Ruble under pressure, once again

Fall in oil prices and inflationary expectations weaken the ruble

Published by Luigi Bidoia. .

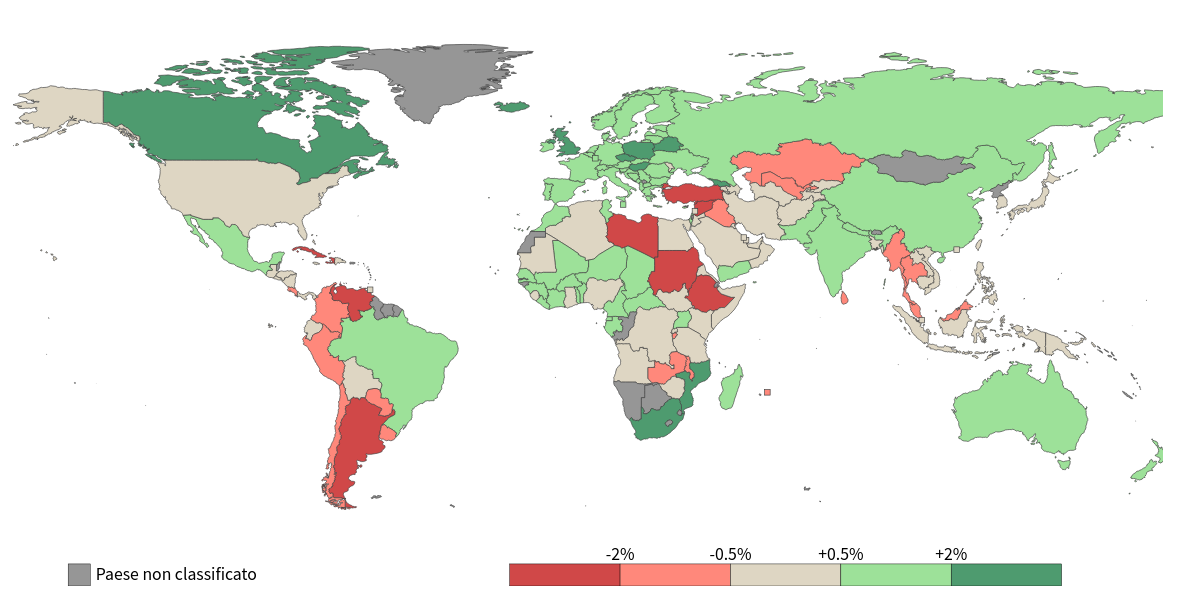

Russian rouble Exchange ratesThe week just ended saw the price of WTI oil fall below US$ 50 a barrel and copper below US$ 6,000/ton. Global markets are facing a significant slowdown, with a consequent lower demand for raw materials. The effect on exchange rates was immediate. This week, Russian ruble (2.8%), Chilean peso (1.5%), Canadian dollar (1.3%), Norwegian koruna (1.1%) and Australian dollar (0.9%) depreciated against US dollar. In contrast, the currencies of the large importing countries of raw materials, such as Indian rupee (2.6%) and Japanese yen (2.0%), appreciated.

The Russian ruble experienced the deepest depreciation in terms of the effective exchange rate.

|

|---|

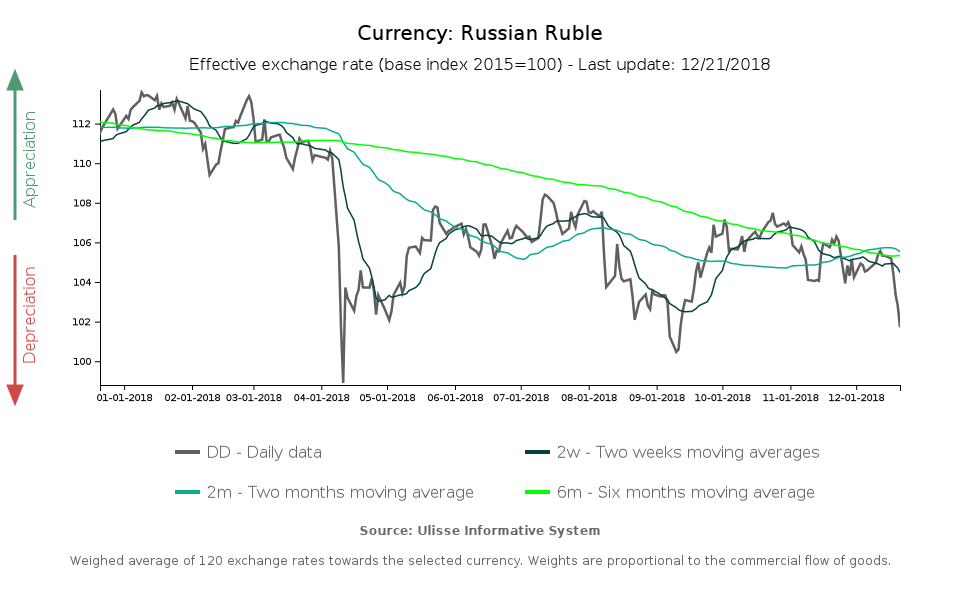

As shown in the graph above, the ruble has moved closer to the minimum value of 2018, frustrating the effort made by

Russian monetary authorities to counter the depreciation and recover part of the currency's value, after the

strong devaluation suffered in the first days of April.

In addition to the fall in the oil price, the reasons for this new weakening of the ruble must be sought in the difficulty of the central bank to contain inflation within the 4% target. Recent data on domestic prices have raised expectations of further increases in interest rates, after that on December 14, 2018 they were raised to 7.75%.