World Exports of Fashion Products in H1 2022: United States rank by far as the leading market

Widespread growth in global sales to the US market, with new highs in many sectors of the Fashion industry

Published by Marcello Antonioni. .

Check performance Fashion United States of America Foreign markets Consumption pattern Export markets Global economic trendsIn the first half of 2022, world exports of the Fashion and Person-related industry, albeit slowing in values at constant prices compared to the average pace of 2021 (+10.7% in H1, compared to +22.9% of the 2021 average), continued to show high dynamism in euro values (+22.1%), at the same rate as last year's average (+21.9%).

The excellent performance of world sales of the Fashion and Person-related industry stands out on the US market

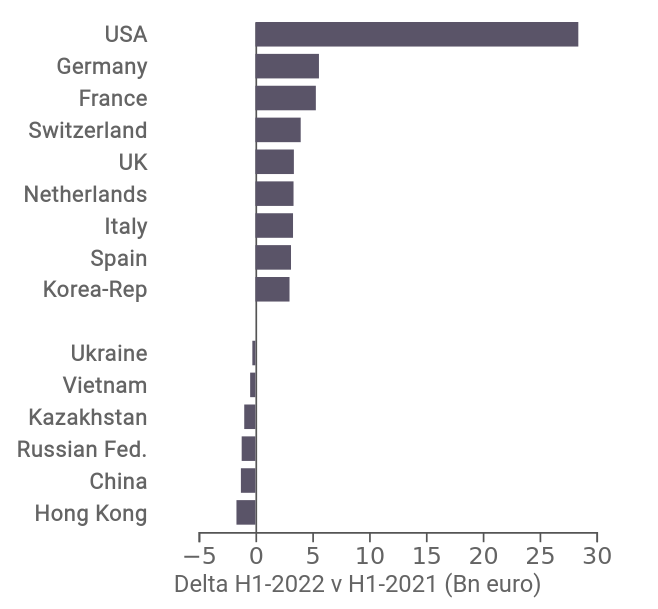

Despite an overall very dynamic context in euro values, there are also significant differences in terms of performance of the individual markets of destination of the world sales of Fashion and Person-related Products: see, for example, the downturns of China and Hong Kong (a total of -€2.9 billion compared to H1 2021, certainly penalized by the prolonged Covid lockdowns that have occurred in recent months), Russia (-€1.2 billion, market heavily penalized by EU and NATO sanctions for military aggression against Ukraine), Kazakhstan (-€1 billion) and - although less significant - those of Vietnam and Ukraine (the latter market rendered impracticable by the ongoing conflict).

On the other hand, there were significant increases in the world sales of Fashion and Person-related Products directed to Germany, France, Switzerland, United Kingdom, Netherlands, Italy, Spain and South Korea (for an overall trend increase of over €31 billion), but above all the strong growth in world sales aimed at the US market (+€28.4 billion compared to the first half of 2021).

World Exports of Fashion and Person-related Products:

Main Increases and Decreases in H1 2022

Source: ExportPlanning-Quarterly World Trade Datamart

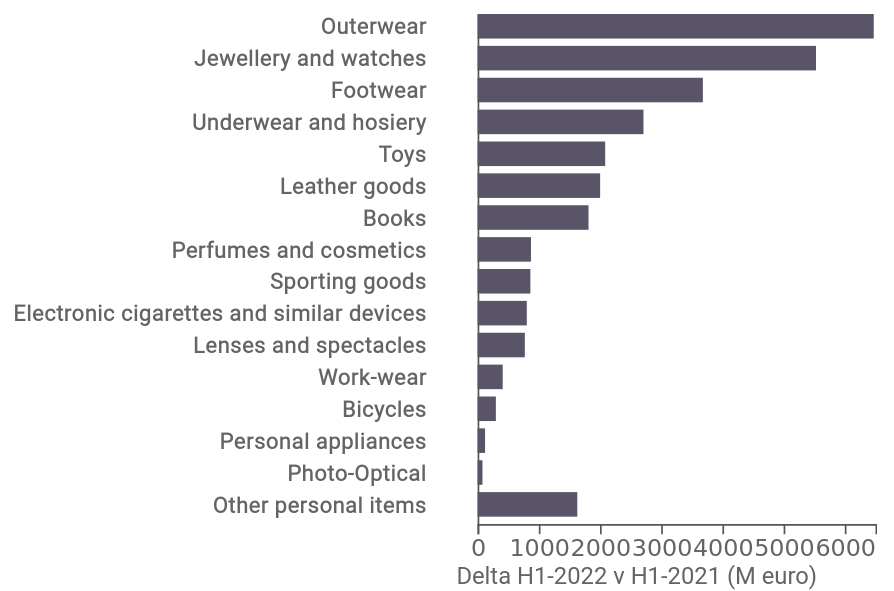

On the US market, there are numerous sectors of the Fashion and Person-related industry which experienced significant YoY increases in the first half of the year. In particular, the growth in imports of:

- Outerwear: +€6.5 billion (+49.2%);

- Jewellery and Watches: +€5.5 billion (+34%);

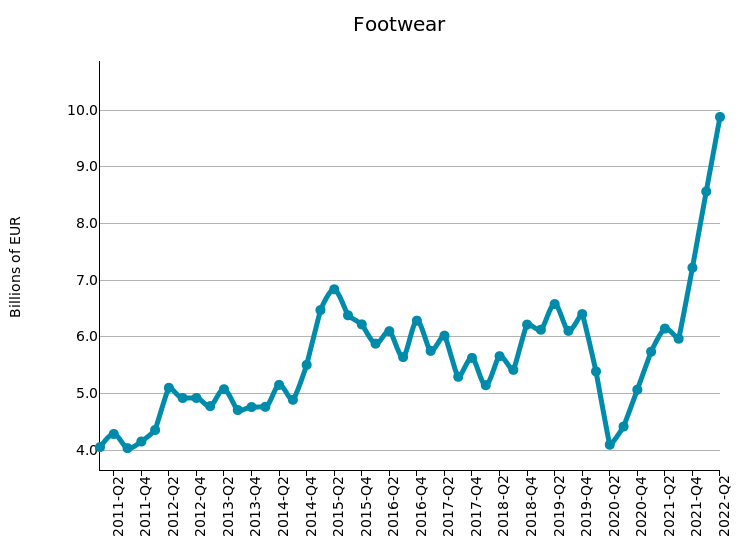

- Footwear: +€3.7 billion (+56.6%);

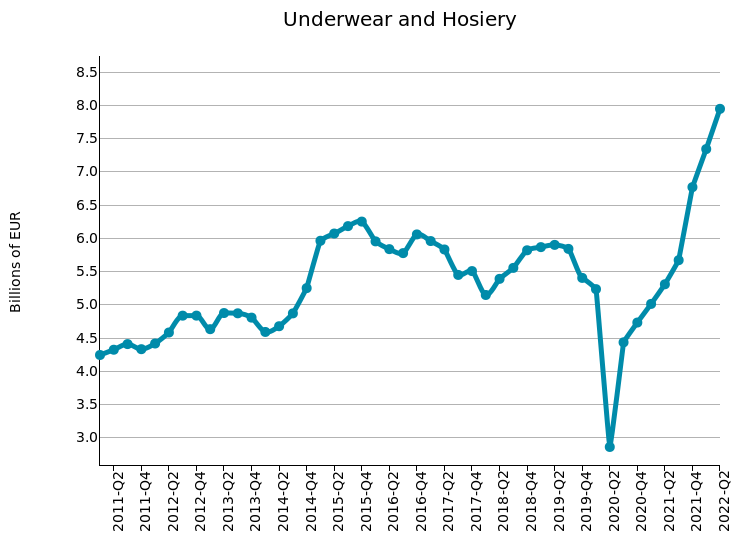

- Underwear and Hosiery: +€2.7 billion (+41.4%);

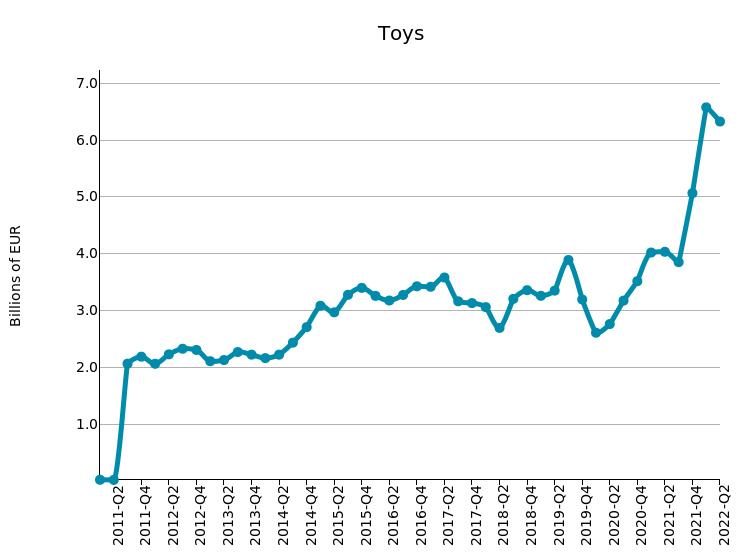

- Toys: +€2.1 billion (+45.1%);

- Leather goods: +€2 billion (+53.9%).

US Imports of the Fashion and Person-related industry, by sectors:

YoY trends in H1 2022

Source: ExportPlanning-Quarterly World Trade Datamart

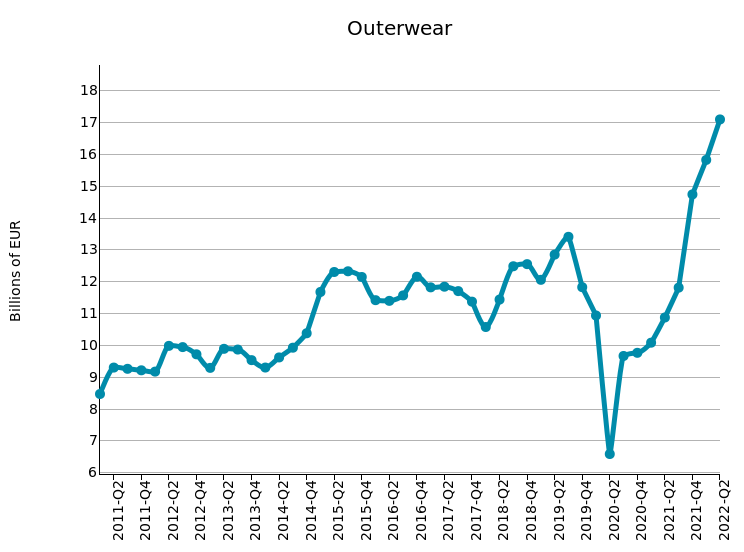

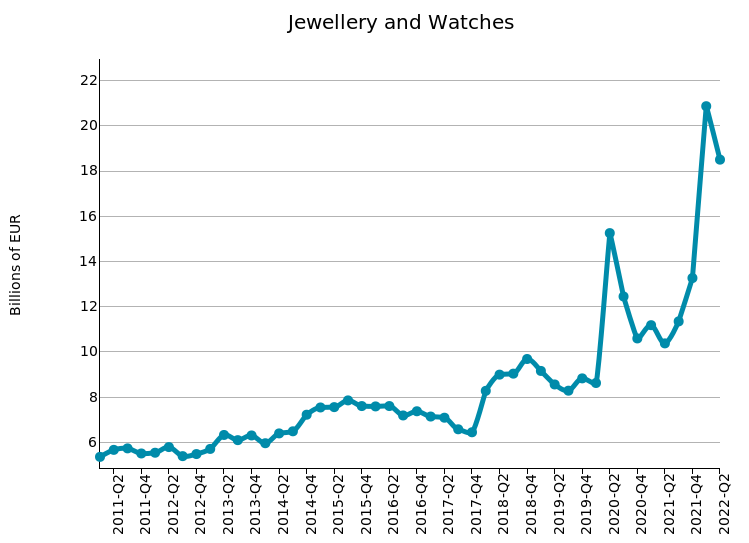

As can be seen from the graphs below, in all the aforementioned sectors, worldwide sales to the US market reached a new absolute maximum in seasonally adjusted values denominated in euros in the first half of 2022.

US Market: Import trends from the world, by sectors

(seasonally adjusted euro)

Source: ExportPlanning-Quarterly World Trade Datamart

Conclusions

Despite the slowdown that occurred in the first part of the year, the world demand for products of the Fashion-Personal System is still showing dynamics of robust growth in euro values. The paradigm of this growth is represented by the US market, which in the first half of 2022 showed record increases in imports of the Fashion and Person-related industry, reaching new highs in many segments.

Given the increased uncertainty for the second half of the year (due to high inflation, slowdown in the international economy, increases in interest rates and - certainly not least - the ongoing conflict in Ukraine), it will be appropriate for the fashion industry exporters to keep on monitoring the evolution of the various international markets, in order to maximize growth opportunities in the most dynamic markets.