US Elections: Financial Markets' Reaction and the Impact on the Dollar

Published by Alba Di Rosa. .

Exchange rate Central banks Slowdown Uncertainty Economic policy Chinese yuan United States of America Dollar Great Lockdown Exchange rate risk Covid-19 Emerging markets Exchange ratesThis week both the press and financial markets were inevitably focused on a key event: the US presidential elections held on November 3.

At the time of writing, the final results of the counting are not yet available; the Democratic presidential candidate Joe Biden is in the lead, with 264 out of 270 electoral votes needed to obtain a majority; the outgoing president Donald Trump is instead at 214. Therefore, if by now the victory seems to be almost in Biden's hands, the possible handover is not going to be painless: in fact, President Trump has already openly criticized the outcome of the vote and accused the Democrats of electoral fraud, thus opening the scenario of a contested election.

Markets' response: US dollar vs EM currencies

The prospect of a clash on the legitimacy of the elections creates, in the short term, a scenario of political uncertainty, that could also translate to the financial level. For the time being, the markets do not seem to be unsettled by this possibility, focusing on the scenario of a democratic victory with a divided Congress (Senate with a Republican majority and House of Representatives with a Democratic majority).

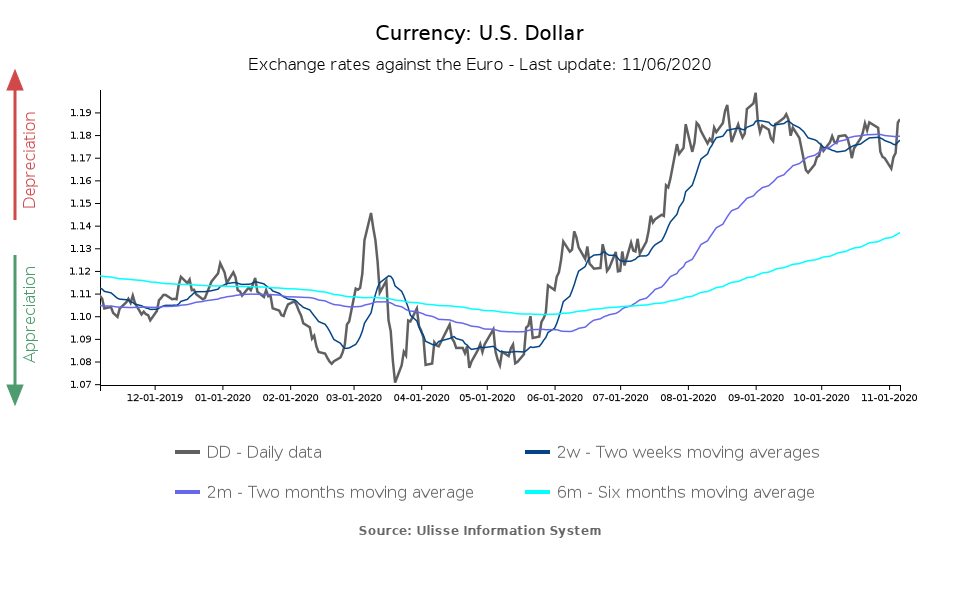

The dollar reacted to the elections and the first indications of their outcome with a weakening, in the face of a recovery in risk appetite. The euro-dollar exchange rate went from 1.17 on November 3 to 1.19 today, as can be seen from the graph below.

In contrast, EM currencies have shown an upward trend: among floating EM currencies, since November 3 the Colombian peso and the Hungarian forint gained almost 3 percentage points against the dollar; Brazilian real, Czech koruna and Polish zloty appreciation by more than 2%. The strengthening was instead close to 2 percentage points for the Russian rouble, South African rand and Mexican peso.

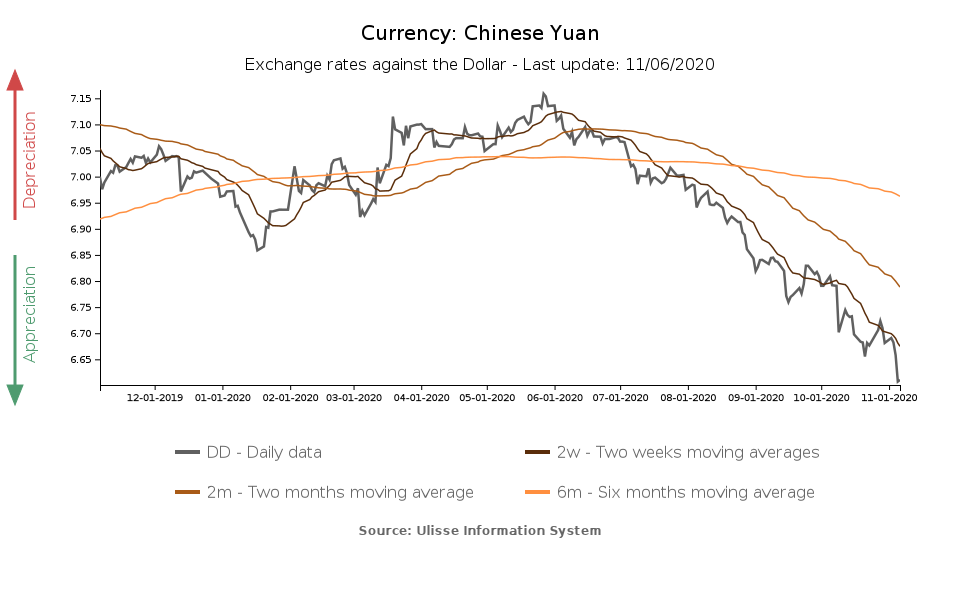

Obviously China has looked closely at this election, for the impact in terms of trade relations and possible easing of tensions between Washington and Beijing with a democratic presidency. In a trend of strengthening that has been going on since the beginning of summer, in the last days the yuan has gained further ground against the greenback (more than 1% from November 3 to date).

Greenback: medium term outlook

Looking ahead, in line with the election result now considered more likely and described above, experts forecast that the dollar will tend to remain weak, due to:

- A progressive normalization on the economic front, with the exit from the pandemic emergency

- A reduction in geopolitical risk in case of a Biden presidency, which could reduce the demand for dollars as safe-haven currency

- Monetary policy stance due to remain very accommodating, as confirmed by the Federal Reserve at the last monetary policy meeting on November 4-5

- US government bonds yields substantially lower than in the pre-Covid era

As in any forecast, however, caution is a must, all the more so in a scenario marked by deep uncertainty like the current one. In fact, analysts' opinions are not unanimous in excluding a new recovery of the greenback, in the face of a pandemic that has not yet been defeated and which continues to represent the main risk factor on the scene.