compared to 2021) and Furniture and Furnishings (+0.8%).

World trade in finished household products

| Values 2022 | % changes at current prices |

% changes at constant prices |

|||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Home Appliances | 196.9 | +12.4 | +40.8 | - 2.0 | +19.1 |

|---|---|---|---|---|---|

| Consumer Electronics | 196.3 | +11.7 | +24.1 | - 0.3 | + 1.4 |

| Furniture and Furnishings | 107.2 | +18.7 | +41.3 | + 0.8 | +12.3 |

| Lighting technology | 65.7 | +14.4 | +37.4 | - 3.6 | +11.3 |

| Home Textiles | 49.8 | +14.4 | +27.1 | + 0.3 | +10.8 |

| Other household products | 194.0 | +20.8 | +37.7 | + 4.8 | +11.4 |

| TOTAL | 810.0 | +15.2 | +34.6 | + 0.2 | +11.4 |

Source: ExportPlanning-Annual Trade Flows Datamart

Also the forecasts for 2023 show unfavorable dynamics for the generality of the sectors of the Home System

Measured in euros, world trade in finished products for the home achieved an average annual increase of +15.7% in the two-year period 2021-2022 (corresponding to an overall increase of approximately 205 billion euros). This is a particularly accelerated performance, which is added to a result in the pandemic year (2020) which is still stable (+0.6% in euro values).

In the 2023-2026 scenario, a significant slowdown in the growth rate of world trade in finished household products in euro values is expected, reflecting the following phenomena:

- the expected slowdown in demand already highlighted in 2022 in values at constant prices;

- the expected stabilization of the euro/dollar exchange rate (with a forecast of a slight appreciation of the single currency against the dollar), which in 2022 (with a depreciation of the euro against the dollar close to 11 percentage points) was found to be a factor supporting turnover denominated in euro;

- the expected retracement of the prices of commodities and basic materials used in the manufacturing sector, in the order of 11.5 percentage points, and, above all, of energy prices (-20.6%)2, which will inevitably lead to downward pressure on the sales price lists of Home System producers.

In particular, in 2023 the world trade of the Home System should show a growth of "only" 2.6 percentage points in euro values (with a slowdown of over 13 percentage points compared to the previous two years), to then recover a pace only slightly more accelerated in the following three years (CAGR: +5.4% in euro values).

In such a context, it seems essential to identify the most resilient markets to the ongoing slowdown in world trade in household products...

A decidedly more selective context such as that represented by world trade in 2023 will oblige the exporters of the Home System to pay greater attention in identifying the markets capable of being more resilient to the expected context of slowdown of the world trade.

.. i.e. markets characterized by a phase of structural acceleration of their imports:

the so-called BLOC (BLue OCean) markets

World trade in finished products for the home is highlighting the presence of various markets in the phase of structural acceleration of their sectoral imports. These markets - denominated BLue OCean (BLOC) - are typically characterized by the offer of new producers, by investments in logistics and distribution and imitative effects in consumer behavior which lead to the start of a path of accelerated growth of imports.

For an exporter who has to operate in a context of uncertainty and increased selectivity, these are certainly favorable conditions because these are markets in which demand for foreign producers is growing at high rates.

Home System's BLOC Markets

Home Appliances

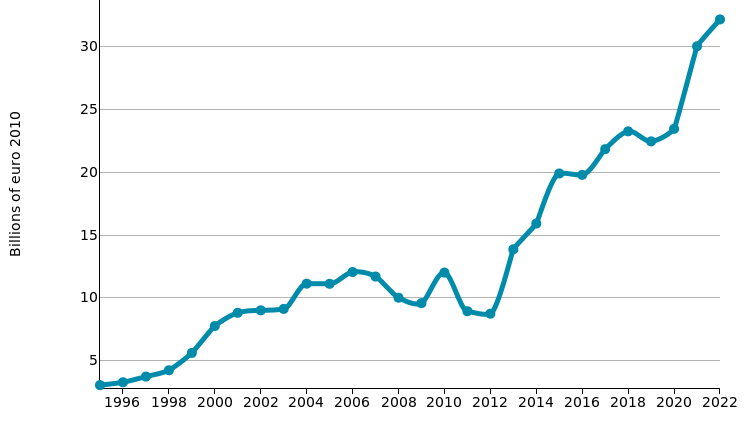

In 2022, world trade in the household appliances3 sector reached approximately 197 billion euros (+57 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

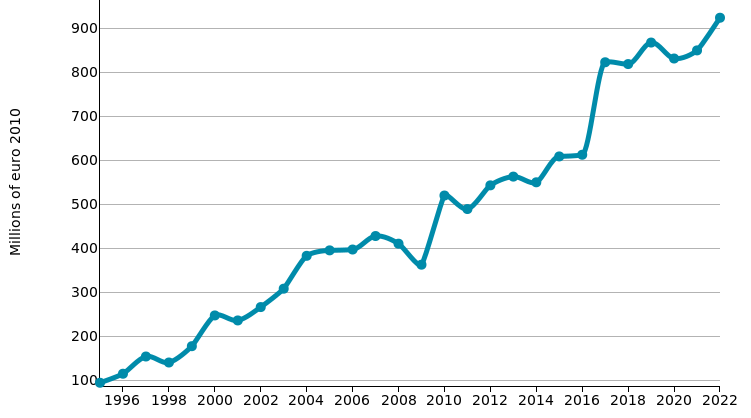

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- United States: with 42.8 billion euros in 2022, it clearly ranks first among the world's importing countries in the sector. In the last three years (2022/2019) imports from this market have achieved an overall increase of over 43 percentage points in values at constant prices (see the graph below)4, resulting drivers (+16.1 billion euro) for global demand for the sector;

- Australia: in 2022 its imports exceeded the value of 5 billion euros, ranking 10th among the sector's markets in the world. As shown in the graph below (with imports expressed in values at constant prices), there has been a particularly favorable growth of this market over the last decade5.

Home Appliances: selection of BLOC markets

| UNITED STATES | AUSTRALIA |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Furniture and Furnishings

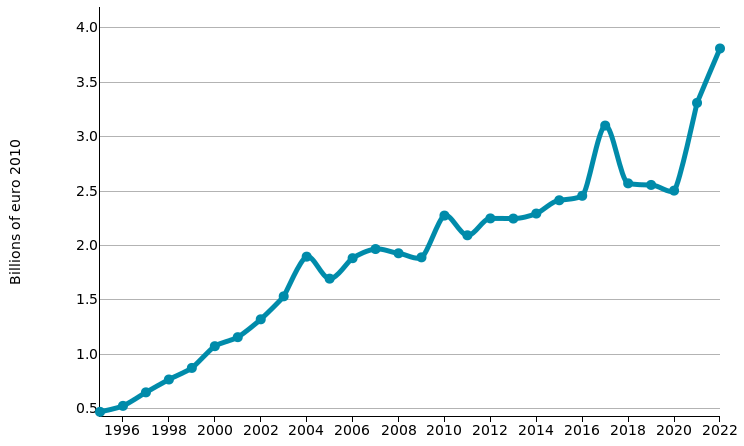

In 2022, world trade in the furniture and furnishings6 sector exceeded 107 billion euros (+31.3 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

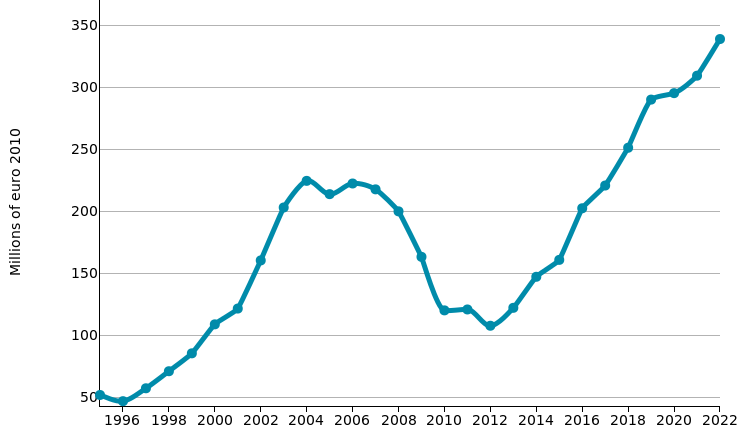

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- Poland: with over 1.1 billion euros in 2022, it ranks 20th among the world's importing countries in the sector. Despite the slowdown in 2022, in the last five years (2018-2022) imports from this market have achieved an overall increase of around 66 percentage points in values at constant prices (see the graph below)7 ;

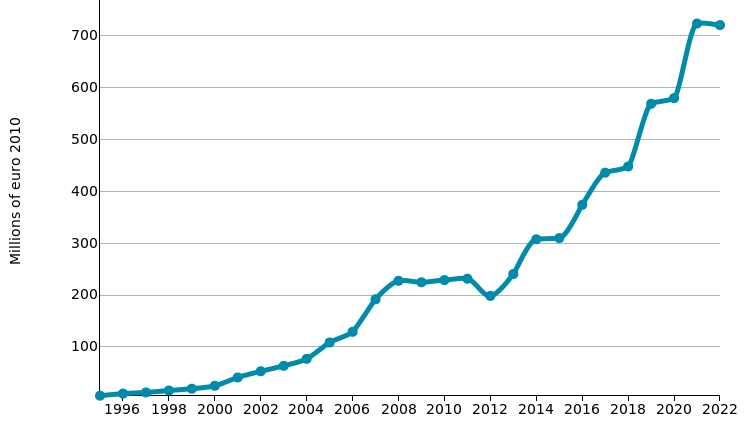

- Hungary: in 2022 its imports reached a value of 368 million euros, ranking 38th among the sector's markets in the world. Although still at relatively low levels, this market has reported particularly favorable growth over the last decade (more than tripling its levels measured at constant prices)8.

Furniture and Furnishings: selection of BLOC markets

| POLAND | HUNGARY |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Lighting technology

In 2022, world trade in the lighting technology9 sector was close to 66 billion euros (+17.9 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

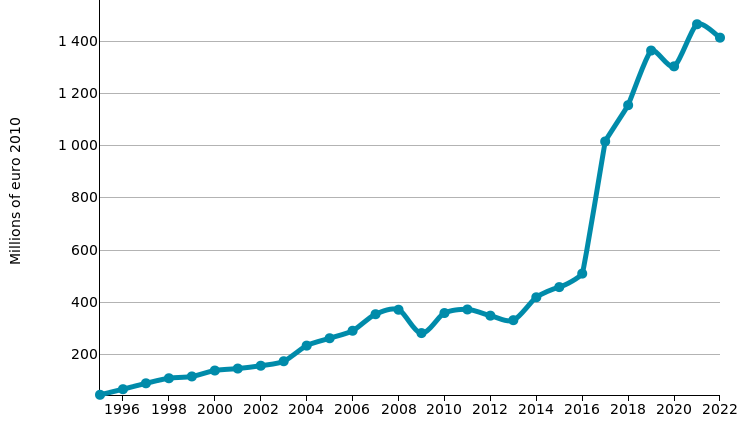

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- Poland: with over 1.5 billion euros in 2022, it ranks 7th overall among the world's importing countries in the sector. Despite the slowdown in 2022, in the last decade imports of this market have more than quadrupled their levels measured at constant prices (see the graph below);

- Australia: in 2022 its imports exceeded the threshold of 1.3 billion euros, placing it in 10th place among the sector's markets in the world. This market reports consistent growth over the last decade (+70% in its levels measured at constant prices)10.

Lighting technology: selection of BLOC markets

| POLAND | AUSTRALIA |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Home textiles

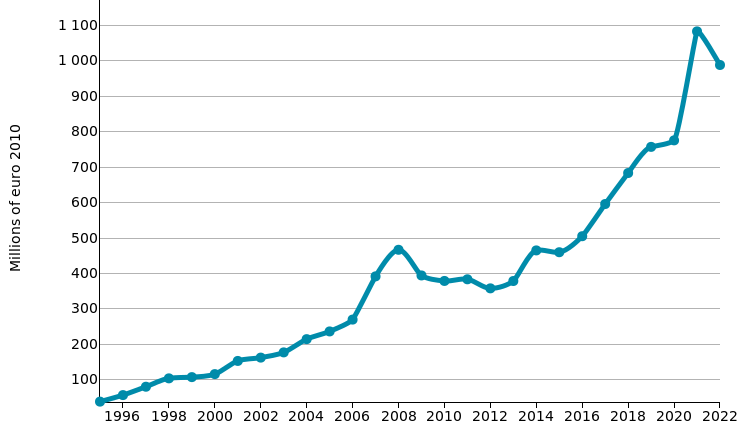

In 2022, world trade in the home textiles11 sector came close to 50 billion euros (+10.6 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

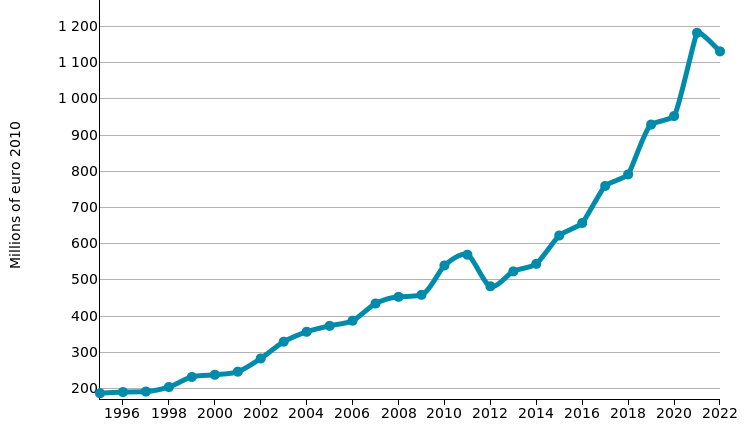

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- Netherlands: with over 1.6 billion euros in 2022, it ranks sixth overall among the world's importing countries in the sector. This market, despite the slowdown seen last year, has reported significant growth in the last five years (+49% in its levels measured at constant prices)12;

- Poland: with almost 1 billion euros in 2022, it ranks 11th among the world's importing countries in the sector. Despite the slowdown in 2022, in the last decade imports of this market have more than tripled their levels measured at constant prices (see the graph below)13.

Home Textiles: selection of BLOC markets

| NETHERLANDS | POLAND |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Conclusions

The 2023 edition of Salone del Mobile at Milan is part of the starting line, for the Household Products industry, in a context of a slowdown in sectoral international trade for some quarters already, after a phase of significant growth.

In such a scenario, which has become decidedly more selective and expected to remain so in the near future, it is particularly important for companies in this industry to identify and develop those foreign markets which - thanks to a phase of structural acceleration - are in a position to offer, despite the current slowdown, greater opportunities for growth ideas.

1) For a list of the segments analysed, please refer to the relative sectoral description.

2) Source: PricePedia (forecast scenario updated to April 2023).

3) For a list of the products included therein, please refer to the relevant segment description.

4) In particular, there is accelerated growth in US imports in the following strategic business areas: combined refrigerators, electric cookers, hobs and ovens, dishwashers, gas instantaneous water heaters, electric files and other electromechanical household appliances.

5) In particular, there is accelerated growth of Australian imports in the following strategic business areas: dryers, electric cookers, hobs and ovens, espresso coffee machines.

6) For a list of the products included therein, please refer to the relevant segment description.

7) In particular, there is accelerated growth of Polish imports in the seating furniture strategic business area.

8) In particular, there is accelerated growth of Hungarian imports in the following strategic business areas: sofas and armchairs, sofa beds, latex mattresses and kitchen furniture.

9) For a list of the products included therein, please refer to the relevant segment description.

10) In particular, there is accelerated growth of Australian imports in the following strategic business areas: electrical appliances for LED lighting and other electrical appliances for the lighting.

11) For a list of the products included therein, please refer to the relevant segment description.

12) In particular, there is accelerated growth of Dutch imports in the following strategic business areas: toilet and kitchen linen and synthetic fiber blankets.

13) In particular, there is accelerated growth of Polish imports in the bed linen strategic business area.