Russia-China-India commercial Alliance consolidates

About a year and a half after the invasion of Ukraine, Russia's foreign trade has changed dramatically: the growing weight of Beijing and New Delhi

Published by Marzia Moccia. .

Asia Europe Conjuncture Global economic trendsAbout a year and a half after the invasion of Ukraine, Russian foreign trade has changed dramatically. Indeed, as a consequence of the invasion and violation of international rights, the entire "Western bloc" has responded with sanctions aimed at isolating Moscow politically, commercially and financially. The Kremlin has thus aimed to offset the damage of the embargo by trying to cement relations with other trading partners, turning its attention primarily to China and India.

Not coincidentally, last March China and Russia signed a cooperation agreement, in which Moscow pledged to meet China's growing energy demand, promising by 2030 to supply at least 98 billion cubic meters of gas and 100 million tons of liquefied natural gas per year, while also pledging to encourage the use of Chinese currency in payments.

At the same time, Russia, in agreement with the Eurasian Union, decided to speed up the process of approving a free trade agreement with India.

The relationship between Moscow Beijing and New Delhi

In the face of the lack of Russian foreign trade declarations, mirroring the deepening rift created between Russia and its allies, one way to be able to read such phenomena is to consider the customs information published by their respective partners, such as China, the European Union and India.

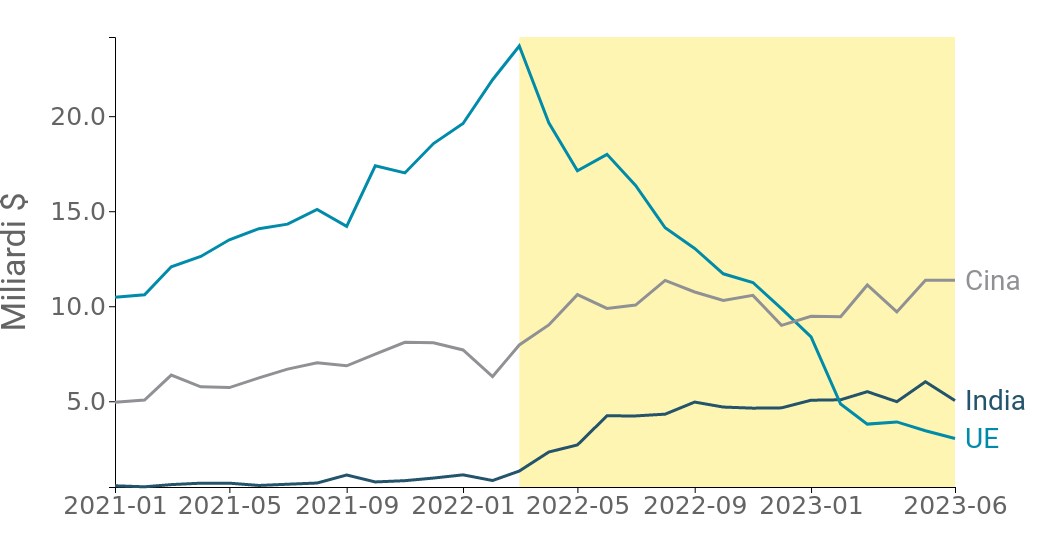

Fig.1 – Russian exports to EU, China and India

monthly data, billions of dollars, area in yellow outlines the outbreak of war

Source: ExportPlanning

It is evident from the proposed graph that the sharp downsizing of the European market has been counterbalanced by the gradual increase in Moscow's exports to China and India.

In particular, according to Chinese customs data, Russian exports to the Dragon country were up 20 percent compared to the corresponding period in 2022 and substantially doubled compared to the 2021 figure.

Even more significant increase for the Indian tiger, where Russian exports went from a negligible share to be close to $32 billion in the first half of 2023 alone.

The relevance of energetics

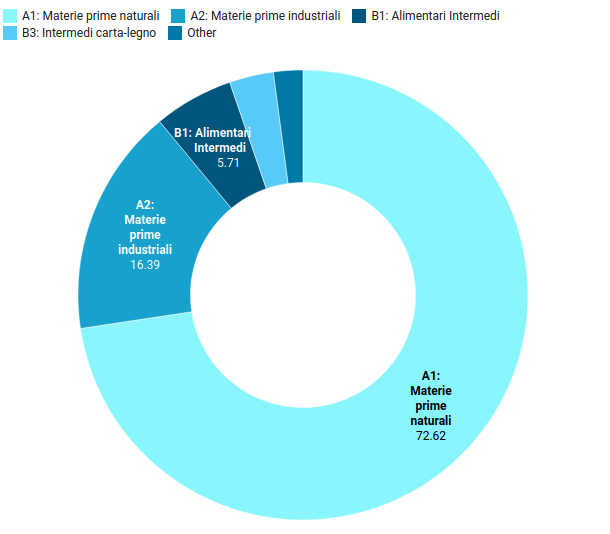

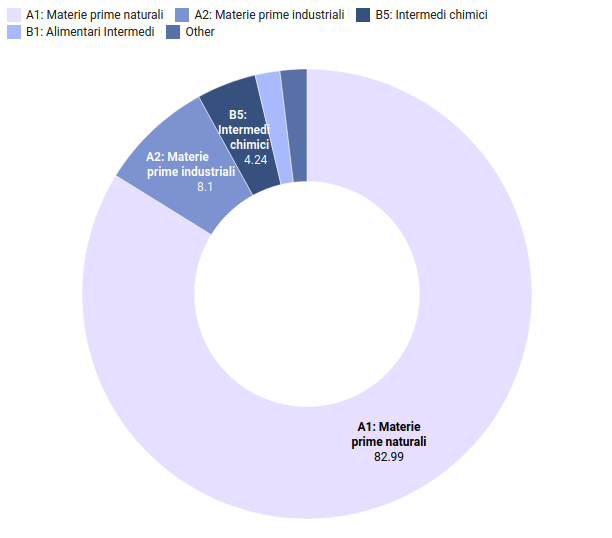

Essentially, the Kremlin's export basket to China and India is composed almost entirely of raw materials, and in particular energy: in fact, as the following figures show, in the first six months of 2023 about 90 percent of direct exports to the two countries were gas, crude oil and derivatives. These were followed, but to a much lesser extent, by food and chemical intermediates.

Fig.2 – Composition of Russian exports to China and India

Source: ExportPlanning

With the gradual and significant loss of the European market, Russia has therefore aimed for a substantial shift in its trading partners, redirecting oil and gas sales to China and India.

The other side of the coin: a balanced relationship?

The trade axis between Russia and the "South" of the world has thus become more solid, even in the face of few Russian alternatives.

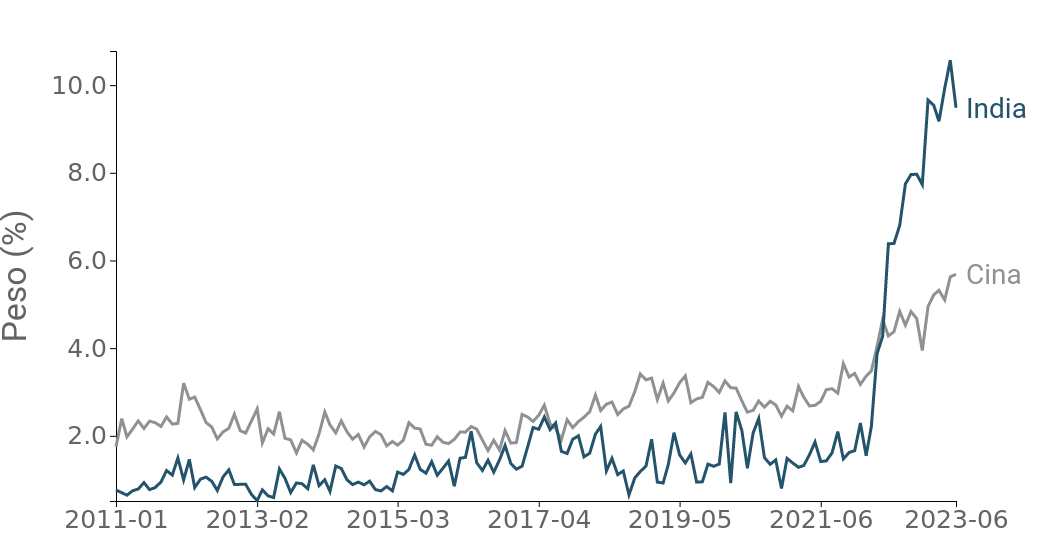

In fact, the Kremlin's weight as a supplier country to China and India has been growing over the most recent months, particularly for India (see chart below).

Fig.3 – Weight of Russia on total from supplier countries

monthly data, share

Source: ExportPlanning

However, it is worth noting how several commentaries have seen the new partnership as an increasingly unbalanced relationship, especially in Beijing's favor.

As noted by Maria Shagina, of the International Institute for Strategic Studies, the sanctions have in fact exacerbated the already asymmetrical relationship between Russia and China, as Russia is to date a minor partner for the Dragon country, weighing in at just over 5 percent, compared to China's significantly more significant role for Russia.