The March of the Epidemic in Brazil: What Prospects for the Real?

Published by Alba Di Rosa. .

Exchange rate Central banks Uncertainty Exchange rate risk Brazilian real Latin America Emerging markets Exchange ratesLast week we mentioned the possibility of an improvement in investor sentiment on international financial markets, addressing the case of the recovery of the Russian ruble. Further signs of easing from the rest of the world suggest that this trend might be continuing: on the one hand the dollar, safe-haven asset par excellence, is starting to recede (-1.3% in terms of effective exchange rate in the last week), and on the other some EM currencies seem to have timidly taken the road to recovery.

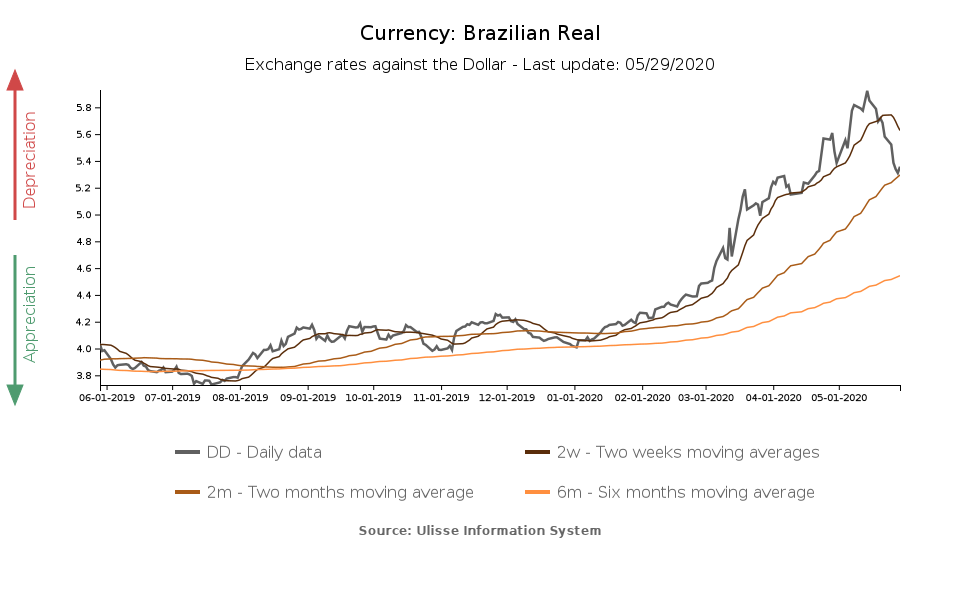

Among them, the case of the Brazilian real, worst performer in 2020 among floating EM currencies, stands out. After a virtually continuous weakening phase since the beginning of the year, a reversal of the trend has in fact began in mid-May, as can be seen from the graph below. In the last two weeks the real has recovered 10% of its value against the dollar: the exchange rate has returned to 5.3 real per dollar, after exceeding 5.9 real per dollar. Let us therefore proceed to analyze the factors at the basis of its latest developments.

Politics, economy and the epidemic

As we have written in this article, the dynamics of the real in recent months has been penalized by a set of factors common to other EM currencies, such as the uncertainty surrounding the Covid-19 epidemic, capital flight and the fall in oil prices. This adds up to the precariousness that characterized the Brazilian economy even before the outbreak, an economy inevitably put to the test by the spread of the virus on a large scale.

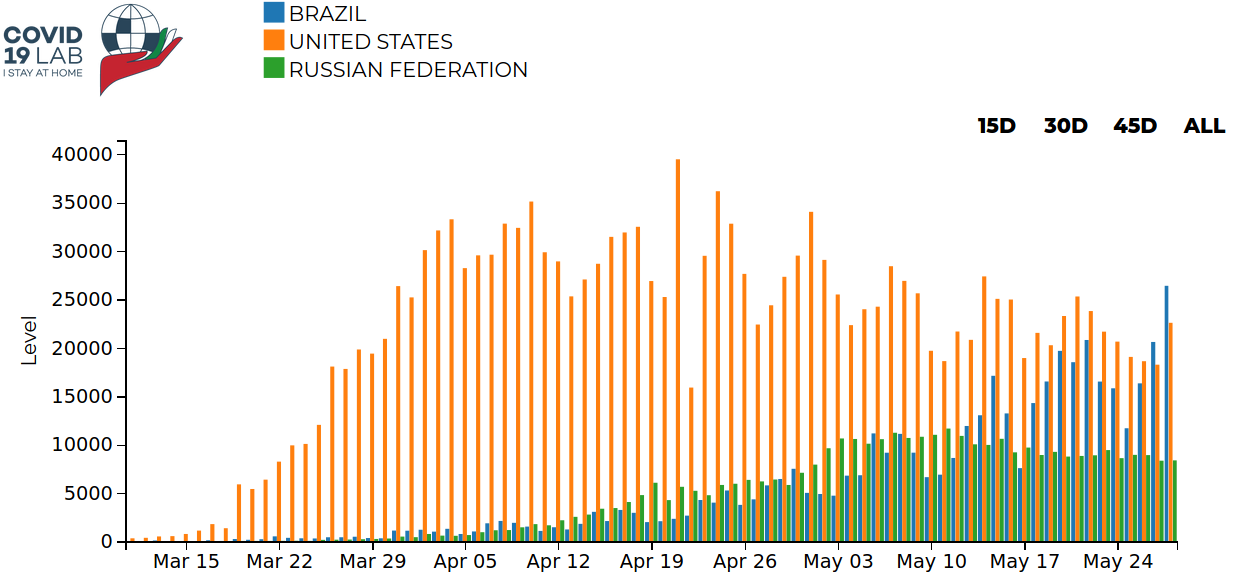

In the last month, the epidemic has in fact shown a clear acceleration in the largest South American country, leading it to rank second in the world for the number of confirmed cases to date (more than 430,000 total cases), shortly followed by Russia, while the United States still rank first, with 1.7 million confirmed cases. However, while the growth of the contagion in the USA seems to be slowing down, the same cannot be said for Brazil, which recorded more than 26,000 new cases yesterday alone. According to statements by WHO regional director Carissa Etienne, Latin America is now the new epicenter of the epidemic.

The situation on the Covid front therefore seems to be getting worse and still represents a pressure factor for the Brazilian currency.

Trends in Covid19 Epidemic: CONFIRMED CASES (LEVEL - DAILY)

As for the political front, tensions continue over President Bolsonaro's approach to managing the epidemic. After the resignation in April of Justice Minister Sergio Moro and the dismissal of Health Minister Luiz Henrique Mandetta, who was in favour of quarantine measures, the new Health Minister Nelson Teich also resigned this month, threatening the stability of an already fragile government.

The president's willingness to avoid a lockdown as in most other world countries, and the call to return to work in violation of local lockdown measures, is causing concern abroad and especially among Brazilians themselves, so much so that the president's approval rate is falling and impeachment is entering public discussion.

Due to the delicate sanitary and political situation, the risk associated with Brazil therefore continues to be high, a factor that is likely to keep investors away in the coming months. On top of that, forecasts are gloomy on the socio-economic front, in a country where a large segment of the population is employed in the informal economy, and where the risk of poverty is becoming more and more concrete.

In this context, the recovery observed for the currency therefore seems out of place and some analysts do not agree that this might be the beginning of an actual turnaround.

What can be inferred from currently available data is that two factors may have played a prominent role in this (temporary?) turnaround:

- The general improvement in investor sentiment, not strictly related to Brazil but rather to the easing of lockdowns and reopenings for many world economies, and the consequent weakening of the dollar as a safe haven asset. Since the exchange rate is by definition bilateral, a weakening for the dollar indirectly supports the other currency involved in the relationship.

- The recent announcement by Banco Central do Brasil that the cycle of expansionary monetary policy, which began in the summer of 2019, may be almost over. After the last cut in May, which brought the Selic rate to 3%, the bank plans to make another cut of the same amount (0.75%) at the next meeting, thus concluding the cycle.

Such monetary policy reassurances could represent a supporting factor for the currency in the coming months, but the risk of depreciation associated with it will remain high as long as health and political risks will firmly remain on the scene.