EU Exports of Machinery: signs of recovery in the 1st quarter 2021, but still below pre-crisis levels on average

Within the industry, there are sectors that are struggling and others that have already significantly recovered from 2019 level

Published by Marcello Antonioni. .

Europe Industrial equipment Export Conjuncture Great Lockdown Global economic trendsIn the first quarter of the year, there are signs of recovery for European instrumental mechanics: more than 6 percent in trend terms for European exports of machinery and industrial equipment.

.

However, Levels in the first quarter of 2021 are still lower (albeit by "only" 2.8 percentage points) than levels in the corresponding period of 2019.

The recovery of pre-crisis levels is however already a reality in several sectors: paper machines, tooling machines and extrusion machines and food machines

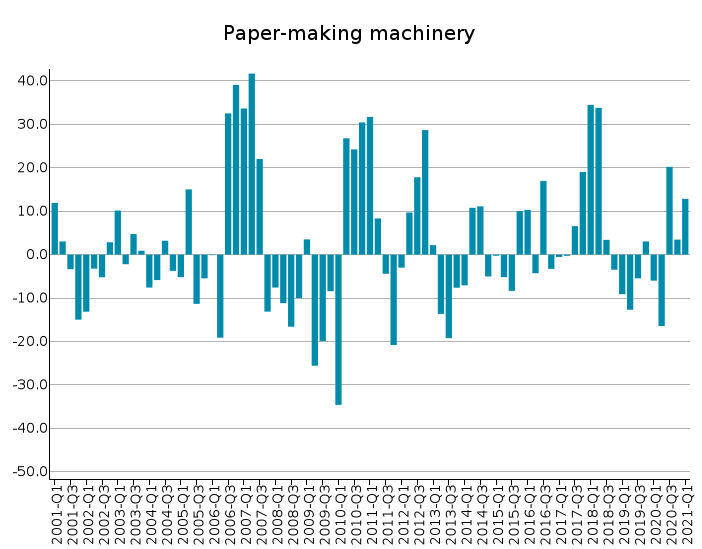

Among the sectors included in the Machinery1industry, we note the very favorable performance of EU exports of Machinery for Paper Mills, up almost 13 percent compared to the corresponding period of 2020 (trending up for the third consecutive quarter) and, above all, at levels already higher than in 2019 (+6.1 percent in euro compared to Q1 two years ago).

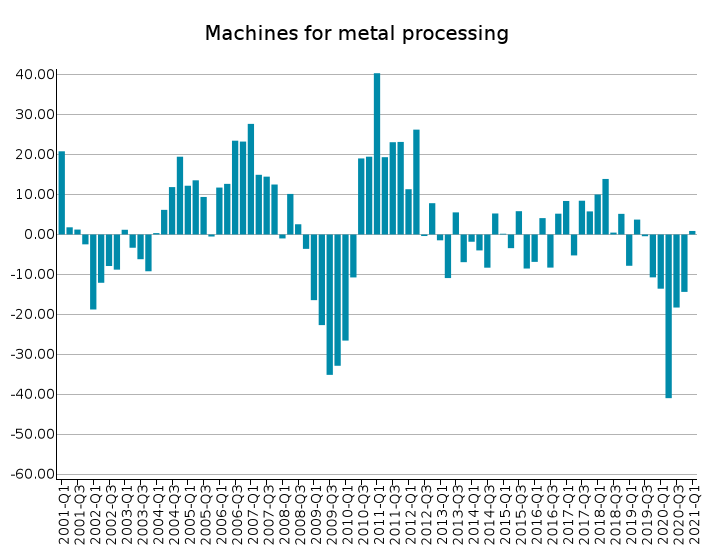

A good recovery in the first quarter of the year for European sales of Machinery for Metals, which - thanks to the very good performance of EU exports - rose by almost 13 percent compared to the corresponding period of 2020 (trending up for the third consecutive quarter).

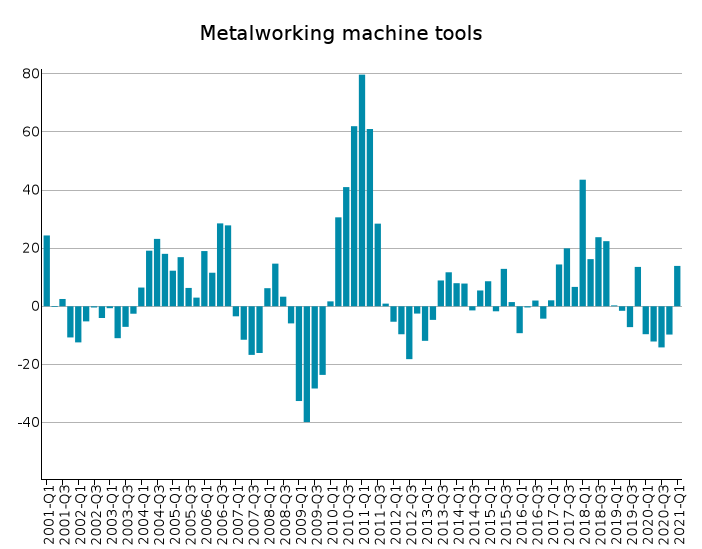

Good recovery in the first quarter of the year for European sales of Machine tools for metals, which - thanks to an increase close to +14 percent over 2020 - saw EU export values returned above 2019 levels (+2.9 percent in euros).

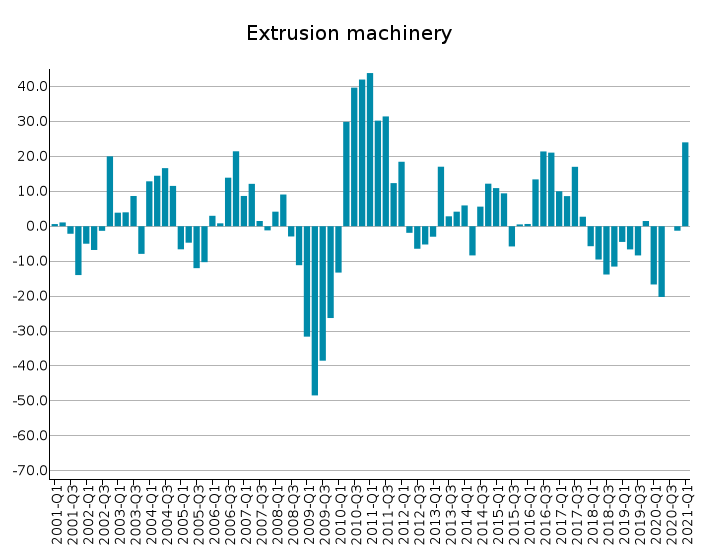

EU exports of Extrusion machinery also appear to be recovering strongly in the first quarter of the year, with a trend increase of as much as 24 percentage points in euros compared to 2020 and, above all, a return to levels higher than pre-crisis levels (+3.3% compared to Q1 2019).

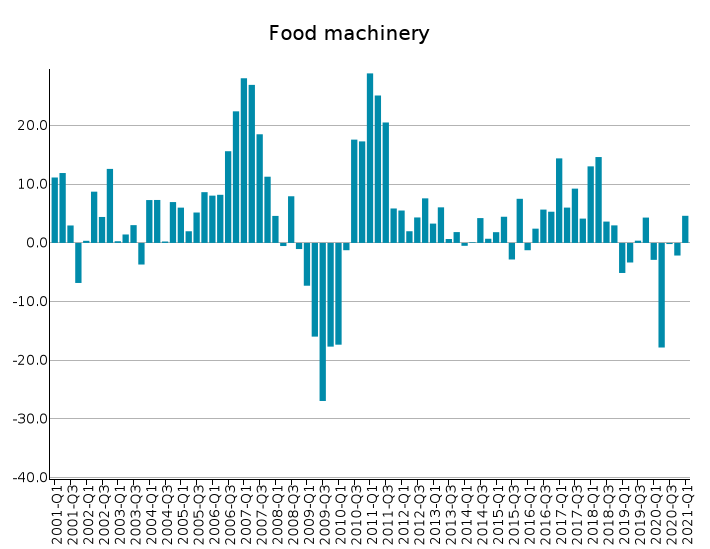

Not least, exports by European Food machinery companies are showing an - albeit moderate - recovery in the first quarter of the year, with a trend increase of 4.6 percentage points in euros compared to 2020 and levels 1.6 points higher than in Q1 2019.

|

|

|

|

|

|

|

|

|

|

Source: ExportPlanning - Market Research - Analytics, EU Trade Datamart

However, for metalworking machinery, machine tools for hard materials, textile machinery and printing machinery recovery from 2019 levels is still a long way off

On the other hand, there are several sectors with early 2021 levels still below - in some cases significantly below - 2019 levels. EU exports of Machinery for Metalworking are still struggling, with a first quarter of the year essentially on the same 2020 levels (+0.9%), and above all with a gap compared to 2019 of almost 13 percentage points in euro values.

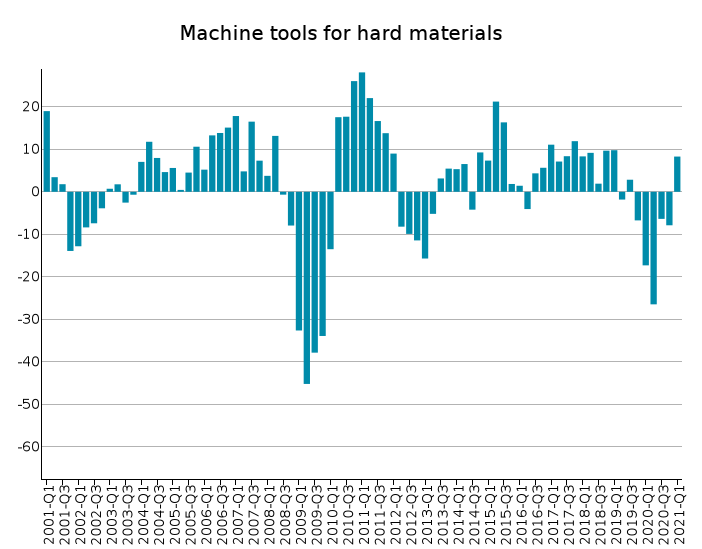

The Machine tools for hard materials sector also reports difficulties in recovering pre-crisis levels, with a negative differential of more than 10 percentage points in EU export values compared to the first quarter of 2019. However, the trend growth compared to 2020 (+8.3% in euros) should be highlighted.

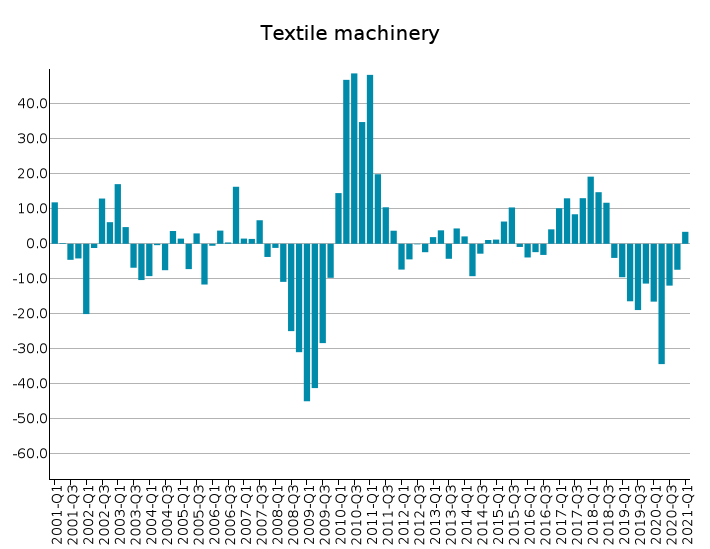

The Textile Machinery sector, while marking a moderate trend increase in EU exports (+3.4% compared to 2020), confirms levels far from pre-crisis levels, with a negative differential of almost 14 percentage points in euro values compared to the first quarter of 2019.

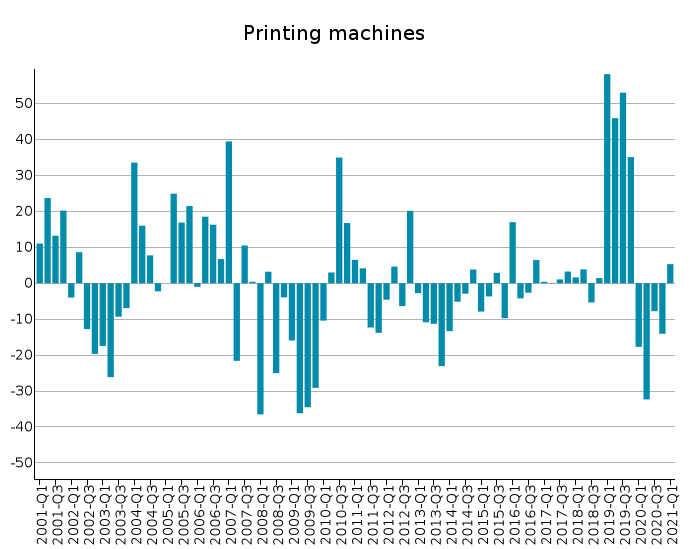

Similarly, the Printing and publishing machinery sector, while also marking a moderate trend increase (+5.3% compared to 2020), confirms EU export levels far from pre-crisis levels, with a negative differential of over 13 percentage points in euro values compared to the first quarter of 2019.

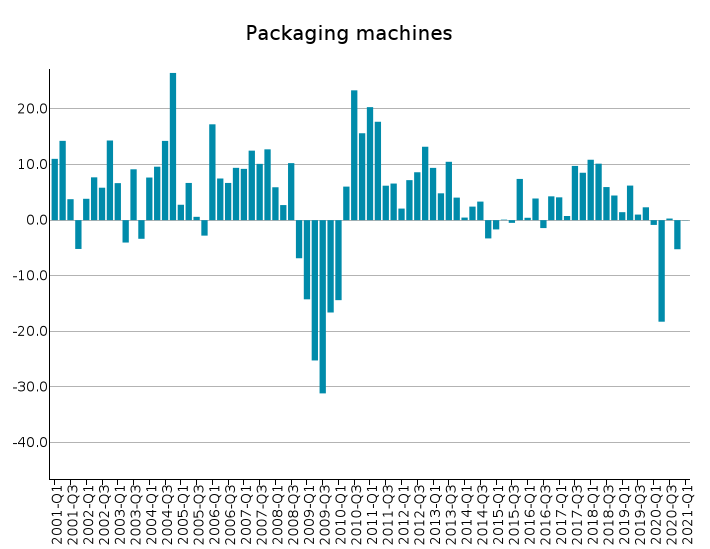

Finally, it should be noted that EU exports of Packaging machinery for packaging are stable compared to 2020 and still at slightly lower levels (-0.9% in euros) than in Q1 2019.

1) See the list of the sectors included in this industry in the related industry's description.