Capital Goods Imports: A Compass for Investments

Published by Pietro Sarti. .

Import Foreign market analysisMeasuring investment trends in a timely manner represents a significant challenge for macroeconomic analysts, given the low frequency of official data. Investment statistics, in fact, are generally available on an annual basis, making it necessary to use intra-annual indicators capable of reliably approximating their dynamics, especially for nowcasting and short-term forecasting activities.

In this context, the evolution of international demand for capital goods – machinery, means of transport, plants, tools, and equipment – proves to be a particularly effective proxy for investment trends. In many advanced economies open to international trade, as well as in several emerging markets, the share of imported capital goods in total investment is significant and, in some cases, increasing, especially in high-tech sectors. Moreover, these goods are reported on a monthly basis, thus offering analysts the opportunity to monitor investment performance in real time.

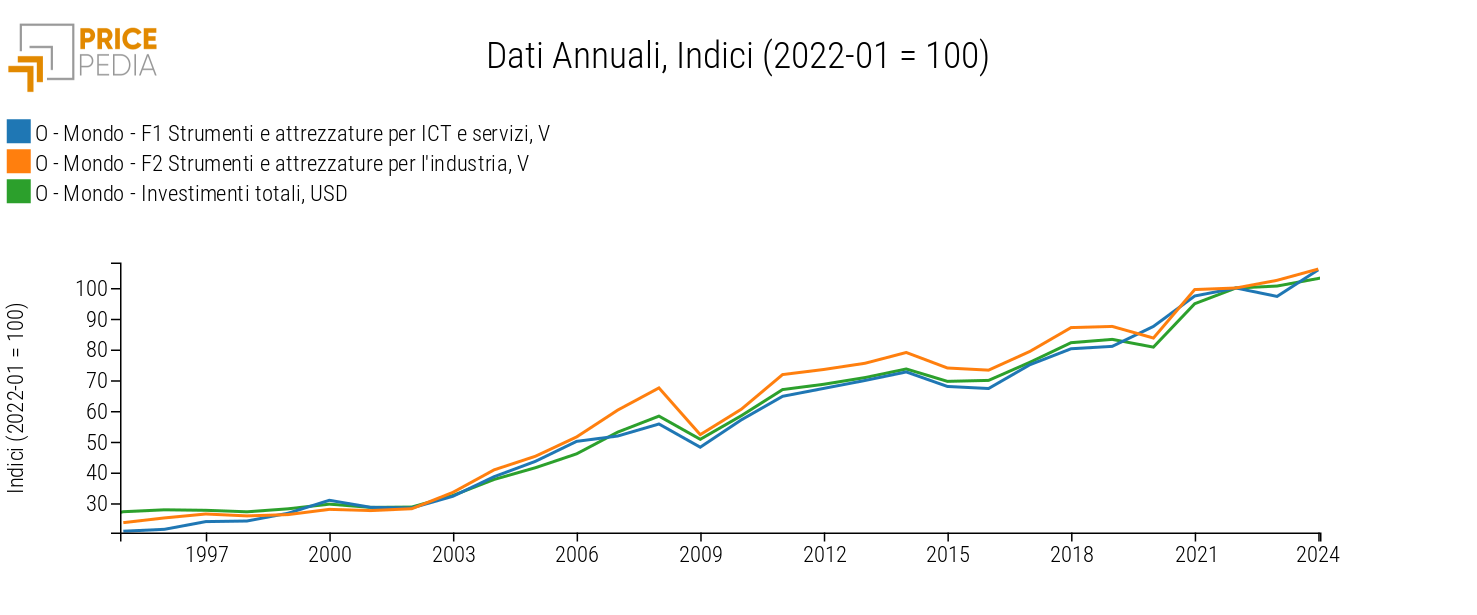

The chart below shows that, from 1995 to 2024, the historical series curves of imports of ICT and services equipment (category F1) and industrial equipment (category F2) are, on a global level, almost perfectly aligned with that of total investments, as reported in the latest issue of the World Economic Outlook (April 2025).

Fig. 1 - Imports of ICT and Services Equipment, Industrial Equipment, and Investment Cycle

Source: PricePedia elaborations

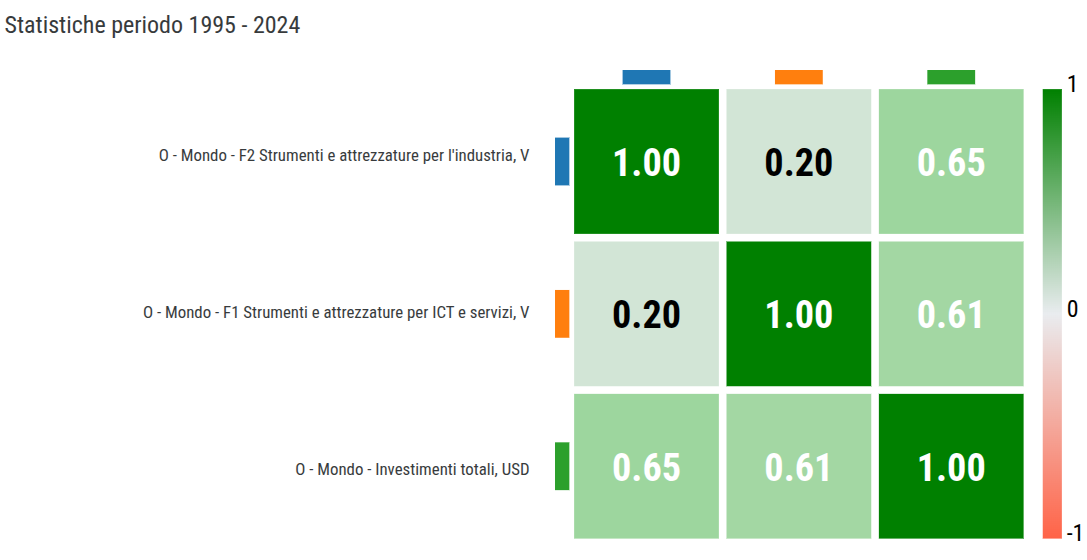

The partial correlation matrix, calculated for the period under consideration (1995-2024), represents an additional useful tool to confirm the existence of a strong relationship between import variables and investment. This reflects a high positive correlation among the various variables, such that an increase in international demand for capital goods constitutes an indirect signal of ongoing production expansion plans or technological upgrading processes. Conversely, a decline in foreign demand for capital goods signals a phase of investment stagnation.

Fig. 2 - Partial Correlation Matrix

Source: PricePedia elaborations

The analysis of the partial correlation matrix among the three variables considered highlights another point of interest. The total investment cycle is significantly correlated with imports of tools and equipment by both the industrial and services sectors, but the direct ("partial," meaning net of indirect effects) correlation between the two types of goods is relatively low (0.20). This indicates that the industrial investment cycle develops in a relatively autonomous way compared to the services investment cycle. Their alignment is mainly due to the influence exerted by general economic conditions supporting investment (measured in terms of total investments), which significantly affect the cycles of both sectors.

Conclusion

International demand for capital goods represents a highly relevant variable, as it allows for the early detection of significant signals regarding firms’ investment decisions. An increase in such demand can indicate a phase of economic expansion, characterized by business confidence and a propensity to renew or upgrade production capital. Conversely, a decline may reflect uncertainty and translate into a reduced willingness to invest. Moreover, the possibility of disaggregating import data by type of goods purchased by each sector or segment makes it possible to obtain an indirect measure of sector-specific investment policies, providing valuable and otherwise unavailable information.