Focus on EM Currencies: the Rand Recovers Ground, but Risk Remains

Published by Alba Di Rosa. .

Exchange rate Central banks Africa Dollar Great Lockdown Exchange rate risk Covid-19 Emerging markets Exchange ratesIn line with the analysis of EM currencies that we carried out in recent weeks, focusing on Russian ruble and Brazilian real, let us now analyze the case of the South African rand. Unlike the other two BRICS currencies previously analyzed, the rand does not show a dynamics of weakening in the last period: on the contrary, despite some short-term fluctuations, the exchange rate of the currency against the dollar has all in all maintained a good stability in the last months, also showing a slight strengthening compared to the beginning of the summer.

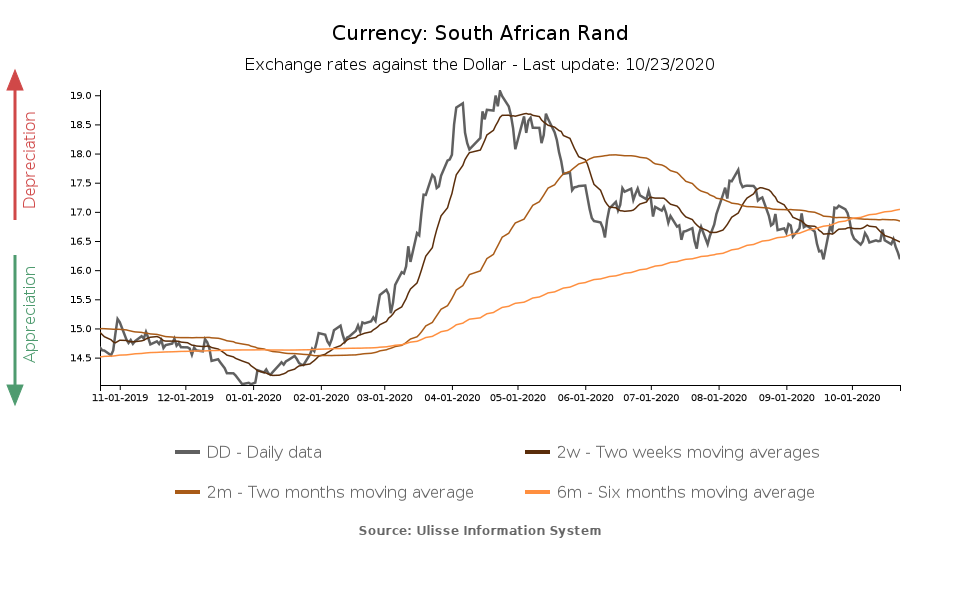

As can be seen from the graph below, moving average time series (2-weeks and 2-months) prove particularly useful, smoothing out short-term volatility and emphasizing the underlying dynamics of the exchange rate.

The rand shows a partial recovery compared to the Covid-related fall. Given the chronic weakness of the South African economy, and the current context of global health emergency, the resilience of the currency is, however, worthy of further study: which factors are driving its dynamics?

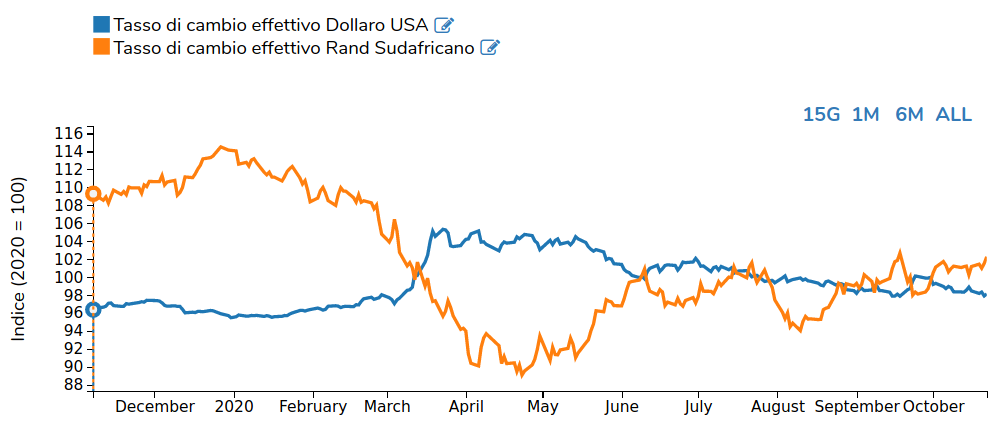

Dollar weakness. In terms of effective exchange rate, the greenback is still relatively weak compared to the peaks reached during the spring. As can be seen from the chart below (source: DailyDataLab), the effective exchange rate of the rand (index 2020 = 100) shows a quite specular dynamics compared to the US dollar, strengthening in the presence of USD weakness and being inevitably penalized by the strengthening of the dollar.

US dollar and South African rand effective exchange rate

Index: 2020=100

The theme of the relationship with the dollar is linked to financial markets' sentiment. The Covid crisis has confirmed the safe-haven role of the dollar, as shown by its powerful appreciation during the spring. The significant fiscal and monetary policy interventions in the major economies, carried out in response to the Covid crisis, have then progressively calmed markets, giving way to a timid recovery of investors' appetite for risk.

One element that has significantly influenced the dynamics of EM currencies and, among them, of the South African currency in recent months, is precisely risk sentiment, which has fluctuated mainly in relation to news about the epidemic and support interventions for affected economies.

If in recent months the global economy's attempts to recover from the effects of the pandemic may have supported appetite for risk, and indirectly the rand, the current start of a second wave of infections in many countries, delays in the approval of a fiscal stimulus plan in the US, the upcoming US presidential elections and the persistent Brexit uncertainty could also lead to a deterioration of this sentiment, penalizing the South African currency as well.

National economy and public finance. Looking at the internal factors that may have influenced the dynamics of the rand, the performance of the South African economy in recent months is particularly noteworthy. According to a recent publication by the South African Reserve Bank (SARB), despite the relatively deep fall in the country's GDP in Q2-2020 (-51% QoQ, seasonally adjusted annual rate), the dynamics of economic indicators in the following months suggests the presence of a strong rebound in Q3. In particular, the leading composite business cycle indicator showed, in August, the continuation of the growth dynamics of the previous month, almost reaching the levels of early 2020.

The recovery of the commodity export index and the business confidence index can be cited as the main contributors to this dynamics (source: SARB).

Positive signals also come from small business turnover, back to pre-crisis levels in September for activities related to Food & Drink and retail.

If these encouraging signs about the country's economy may therefore have supported the rand, at the same time some elements of risk remain strongly on the scene, and will inevitably weigh on the currency in the near future.

The epidemic in South Africa has severely penalized the labour market and the country's growth prospects: SARB forecasts that GDP will remain below 2019 levels until the end of 2022. Another element that constitutes a source of immediate concern for financial markets is the state of health of public finances, as described for the case of Brazil.

On Wednesday 28 October, the government should announce its medium-term budget and its economic forecasts: the event brings the markets' attention back to the fiscal position of South Africa, already weak before the pandemic, and at risk of further deterioration. Government statements should clarify the extent of this deterioration and its impact on debt sustainability, which represents a significant risk factor for the currency.