Watchword: QE

Expansionary monetary policy helps to reassure the markets. Emerging markets currencies and USD are poles apart.

Published by Alba Di Rosa. .

Exchange rate Central banks Eurozone Europe Uncertainty United States of America Exchange rate risk Dollar Emerging markets Exchange ratesThe general panic that hit financial markets in recent weeks, due to the fear of an escalation of the Coronavirus epidemic and of the consequent impact on the world economy, has partially subsided in recent days, thanks to new massive interventions by the major central banks. However, volatility remains high, and the impending recession is turning from fear to certainty for most analysts.

European Central Bank

As Europe becomes the new centre of the Covid-19 epidemic, on March 18 the ECB announced a new intervention after last week's first measures:

the Pandemic Emergency Purchase Programme is a €750bn temporary plan for the purchase of public and private sector securities, launched to counter the risks posed to the euro area by the health emergency. Contrary to last week's words ("We are not here to close spreads," said ECB President Lagarde, causing panic on the markets), this week's official statements showed the central bank's willingness to do everything possible to support the economy in the current phase of unprecedented shock.

The ECB's announcement did not substantially impact on the euro, which remained stable, but reassured markets: yesterday the BTP-Bund spread narrowed and European stock exchanges showed a general positive reaction, with a slight recovery from previous days' losses.

Federal Reserve

The US Federal Reserve has also taken action again in recent days, with a further cut in interest rates (100 basis points, 0-0.25%). The FED has also announced a plan to purchase $700 billion worth of securities and various initiatives to facilitate the flow of credit to households and businesses. As well as the ECB, the FED has also declared its willingness to use all the tools at its disposal to support the provision of credit to households and businesses in this difficult phase.

A bird’s eye view on currencies

While monetary policy interventions seem to be helping reduce volatility on stock exchanges, currencies, for their part, are less responsive to such announcements, confirming the dynamics showed since the beginning of the health emergency.

Notwithstanding some brief moments of recovery, the depreciation trend of emerging countries' currencies keeps going, confirming them as victims of the reduced appetite for risk.

The chart below shows the currencies in the EM cluster that have depreciated in terms of effective exchange rate since the beginning of 2020.

EM currencies depreciation

(Effective exchange rate, 2020)

As you can see, the Mexican peso has been the most affected, weakening by almost 20%; Russian rouble, Brazilian real and Colombian peso follow, with a weakening exceeding 15%.

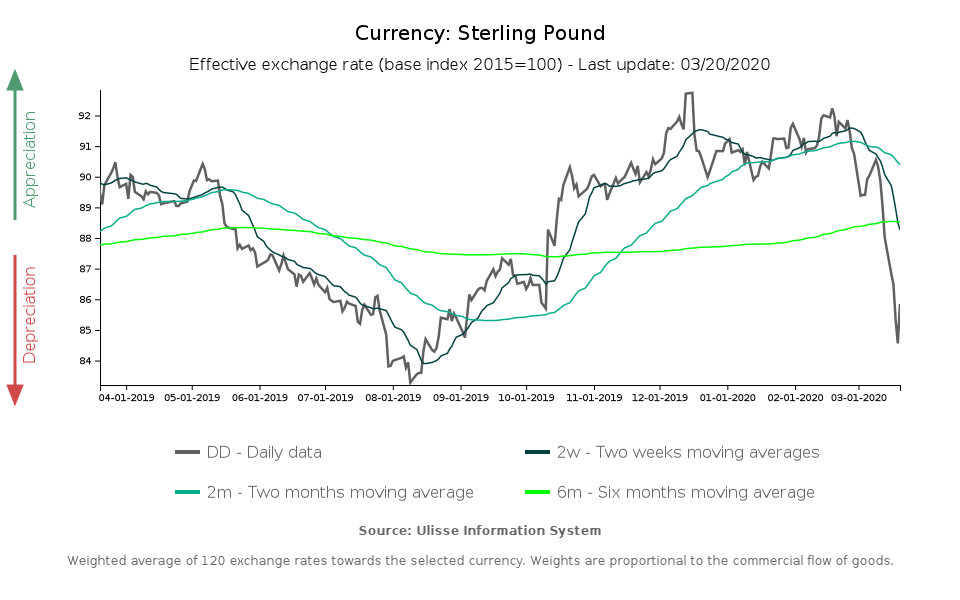

Emerging markets currencies are not the only one experiencing a hard time: British pound has collapsed in the last two weeks, losing more than 5% of its value in terms of effective exchange rate. The GBP showed a slight rebound today, probably due to the new QE measures introduced yesterday by the Bank of England.

The pound, which is not affected by risk aversion, may have been penalized, on the one hand, by the strength of the dollar (like all other currencies), but also by the slow reaction of the Johnson government to the Covid-19 emergency and by the structural weaknesses weighing on the British currency: first of all, British large current account deficit, which can constitute a predominant element of risk in times of crisis, in the face of a possible reduction in investment inflows in the country1.

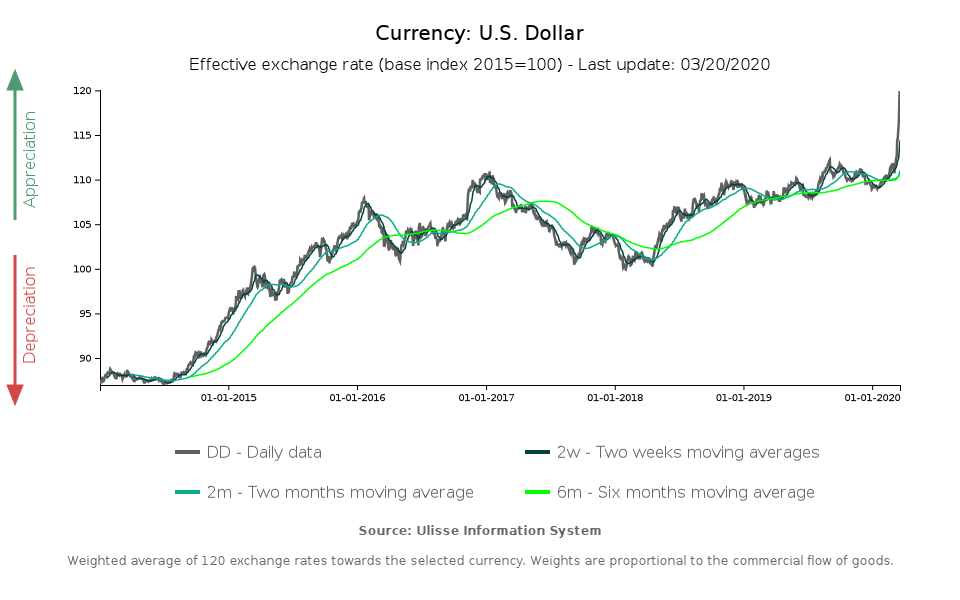

The dramatic situation of some currencies is counterbalanced (and exacerbated) by the strength of the dollar, which is at an all-time high.

EUR/USD exchange rate is closing today at 1.07: the single currency has never been so weak since spring 2017.

The strength of the dollar is linked to investors’ high demand for liquidity: these days the dollar is even preferred to gold which, although its safe-haven asset status, has shown a price drop in recent days.

1. Access Exchange Rate Risk database.