The Monetary Policy Week

General stability of interest rates for developed countries, while the FED opens the door to tapering; Norway bucks the trend

Published by Alba Di Rosa. .

Exchange rate Exchange rate risk Central banks Uncertainty United States of America Dollar Euro Exchange ratesThe last week proved to be rich in financial events due to the various central banks' meetings held on a global scale. Among these we can find the US Federal Reserve (FED) at the center of the scene, due to the primary role played by the United States in the world economy.

US monetary policy: interest rates unchanged...

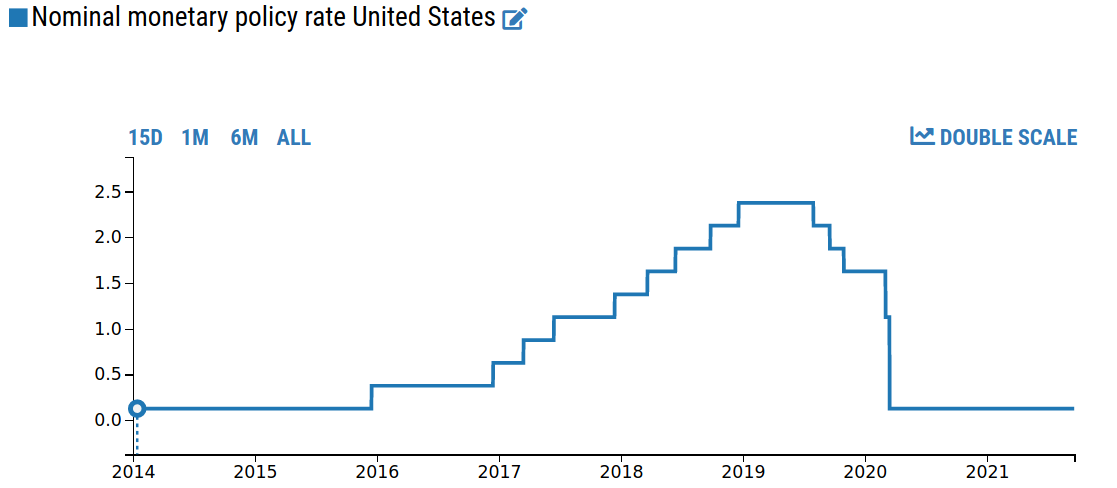

At the Federal Open Market Committee (FOMC) meeting on September 21-22, the Fed stated, in line with expectations, that it intends to maintain an accommodative stance for monetary policy. According to chairman Jerome Powell, US monetary policy aims to support the economy until a full recovery is achieved. The benchmark interest rate thus remains at the trough of 0-0.25%, as generally expected.

As reported in the recent economic projections released by the FED, 6 members of the FOMC are aiming to an increase in interest rates for 2022; 3 members point to a double increase next year, while 9 members expect a continuation of the current phase of stagnation. It is therefore a more hawkish turn of events compared to the prospects of early summer released by the central bank, which considered more likely a possible rate increase from 2023.

… and focus on tapering

While the stability of interest rates thus confirmed already widespread certainties, analysts' attention at the latest FOMC meeting was mainly focused on tapering, i.e., the slowdown in the pace of asset purchases on the market by the central institution.

At the annual symposium held at Jackson Hole in late August, markets were already expecting an imminent tapering announcement, which instead resulted in Powell's statements of a potential reduction in asset purchases by the end of 2021. The latest FOMC meeting has officially confirmed this line: the FED has in fact announced that a "moderation in the pace of asset purchases may soon be guaranteed". As of today, the FED foresees the start of a "gradual tapering process that concludes around the middle of next year".

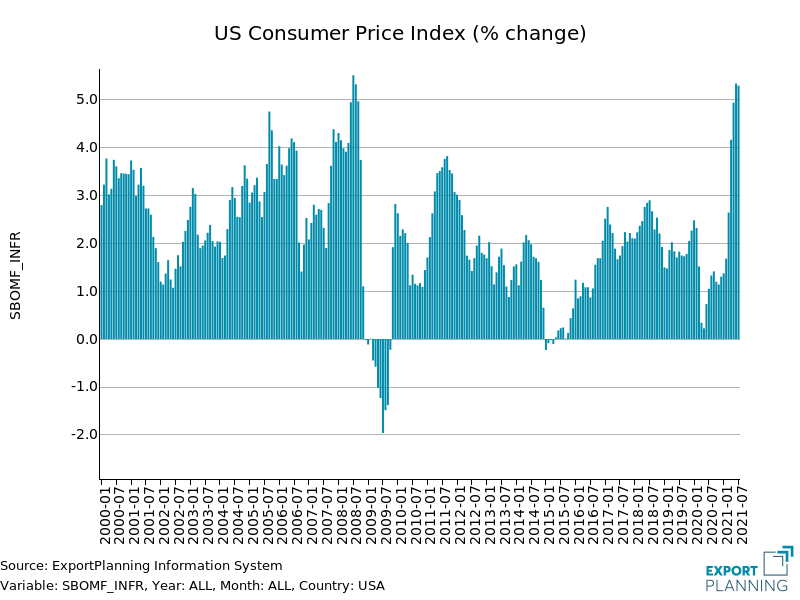

As stated by chairman Powell, the reduction in asset purchases is not intended to provide any signals regarding the rise of interest rates, which the FED instead plans to leave unchanged until the labor market is headed for maximum employment and inflation firmly back above 2%. The recent climb in the consumer price index, which exceeded 5% in both June and July, is in fact defined by the central bank as a transitory phenomenon, although it is certainly under strict observation.

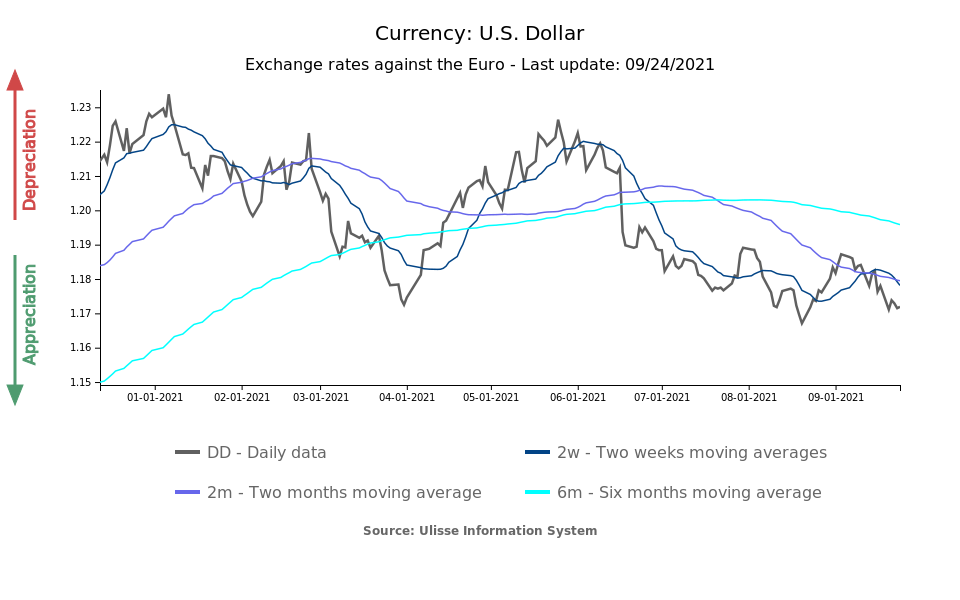

From the FX point of view, the dollar did not show significant reactions to the central bank's decisions: in the last few days, the greenback has in fact confirmed its central role in a historical moment that is still highly uncertain for many countries, first of all the emerging cluster, lagging behind developed countries in the race for vaccines against SARS-CoV2. The exchange rate closed the week at 1.17 against the euro.

Outside the States, monetary policy remains accommodative for developed countries

Broadening the view to other countries that took part in the "monetary policy week", we can find the Bank of England (BoE), which also decided to keep its reference interest rate unchanged; the BoE also reduced the country's economic growth projections for Q3-2021. The Bank of Japan, which kept its short-term interest rate at -0.1%, is on the same wavelength; no signs of tapering emerge from the eastern country, which instead confirms purchases of national government bonds without a predefined limit. Accommodative monetary policy lines also remained unchanged for Switzerland (-0.75%, the lowest rate in the world) and Sweden (0%).

On the contrary Norway bucked the trend and, as expected,

at its September meeting raised its key interest rate from 0% to 0.25%: "A normalising economy now suggests that it is appropriate to begin a gradual normalisation of the policy rate," said Governor Øystein Olsen. Norway therefore sides with South Korea, the first developed Asian country to move towards monetary policy normalization at the end of August.