Brexit Chaos: a Light at the End of the Tunnel, at last?

In spite of the outcome of UK parliamentary elections, which produced a strong conservative majority, Brexit is still far from "done".

Published by Alba Di Rosa. .

Brexit Exchange rate Uncertainty Exchange rate risk Pound Exchange ratesThe news of the day is undoubtedly Boris Johnson’s landslide victory in British parliamentary elections, held on December 12. The elections, which basically represented a referendum on Brexit ("Get Brexit Done!" was the slogan of the outgoing PM), were called by Johnson in the hope of obtaining a strong conservative majority in the House of Commons and therefore end the stalemate on Brexit with the approval of the agreement negotiated with the EU.

With 365 seats, which largely exceed the 326 required for a Tory majority, this goal appears to have been largely achieved; after 3 years of uncertainty and negotiations, the prospect of Britain's exit from the Union now looks more certain than ever.

The reaction of the pound

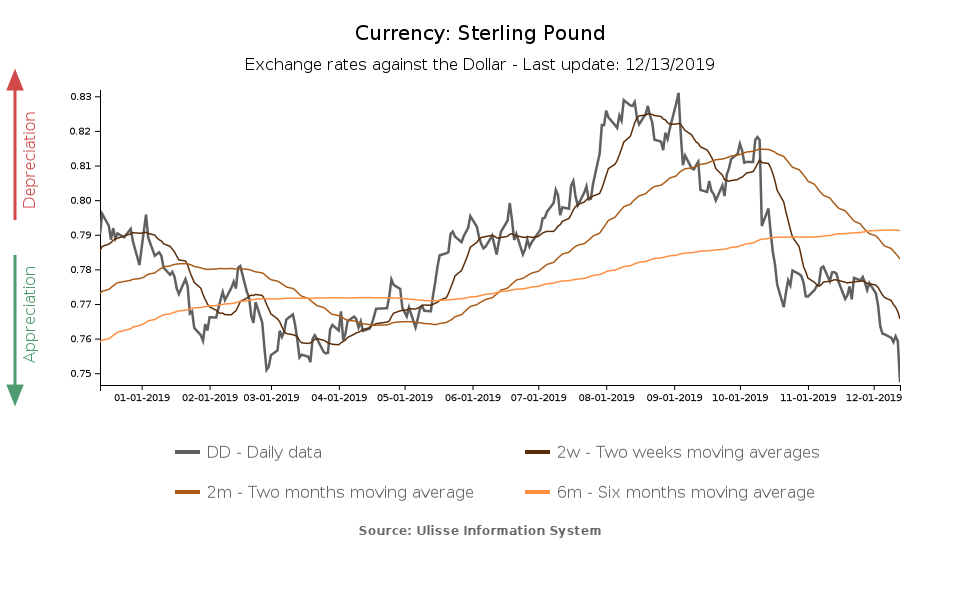

The British currency showed a strong positive reaction to the news of the election result: just after the first exit polls were released last night, the pound recorded a 2% jump against the dollar, and then lost part of the conquered ground today. Overall, in the last 2 days the currency strengthened by 1.84% against the dollar.

As can be seen from the graph, the recovery trend of the pound against the dollar had already started a while ago: a Tory’s victory had therefore already been partially priced in – and hoped for – on FX markets. Although markets have long been perceiving Brexit as a risk, the certainty of leaving the EU with an orderly withdrawal agreement, compared to the prospect of prolonged uncertainty, looks now quite a desirable option.

Today, European stocks reacted positively to the news as well, also supported by the optimism for the alleged achievement of a Phase One Deal between the United States and China on the trade war front.

Perspectives and challenges

Investors are now quite confident that a soft Brexit will be carried out shortly: given the strong conservative majority emerged from the elections, Boris Johnson’s new government should not find it hard to receive parliamentary approval for the withdrawal agreement negotiated with the EU in October. If this happens, Britain will formally leave the EU on January 31 2020.

However, this would only represent a formal step: after this deadline, a transition period will start, during which the EU legislation will still be valid for the United Kingdom, as well as its trade, home affairs, defence and foreign affairs policy.

The transition period will end on December 31 2020; nonetheless, most analysts agree that concluding the negotiations on a trade agreement with the EU by that date is highly unlikely. The Prime Minister may then be forced to request an extension of the transition period, postponing the effective exit date.

Meanwhile, on the other side of the Atlantic, US President Donald Trump congratulates Boris Johnson for his victory, opening the door for a free trade agreement with the UK, once Brexit will be effective.

Congratulations to Boris Johnson on his great WIN! Britain and the United States will now be free to strike a massive new Trade Deal after BREXIT. This deal has the potential to be far bigger and more lucrative than any deal that could be made with the E.U. Celebrate Boris!

— Donald J. Trump (@realDonaldTrump) 13 dicembre 2019

Despite some signs of easing, the new government will have to face evident challenges. These elections have in fact strengthened the Scottish National Party, which strongly opposes the exit of the United Kingdom from the EU. Despite the opposition of PM Johnson, Scottish Prime Minister and SNP leader Nicola Sturgeon has declared that she will formally ask the London government the permission to hold a second referendum on Scottish independence (the first one, held in 2014, led to the victory of the “no” front).

As regards Northern Ireland, nationalist Catholic parties – favouring a united Ireland – won more seats than the Democratic Unionist Party, which advocates Northern Ireland’s belonging to the Kingdom. Potential sources of tension therefore lie ahead.

Another element of risk is the possibility, already mentioned above, of not reaching a trade agreement with the EU by the end of 2020. The request for an extension would not only break PM Johnson's promises, but could also meet with the opposition of the most radical Brexiteers. The risk of a no-deal Brexit is therefore not completely gone, yet.