Wine: Potential and Accessibility of the Swiss market

Published by Matteo Olivieri. .

Food&Beverage Internationalisation Planning Premium price International marketing Marketselection Foreign markets Market AccessibilityThis article was written in collaboration with Valeria Minasi, export and internationalization consultant. She collaborates with the ExportPlanning team within the International Market Accessibility project.

The Swiss market offers a panorama of great opportunities for exporters of quality wines.

As documented in the graphs below, extracted from ExportPlanning, in 2019 the High price range accounted for almost all imports of still wines and around 70% of imports of sparkling wines of the Swiss market.

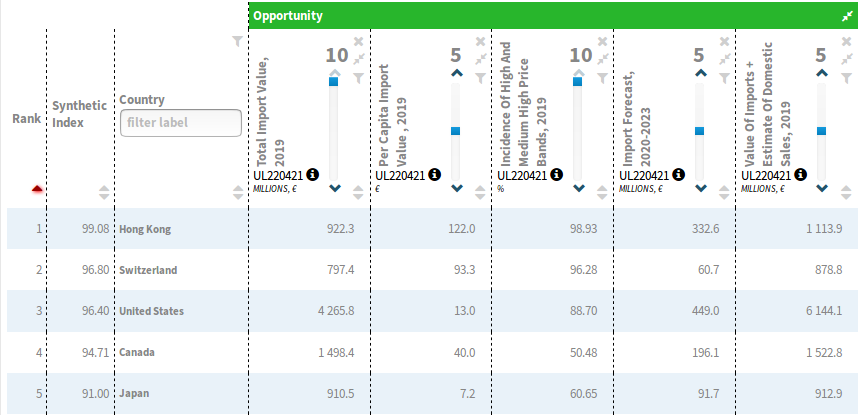

The ranking of market with the highest potential, formulated through ExportPlanning (see table below), places Switzerland in second place for still wine export potential. In particular, it shows the strong incidence of premium segments (High- and Medium-High price ranges).

Export Potential of Bottled Wine: Top Markets

Source: ExportPlanning - Market Selection

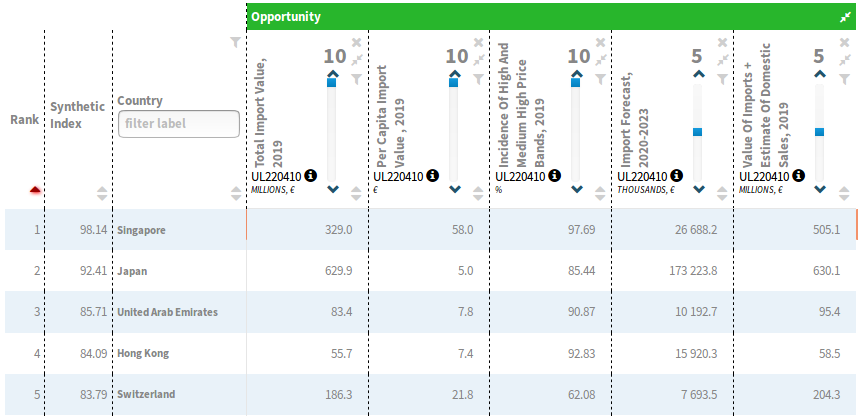

With regard to sparkling wines2, according to ExportPlanning (see table below), Switzerland ranks fifth in the highest potential market list.

Export Potential of Sparkling Wine: Top Markets

Source: ExportPlanning - Market Selection

Market Accessibility information

About market accessibility, Switzerland doesn’t present major problems, but it’s good to know some important indications, some of protectionist-tariff nature and others of a documental type.

Duties and Quotas

In Switzerland there is a customs quota for natural wines equal to 1.7 million hl per year, valid for red and white wines that can be imported at the contingent duty rate. The contingent is assigned based on the order of entry or acceptance of customs declarations at the border.

It’s important specify that in the past years the contingent has never been reached, but it’s good that exporters are aware of this measure. There are also customs imports duties, which can be consulted on TARES platform.

If the importer has a contingent quota, the customs tariffs will be very low and null in some cases. If not, the discounted rate provided by the free trade agreements should be taken into account. In addition, the customs administration has the right to collect the value tax added equal to 8 %.

Documentation

CUSTOMS DECLARATION

The importer of goods destinated for the Swiss market must to present them to a customs office competent and declare them for customs taxation. In addition to the customs declaration correctly completed, the importer must present the transport documents. This declaration can be made by those who transport the goods (shippers) or those who commission to transport it (importer).

It is possible to submit the customs declaration electronically through the e-dec import taxation only if the submitter is registered to the Federal Customs Administration3.

CERTIFICATE OF ORIGINS

Switzerland is a member of the Council of Europe, and of EFTA, but isn’t part of European Union.

It is currently in force The Bilateral Agreement between Switzerland and the European Union, in force since June 1st 2006. Based on this Agreement, goods from EU enjoy a preferential system; the EUR 1 document has the function of certificate of origin. In the case of shipments less than 6.000 Euro, EUR 1 can be replaced by a declaration on the invoice, prepared by the exporter, which details the products to allow their identification. Talking about wine products, Switzerland is treated as all the others EU countries.

IMPORT DOCUMENTS

A General Import Permit4 is required to import many agricultural products into Switzerland.

The General Import Permit is granted on request by Federal Office of Agriculture (FOAG) to all natural and legal persons, community of people with domicile or registered office on Swiss customs territory.

The General Import Permit is free, has unlimited validity and is not transferable. The General Import Permit doesn’t automatically give the right to the owner to import products at the lower or null duty rate of the ADC quota; it’s necessary an allocation of the tariff quota or an agreement to use tariff quotas.

Please Note: for wines and grapes to be pressed, the General Import Permit is granted only to legal persons based in Switzerland and also if the legal person already has a company number assigned by the Swiss Wine Trade Inspection5.

1) The customs code considered is HS220421: see the following description table.

2) The customs code considered is HS220410: see the following description table.

3) For further information, please refer to the following link of the Federal Customs Organization's website: e-dec Import. Since January 1 2013, Switzerland no longer accepted paper versions of the 11.010 model, but only from e-dec Web app.

4) No General Import Permit is required for the importation into Switzerland of sparkling wines and, as regards EU countries, those with Nomenclature Combined code CN2204.2150 (sweet wines, specialties wines and mistelle).

5) The regulation governing the importation of wine is Ordinance of November 14 2007 of the Federal Council Ordinance of Wine. The Swiss Wine Trade Inspection's functions are the protection of the geographical names and the application of the conditions, it controls and provides information to trade companies in wine, in collaboration with the Supervisory Authority.