International Trade by Sectors: 2020 Figures

World trade ends 2020 with a single-digit decrease and a rather differentiated situation among sectors

Published by Marzia Moccia. .

Uncertainty Conjuncture Foreign markets Consumption pattern Covid-19 Great Lockdown Global economic trends

Almost a year after the official start of the Covid-19 pandemic, world trade appears to be on a significant upswing, ending the year less negatively than initially assumed, as discussed in the article "World Trade Closes 2020 with Single-digit Decline".

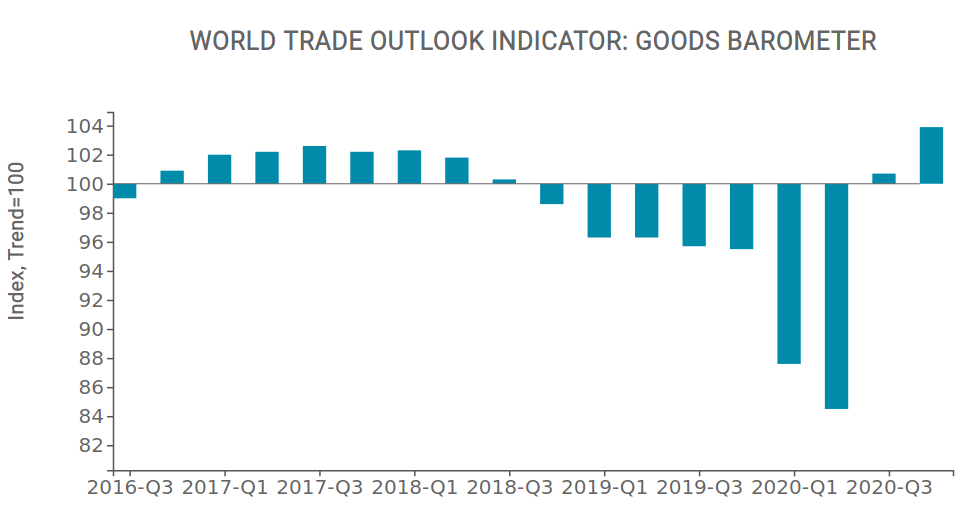

The latest World Trade Outlook Indicator, released by the WTO on February 18, further certifies this result: in the fourth quarter, the economic indicator recorded a value of 103.9. The value indicates an expansion above the trend (= 100) and a further increase compared to the previous value of 100.7, as the chart shows.

Source: ExportPlanning Analysis on WTO data

The World Trade Outlook Indicator consists of a set of forward-looking indices such as:

- Export orders of a sample of companies

- The air cargo transport index released by the International Air Transport Association (IATA)

- The number of containers moved in the main international ports of North America, Europe and Asia

- The number of cars sold and produced in the world

- World trade od of electronic components and agricultural raw materials

For each of these components, the fourth quarter of 2020 was more dynamic than the trend.

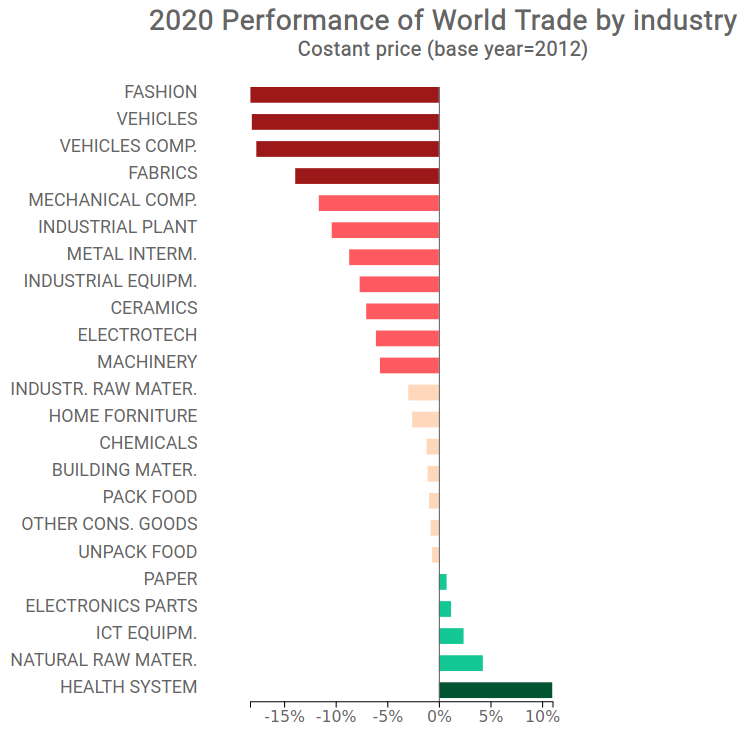

While the main economic world trade indicators point to a rapid recovery, the picture of this resumption is nonetheless mixed. The unevenness that is currently shaping the recovery returns a relatively differentiated picture for the different industries at the end of 2020, as shown in the chart below.

Source: ExportPlanning

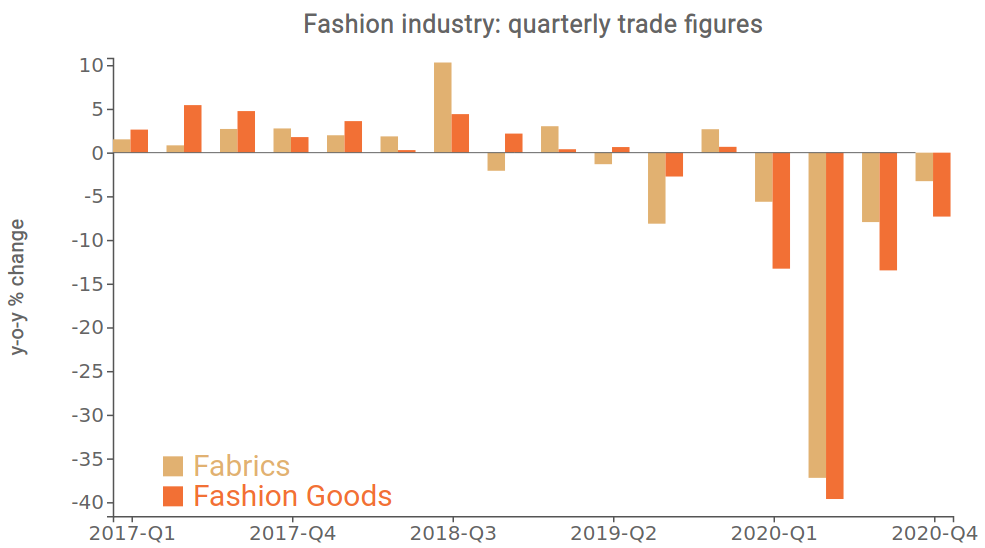

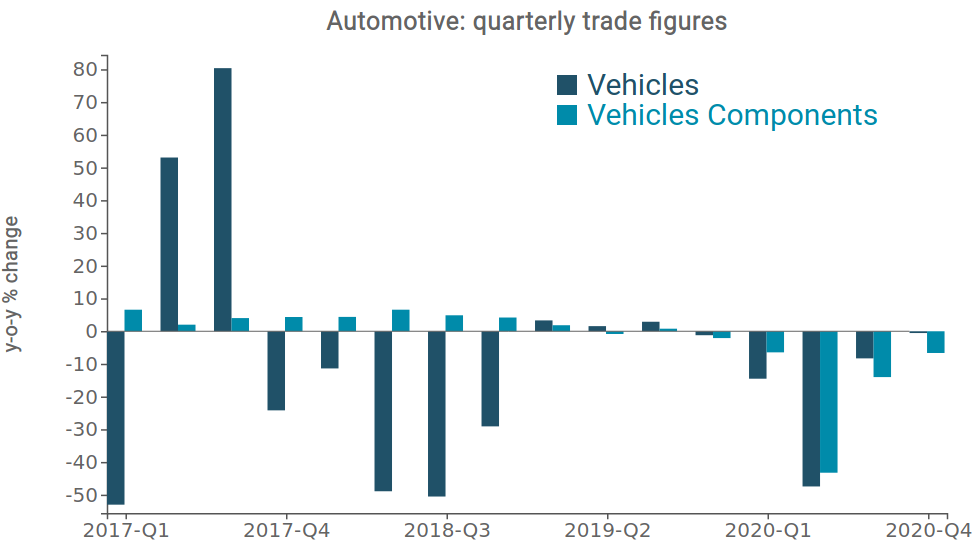

The most significant downturns are visible in textile-fashion and automotive sectors: the two industries closed 2020 with a larger drop of -15% in quantity compared to 2019. However, for the automotive sector a significant recovery emerges in the last quarter of the year. In Q4-2020 the global demand for Transport Equipment almost entirely recovered the gap with Q4-2019 values (see chart below); the same cannot be said for the textile-fashion sector, which has shown a slower resumption (see chart below).

Source: ExportPlanning

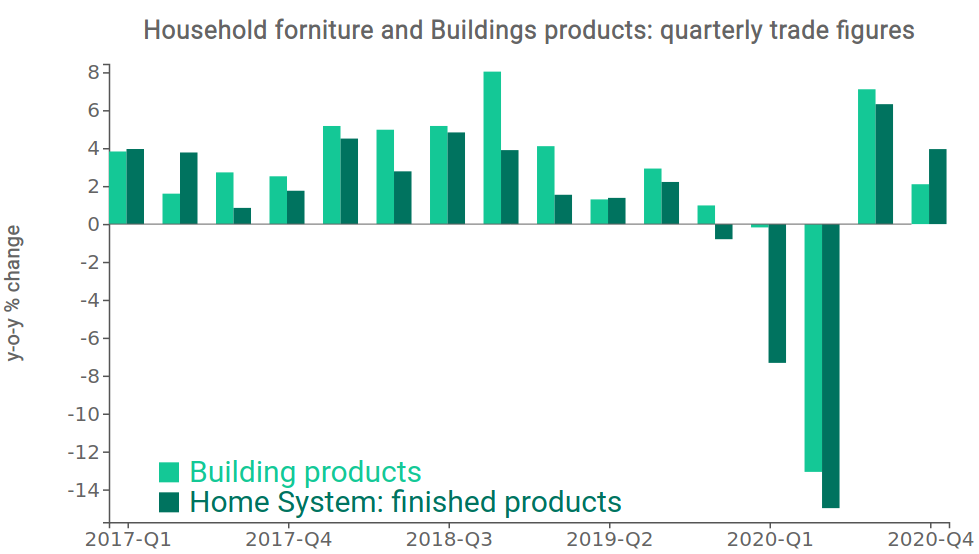

The main investment goods industries, such as Industrial Equipment, Plant Technology, Electrotechnology and Machinery, contained their losses between -5% and -10%, showing good resilience in the second part of the year. Very impressive was the recovery in global demand for Household and Construction Products: thanks to a strong rebound in the second half of 2020, these two industries are among the most robust in the current economic situation, together with food products.

Source: ExportPlanning

Net of the Pharmaceutical industry, few positive performances can be highlighted for the remaining industries. Among these, the results of Electronic components and ICT tools and equipment stand out, strongly favored by new international consumption habits.

Conclusions

Despite the better-than-expected recovery, the challenge of fully recovering the development path of world trade remains, in a context of heterogeneity of the recovery and increased international risks. Moreover, according to the WTO Goods Trade Barometer, the prospects for a further consolidation of the recovery path in the first quarter of 2021 remain highly uncertain, due to the spread of new virus variants and the normalisation of the rebound phase into which world trade might enter at the beginning of the year.