IMF|World Economic Outlook: the Picture of World Recovery in July 2021 update

Global economic recovery continues, but gap between advanced and emerging economies widens

Published by Marzia Moccia. .

IMF Macroeconomic analysis Conjuncture Foreign markets Covid-19 Great Lockdown Global economic trends

On July 27, the International Monetary Fund (IMF) updated the world GDP growth estimates published in the April forecast scenario, accessible through the World Economic Outlook datamart of the ExportPlanning Information System.

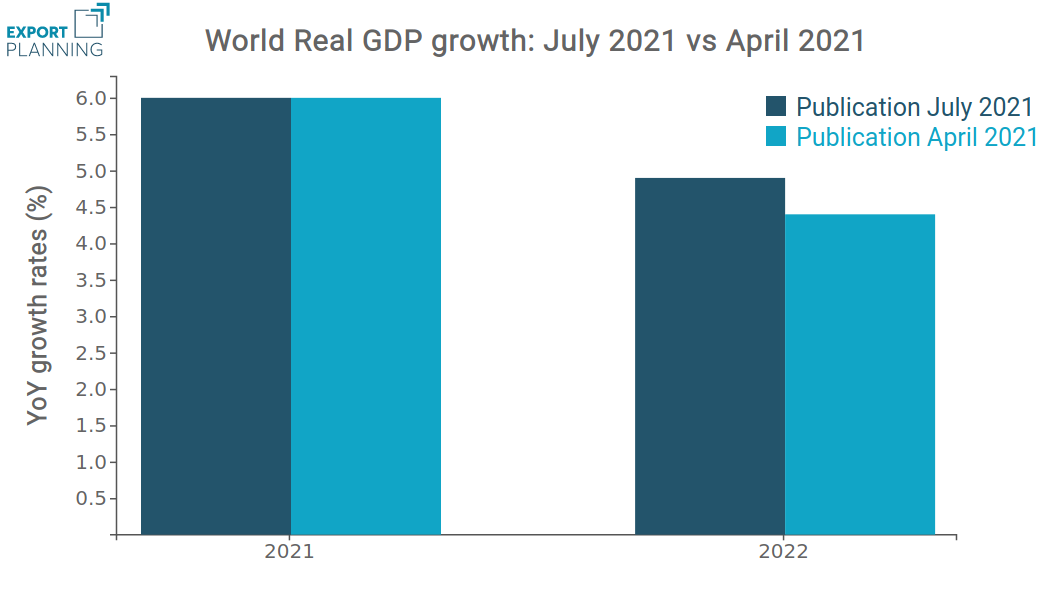

Based on the latest update, the global economy is expected to grow 6.0% in 2021 and 4.9% in 2022, as shown in the chart below. The new forecasts leave the April Outlook for 2021 unchanged, while those for 2022 have been revised up by 0.5 percentage points, thanks to additional fiscal policy measures planned in the United States and the European funds of the "Next Generation EU".

Global trade in goods and services has also experienced an upward revision for its growth prospects, which are estimated around 9.7% in volume for 2021 (+1.3 compared to the April figure) and 7% (+0.5) for 2022.

Source: ExportPlanning on World Economic Outlook Update - July 2021

Although the global GDP forecast for 2021 is unchanged from the April release, the new estimates have changed their composition, predicting a downward revision of the economic outlook for emerging markets and developing economies, and an upward revision for advanced economies.

The following chart maps the world's major countries, distinguishing between economies that experienced a worsening of their outlook and those that, instead, showed an improvement.

World Map: World Economic Outlook Update July 2021

Source: ExportPlanning on World Economic Outlook Update - July 2021

It is clear that the downward revisions have particularly affected the main Emerging Asian economies, due to a resurgence of the virus that is threatening activity levels. This dynamics is affecting above all the ASEAN economies, such as Indonesia, Malaysia, the Philippines and Thailand (for a more in-depth analysis, read the article Emerging Focus: ASEAN Currencies on a roller Coaster).

Growth estimates for the Dragon Country have also been revised down slightly by 0.3 percentage points, due to the gradual scaling back of the overall fiscal stimulus and public investment.

In contrast, it is particularly the cluster of advanced economies that have seen a general upward revision to growth forecasts for 2021, reflecting the above-expected recovery in activity levels during the first quarter of the year.

An increasingly divergent recovery

The July 2021 WEO update thus returns an even more divergent picture of the recovery, due to the stark differences in vaccine campaign advancement and fiscal stimulus policies that exist between advanced and emerging/developing economies. Despite the cooperation efforts of advanced countries, the difference in the advancement of vaccination campaigns between richer nations and emerging ones is in fact still very wide: if about 40% of the population in advanced countries is fully vaccinated, the percentage drops to just 11% for emerging countries and 1% for the poorest category of countries. In addition to this, we can find the varying capacity of the different areas to introduce fiscal stimulus packages: while in 2021 in most advanced countries such measures are going on, in many emerging and developing economies they run out by 2020 due to different budgetary conditions. Some countries, including Brazil, Hungary, Mexico, Russia, and Turkey, have also begun normalizing monetary policy to counter upward price pressures.

The inflationary threat

An additional threat to growth prospects is inflation.

What the IMF refers to as supply-demand mismatches are in fact exerting bullish pressure on prices: spikes in demand, especially for particular product categories, have in fact run up against temporary supply shortages and logistical bottlenecks, creating transitory mismatches between supply and demand. According to the latest WEO update, inflation is expected to return to pre-pandemic thresholds in most countries starting in 2022, once the transitory disruptions are gradually reabsorbed.

There is, however, a risk that transitory pressures could become more persistent if medium-term inflation expectations (which, for now, appear to be anchored to central bank targets in most economies) are triggered.

Despite a general decline in the risk outlook, there are still uncertainties on the international outlook that threaten the recovery, which results inextricably linked to large-scale vaccine availability and inflation expectations. Delays in vaccination campaigns could in fact allow the virus to mutate further, threatening a worsening of pandemic dynamics in the most exposed countries. The current forecast also assumes a gradual shift from expansionary monetary policies to private activity-led growth, but financial conditions could tighten rapidly as inflation expectations change, leading to a more abrupt tightening of central bank monetary policies.