October 2020: A bird’eye view on Exchange Rates

Published by Alba Di Rosa. .

Exchange rate Euro Brexit Uncertainty Economic policy Pound Exchange rate risk Dollar Covid-19 Exchange ratesWhat topics are dominating the discussion on foreign exchange markets these days? Among major currencies, the spotlight remains on the dollar and the pound, whose dynamics signal, on the one hand, markets' fears in relation to the health risk and, on the other hand, the developments on the Brexit front.

Euro vs dollar

In the balance of power between the euro and the dollar, the single currency confirms, at the beginning of October, its levels of relative strength against the greenback: today the euro-dollar closed at 1.17, although last week the dollar experienced a brief phase of recovery, reaching the 1.16 threshold. The fluctuations of the dollar towards a strengthening are mainly related to its status as a safe-haven currency, and therefore to growing market fears about the state of health of the world economy and the risk of new lockdowns, following the increase in Covid-19 cases in Europe and the United States. Investors therefore remain cautious in terms of risk appetite, also in relation to the stalled negotiations for a new fiscal stimulus plan in the United States.

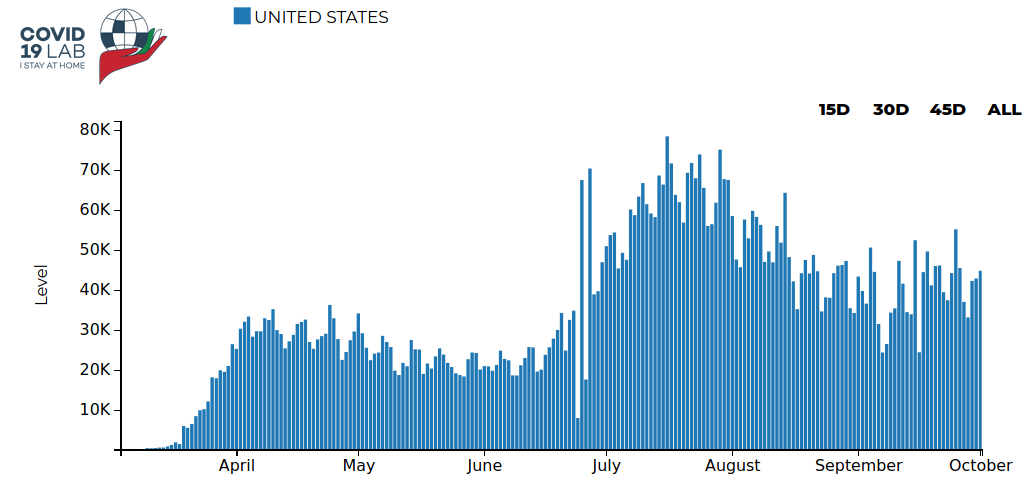

As can be seen from Covid19Lab data, in the last two weeks in the United States the downward trend of new confirmed cases has stopped; in the same way, upward trends can be detected in all major European countries.

New daily Covid-19 cases: US

A key factor that will influence the dollar in the coming weeks, and will constitute a source of uncertainty on currency markets, are also the upcoming US presidential elections in November. Analysts therefore expect volatility for the greenback, but its underlying trend seems to hover around weakness, also due to structural factors such as:

- monetary policy, which aims to remain very accommodative at least until 2023, according to the indications given in the last Federal Open Market Committee Meeting, in September;

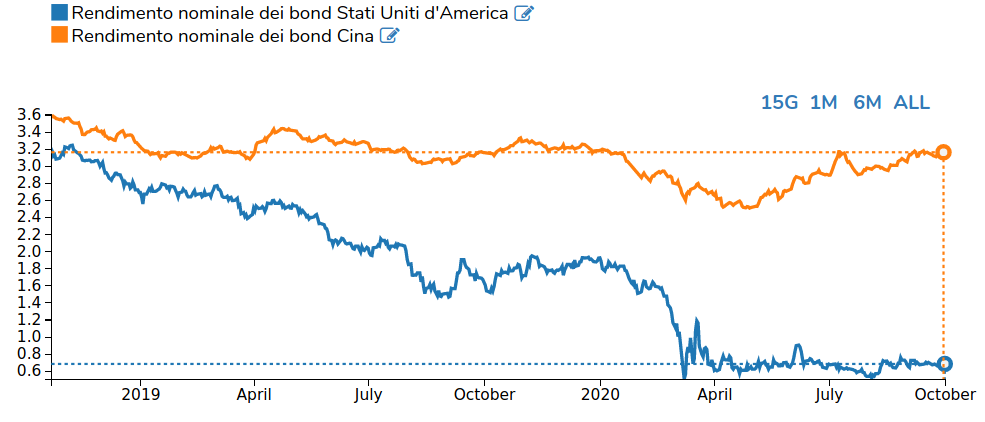

- lower government bond yields compared to the pre-Covid era, as can be seen from the chart below, that plots nominal 10-year bond yields for the US and China. If the gap between the two series was already present before the Covid crisis, the latter contributed to exacerbate it, thus generating a reduction in the attractiveness of US government bonds compared to the recent past - a factor that could weaken capital inflows to the US. The weight of an important support factor for the US currency has therefore been reduced.

Nominal 10-year bond yields: US and China

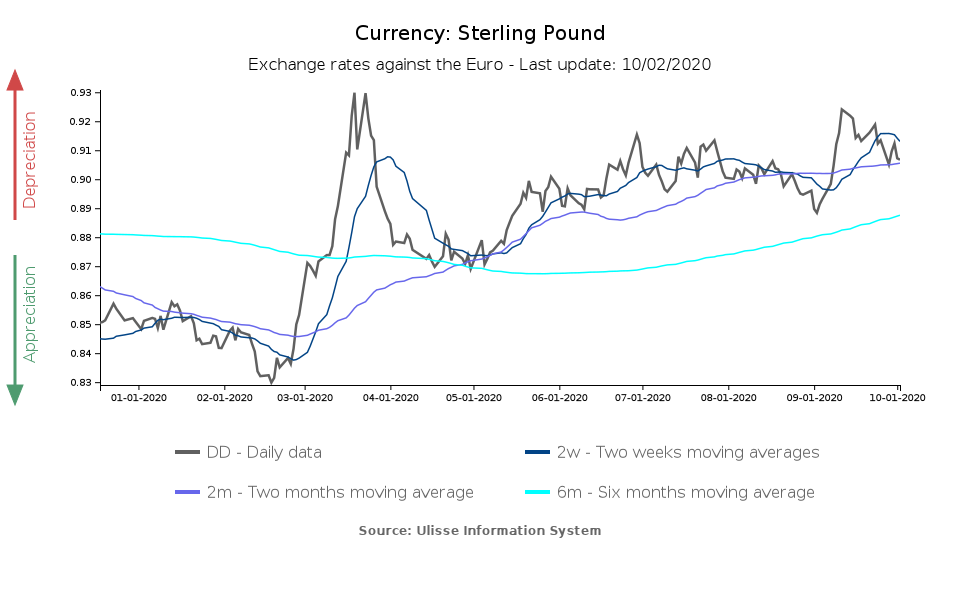

Pound: still marked by uncertainty

Another currency in the spotlight these days is the pound, which keeps on tracking Brexit tensions, as the deadline for an agreement looms. After a weakening in the first half of September, following the unveiling of the Internal Market Bill (IMB), the British currency has partially recovered in the second half of the month.

From the ninth round of negotiations on the EU-UK agreement, ending today, some cautious optimism seems to have re-emerged, compared to the dominant mood a few weeks ago. This optimism seems to have resisted yesterday's announcement by the European Commission of the launch of an infringement procedure against the UK linked to the Internal Market Bill, which was not withdrawn by the end of September as requested by the EU. In fact, the EU reaction had already been announced, and it did not seem to have had a significant impact on the pound's exchange rate against the euro.

Financial markets' cautious optimism would allegedly derive from the fact that, in this round of negotiations, the UK has opted for a more conciliatory and proactive approach; moreover, although the Internal Market Bill has been approved by the House of Commons, it will not reportedly reach the House of Lords before the end of the year, therefore buying time for the negotiators to reach an agreement.

However, there are still some unresolved issues such as state aid and fishing rights, and the clash on the IMB theme weighs on the confrontation. Despite some limited progress, the games on Brexit therefore remain open.