Automotive components: opportunities across the border

The motorization process taking place in the world is changing the opportunity map for the component industry.

Published by Alba Di Rosa. .

Automotive Export Siulisse Asia Emerging markets AutomotiveOne of the sectors that is most reflecting the economic development of emerging countries is the automotive one. In order to construct a compass for companies linked to the automotive sector, such as the components industry, it is useful to look at the changes in the geography of the production of motor vehicles. This valuation could help identifying not well known markets that could prove crucial in the next years.

Production of motor vehicles: confirmations and novelties

To identify the upward and downward trends that took place over the last decade, we analyzed the OICA's data on the world production of motor vehicles and compared the situation in 2017 with the 2007's one.

Let us consider the variation in the number of produced vehicles only in those countries where the produced amount exceeded the million units. On the East side, significant increases occurred mainly in China, but also in India, Indonesia, Iran and Thailand; on the contrary, Japanese production has decreased by 16%.

In Europe, the most remarkable production growths were located in Slovakia, Czech Republic and Turkey. The production of motor vehicles in Italy, even though strongly growing in the recent years, has not recovered yet to the pre-crisis volumes (almost 1 million and 300 000 vehicles produced in 2007). There is a slight decline in Germany and Spain too in the number of vehicles produced compared to the 2007 levels, as well as for Great Britain and France.

The Mexican production grows strongly in the (so-called) NAFTA area; weak increase for US production, while the Canadian one decreased.

New producers: not just the East

Considering the countries in which the automotive industry still plays a marginal role, but that experienced a rapid growth, the cases of Hungary and Morocco are remarkable. The first one almost doubled its production in the last decade, while in the latter occurred an exponential growth, signaling the establishment of a previous substantially absent automotive industry.

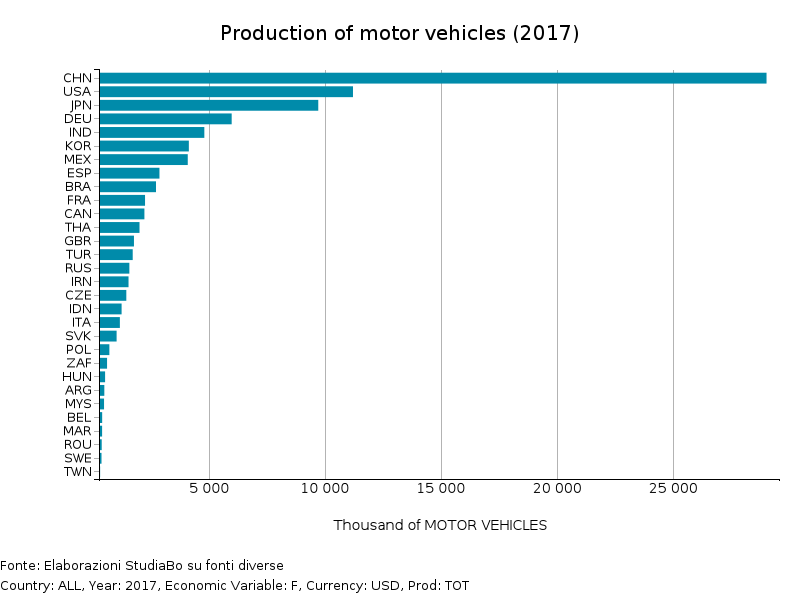

The actual production scenario is summarized in the following graph.

|

|---|

The undisputed primacy is held by China, with more than 29 million produced vehicles last year, close to 30% of world production and more than twice the US levels, slightly more than 11 million. The third world producer is Japan, followed by Germany.

Italy only ranks in 19th place, down by 4 positions compared to 2007, surpassed by emerging countries such as Turkey, Iran, Indonesia and the Czech Republic.

The opportunities for Italian components makers

Knowing the geography of the production of motor vehicles is essential for all those industries that are linked to the automotive industry, creating a real interconnected supply chain.

The export routes

Although foreign sales have a key position for the Italian components producers, the largest recipients of these goods are located in the neighboring countries, either from a geographical or a business point of view. 70% of Italian exports of components is destinated to the EU28 markets, while only the remaining 30% is sold to non-EU markets. As shown in the graph below, Germany, France, USA, Great Britain and Spain absorb half of Italian exports of transport equipment components.

The analysis of the geography of production has shown that the major production developments in the automotive world are now taking place elsewhere, outside the so-called mature markets. For the companies in the components sector, it could therefore be important to strengthen their position in emerging markets too, which could offer the greatest opportunities in a few years, as witnessed by the constantly rising imports of components for motor vehicles.