Mexico: global opportunities, local inequalities

Published by Veronica Campostrini. .

Macroeconomic analysis Latin America Foreign markets Internationalisation Foreign market analysisMexico is currently one of the main areas of interest for global investors. Its strategic geographic location, openness to trade, and solid industrial base make it a crucial hub in North American value chains and a key player in the Latin American context. However, behind the positive figures for exports and investment lies a more complex reality, marked by structural imbalances, regional disparities, and an institutional trap that is difficult to escape.

An Economy Integrated into the Global Market

Few emerging countries can boast a level of integration into global trade comparable to Mexico’s. Exports and imports account for around 70% of GDP, highlighting a strongly outward-oriented economy. It is no surprise, then, that the country ranks ninth worldwide for foreign direct investment inflows, attracted by a favorable operating environment: a young and skilled workforce, competitive costs, and a progressively improving logistics infrastructure.

The more than 3,100-kilometer border with the United States is a fundamental economic lever.

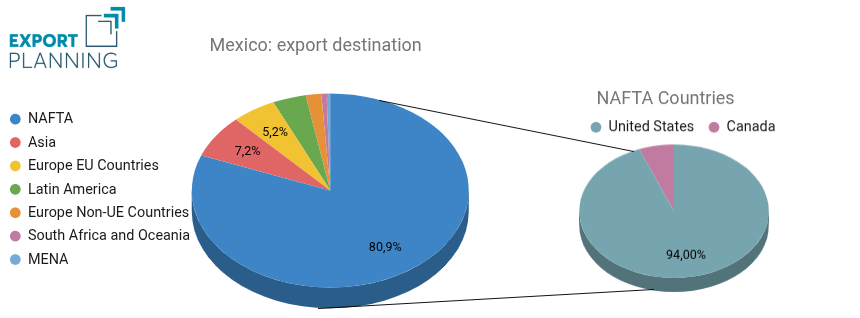

Analysis of Mexican Exports

Source: ExportPlanning elaborations

Over 80% of Mexico’s exports are directed to its northern neighbor, making the country an essential pillar of American industry. Bilateral trade between the two countries approaches 600 billion dollars annually. Even the recent protectionist winds from Washington, with the introduction of tariffs under the Trump administration, merely slowed—but did not interrupt—this interdependence.

A Broad but Uneven Industrial Base

Mexico’s economy is surprisingly diversified. High-intensity manufacturing, particularly in the automotive and electronics sectors, is complemented by growing areas such as finance, technology, and services. The government, aware of the country’s attractive potential, has implemented investment support programs in the most innovative sectors, with a special focus on renewable energy and industrial digitalization.

However, this economic dynamism is not evenly distributed. Mexico remains a country marked by strong territorial and social disparities. Rather than a two-speed economy, it is a dual-structured one: on one side, regions benefiting from foreign investments, modern infrastructure, and relatively efficient governance; on the other, vast areas still on the margins of development, plagued by chronic poverty, weak institutions, and inadequate services.

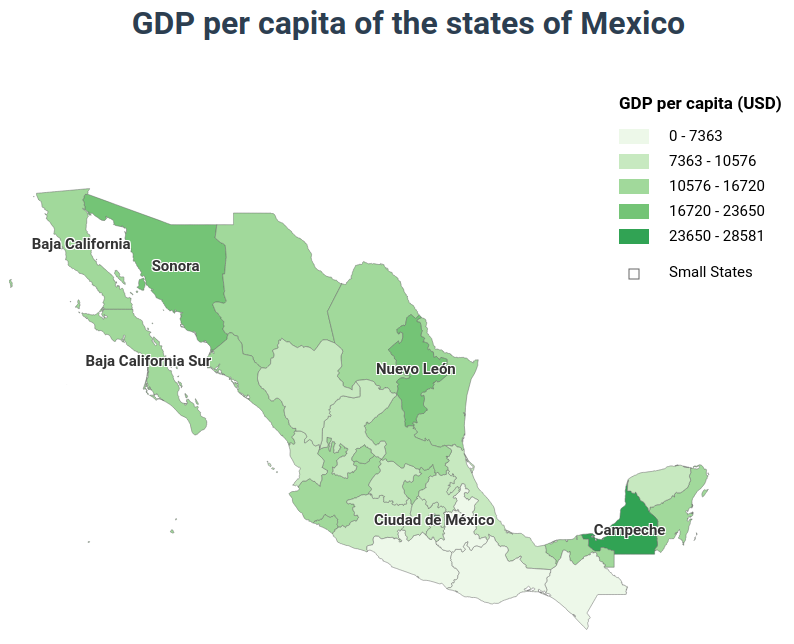

A Mirror of Inequality: Regional GDP per Capita

To grasp the depth of the internal divide, one need only look at the distribution of per capita GDP across the federal states. The map clearly shows a segmented economic geography.

Map of Mexico

Source: ExportPlanning elaborations

Northern states such as Nuevo León, Baja California, and Sonora, along with Mexico City and Campeche, show high levels of per capita GDP. However, this figure should not be confused with a true measure of wealth. In many of these areas, the value is influenced by low population density (as in the case of Campeche) or by specific high-productivity sectors with limited redistributive impact. At the opposite end, densely populated regions such as Oaxaca, Chiapas, Guerrero, and Puebla register levels below USD 7,500, revealing a stagnant and marginalized economy.

The result is a territorial mosaic where a few poles thrive while a broad periphery remains excluded from the benefits of globalization. This dualism, fueled by unequal resource distribution and limited institutional capacity, creates a "development trap" that Mexico struggles to overcome. Institutions, often fragile or dysfunctional, fail to promote inclusive growth or correct the deep-rooted inequalities.

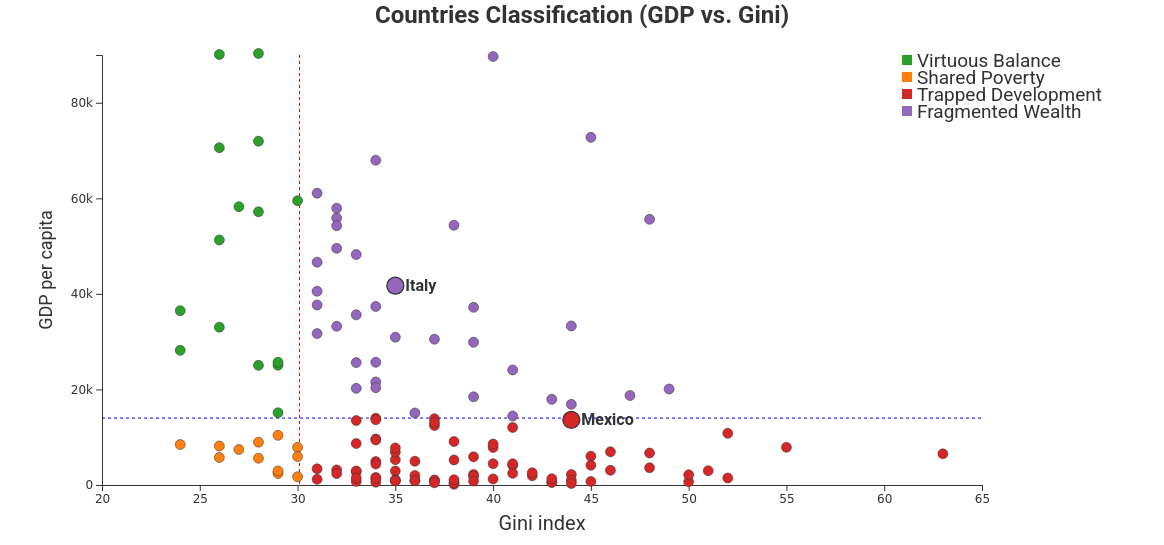

Mexico’s difficult development status becomes clear when placed on a map that crosses, on the horizontal axis, wealth distribution, and on the vertical axis, per capita GDP. In this interpretative framework, the country falls squarely within the “Trapped Development” area—far from the “Virtuous Balance”[1] zone, where economic growth and social inclusion reinforce each other.

Development Matrix

Source: ExportPlanning elaborations

A High-Potential Bet

Despite its challenges, Mexico remains fertile ground for investment. Its demographic potential, macroeconomic stability, and privileged access to North American markets—especially if the United States-Mexico-Canada Agreement (USMCA) remains in force—are assets that cannot be overlooked. However, foreign companies looking to enter this market must navigate a landscape of contrasts: a country that appears modern in numbers, yet retains outdated mechanisms for distributing power and wealth.

The challenge for those viewing Mexico as a strategic interest will be to seize its opportunities without losing sight of its vulnerabilities. Because Mexico, now more than ever, is an economic giant with feet of clay: solid in appearance, unstable in structure.

For those looking to explore this high-potential market in more depth, the Country Report on Mexico is now available—a comprehensive tool to understand the country’s economic, social, and institutional context. The report can be downloaded free of charge on the Country Report page.

[1] For a description of the different zones in which a country may fall along its path of economic development, see the article Beyond GDP: Inequality and Economic Growth